The FOMC this week will go into its meeting with a wealth of new economic data that should be significant for its decision. More specifically, the committee will have the new readings on Q3 real GDP, the September’s jobs situation, and the September PCE and CPI inflation indices. In addition, the committee and staff will have digested the Beige Book, which provides a geographical breakdown of growth and the employment situation.

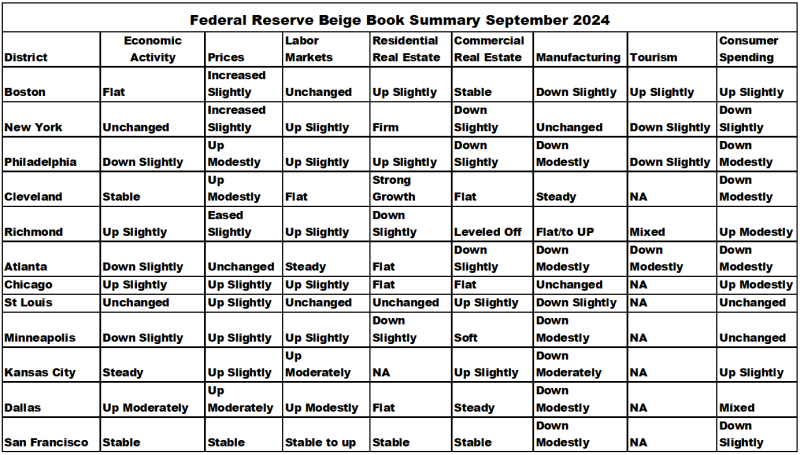

The Beige Book breakdown of economic conditions across the 12 Federal Reserve districts suggests a mixed picture, as is shown in the table below; but, overall, the story seems to be consistent with the new Q3 GDP putting real growth at 2.8%, down only two tenths from the 3% reported for Q2.

The main contributors to growth were exports, nondurable goods, motor vehicles and parts, healthcare, food services and accommodations, defense spending, exports, and the capital goods component of imports. The decline from Q2’s 3.0% was a drop in inventories, suggesting a shortfall to cover sales. Of course, these preliminary figures can be adjusted going forward as more complete data become available. For Q2 for example, the advance release had GDP growth at 2.8%, which was revised up as time progressed to the current 3.0% estimate. The relatively stable GDP story of slightly above-trend growth was coupled with a very positive story for inflation.

The September PCE Index, which the FOMC has targeted to be 2%, hit 2.1%, down from 2.3% in August. By comparison, the September CPI was at 2.4%; and this index tends to run above the PCE, which focuses on consumer spending on goods and services whereas the CPI focuses on out-of-pocket expenses. Again, the above chart suggests that prices are up slightly, which is consistent with the 2.1% increase in the PCE.

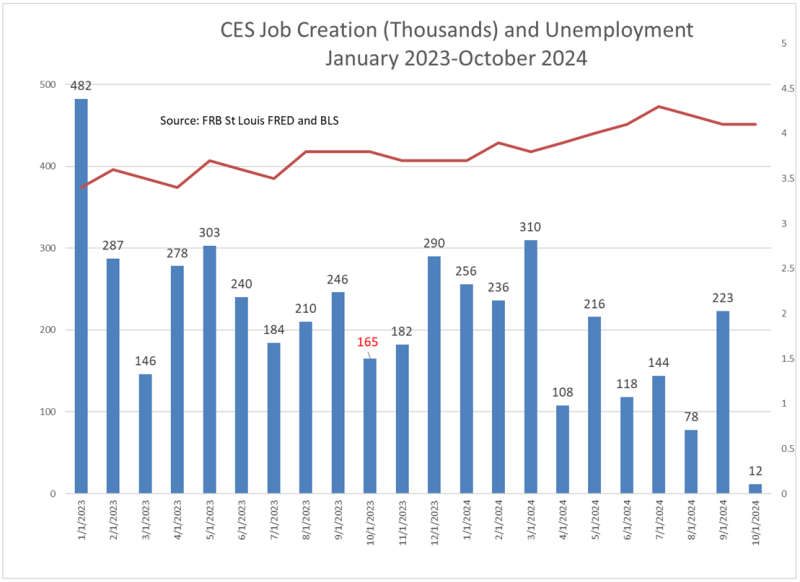

Lastly, we got new data on the jobs market on Thursday, October 30. New claims for unemployment insurance were down 12,000 from the previous week; however, on Friday we got the BLS jobs data, shown in the next chart.

The release showed that only 12,000 new jobs had been created, a number significantly lower than the 106,000 that had been predicted; and the unemployment rate remained steady at 4.1%. Most noteworthy is the fact that the numbers for August and September were revised down by 81,000 and 31,000, respectively, suggesting that the labor market was weaker than previously thought. Indeed, jobs declined in professional and business services, temporary services, and manufacturing but increased in government and healthcare. Job openings and layoffs were relatively constant at 7.4 million and 4.5 million going into the month of October.

Those FOMC members mulling the question of whether to pause or to continue on the path of further rate cuts are now, given the weakness in the employment numbers, more likely to favor a cut at this upcoming meeting. And given that the election will have already been decided, there is no political risk of being accused of favoring one party over another. For those who were already favoring additional cuts, their focus will be on whether another 50-basis-point or 25-basis-point cut is called for.

Robert Eisenbeis, Ph.D.

Vice Chairman & Chief Monetary Economist

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Sign up for our FREE Cumberland Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.