A critical factor impacting Federal Reserve policy and when the Fed will begin moderating its accommodative monetary policy depends, under its new framework, on progress in achieving its “broad-based and inclusive maximum-employment goal.” This issue was addressed in the minutes of the July FOMC meeting, where participants concluded that its goal had not yet been achieved and noted, in particular, that “the labor market recovery continued to be uneven across demographic and income groups and across sectors.”

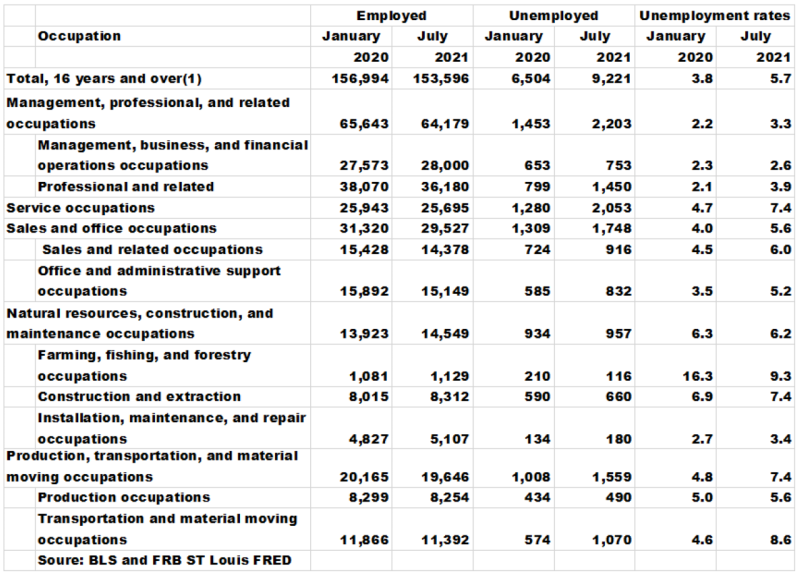

The recent release of the CES employment data for July enables us to dig a bit deeper into exactly what groups have been and continue to be impacted by the pandemic and where we stand relative to the pre-pandemic labor market. The FOMC minutes mentioned that the recovery has been uneven across industry groups. The following table compares employment and unemployment across some broad economic sectors, comparing where we were prior to the pandemic in January 2020 to where we stood as of July of this year. Overall, employment is still down over 9.2 million people from the pre-pandemic level. Hardest hit has been management, and professional jobs and services.

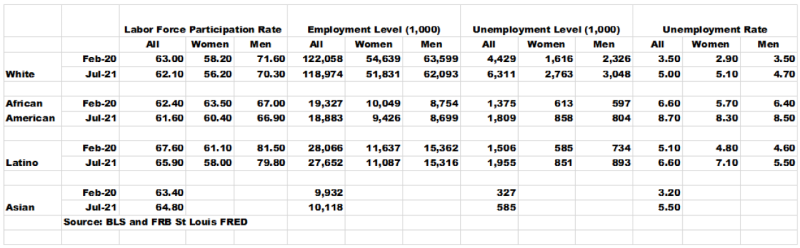

As we know, Chairman Powell has repeatedly emphasized the FOMC’s concern about not only employment across job categories but also the need to ensure that women’s and minorities’ positions in the labor market are taken into policy consideration. The CES employment report allows us to see exactly where these sub-labor-market groups are now and how they have been impacted by the pandemic.

(Breakdowns of Asian employment by gender are not available in the CES data.) The data are quite clear that while virtually all segments experienced the negative impact of the pandemic, women of all races and African Americans were hardest hit. Participation rates dropped, but more for women than for men. Many explanations have been offered to explain the decline in participation rates for women in particular, such as the need to care for children who were not in school and to provide healthcare support at home. Employment levels declined across the board and for all ethnic groups but Asians, and unemployment rates increased. Finally, the unemployment rates are highest for African Americans and Latino women but are also high for African American men. Again, the data are consistent with the FOMC’s expressed concern that their policies and policy accommodation should consider not just the overall employment situation but also those who have been hurt the most. These data suggest that the FOMC will be unlikely to make significant policy changes until more improvement in the labor market becomes apparent.

The resurgence of the pandemic in many states introduces additional uncertainty about the recovery. And this may be further exacerbated, as was discussed at Cumberland’s Camp Kotok outing in Maine, by what now is called long-haul COVID, as people who have experienced COVID cope with lingering and potentially debilitating complications that may delay their return to the labor market. This COVID-driven surge in temporary or permanent disability sets up a challenge for the Committee, given what now appear to be persistent inflation pressures. The one move that the Committee can make — one that seems to have received significant discussion at the last meeting — is to begin to slow down the Fed’s asset purchase program and not make any further policy changes, in interest rates, for example, until the purchase program has stopped.

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.