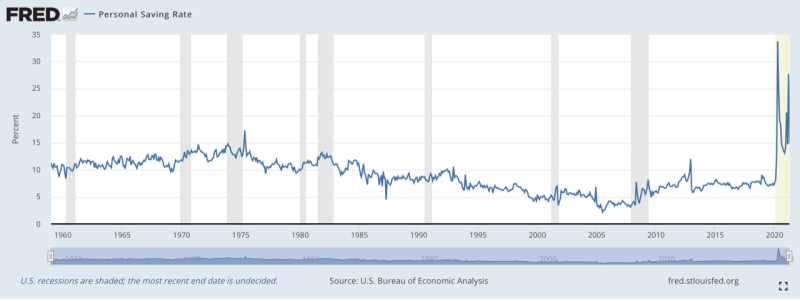

This link will take you to a chart, courtesy of the Federal Reserve Bank of St. Louis. The chart depicts the personal savings rate from 1960 through 2020: https://fred.stlouisfed.org/series/PSAVERT.

Prior to the pandemic, the savings rate in the United States was reasonably predictable and in the mid single digits. Then along came the pandemic shock, which you can see in the chart.

Remember that the savings rate has two component parts to it. If income goes down while savings go up, the savings rate is more dramatically portrayed, since it is a ratio (percentage) of amounts of disposable income that are actually saved. It’s also an aggregate number for the entire country, so it does not reflect the experience or behavior of one individual. We can see the erratic volatility of the savings rate during the pandemic, and at the St. Louis Fed link (https://fred.stlouisfed.org/series/PSAVERT) you can hover over the chart and pick your period of time to review the changes in the savings rate.

What do we know so far? We know the savings rate shot up like a rocket in March 2020. Did folks save because of fear or lockdown? Maybe some of each. We know that it has been erratically in decline since, and we know that it has a long way to go before it is normalized again. The savings rate is an indicator; it doesn’t give us the specifics of each person’s savings rate. That’s idiosyncratic to you or me. But what we also know is that the savings rate needs to decline to more normal single digit numbers or levels before we can say that the effect on asset prices, whether of stocks or real estate or art or other goods, is back to some normal baseline.

Also remember that savings go up if you use the money to pay down debt. If you take money out of your disposable income and pay off a loan instead of acquiring an asset, the savings rate goes up. So we see the effects of the savings rate changes, and we see changes in people’s behavior reflected in the rate. Gary Shilling’s Insight (https://www.forbes.com/newsletters/gary-shillings-insight/?sh=745d77e91471) in June noted how, as time goes by and there are additional stimulus checks coming out of the federal government, less and less of each of those checks is being spent on consumption, which means it’s being spent on something else instead. It’s either raising savings because people are afraid or because they want to increase savings for some other reason, or it’s reducing debt, but it’s not being spent on consumption. The first slug of stimulus money was spent on consumption; but for each slug of money that followed, less was spent for that purpose.

The other thing we know is that in about 25 of the 50 states the $300 supplemental unemployment payment will expire in June or July. We’re going to have about 25 states that will continue some form of payment and another 25 states that will not. What does that mean? Are we going to able to observe comparisons between these two cohorts of states? Will there be any job migration? Will people move for benefits? (They won’t be able to get them if they go to a state where the benefit is higher because they won’t be there long enough to qualify.) We’re going to learn a lot in August and September and October, but what we do know now is that when a $300 payment stops – the average monthly check is about $1200 for the employment cohort in a very broad definition – that’s a drop in income and spending power. And it will coincide with changes in behavior that will be reflected in the savings rate.

Where do we end up with this? We’re in the business of asset prices, and specifically in two asset classes, the stock market and the bond market. We keep a very watchful eye on real estate prices for all the obvious reasons; but as a practical matter, Cumberland Advisors is a money manager in the stock market sector and the bond market sector. And what we see is a transition underway. The spike in savings that was deployed energetically in financial markets has peaked and started to decline.

The surge that reflects the recovery from the extraordinary bottom in March and April of last year is slowing, and we expect it to slow further. How much it slows remains to be seen. And what will that slowing do for the various pressures in financial markets and in the economy as we come off this rocket ship of an upward surge and start to plateau and flatten out? We’ve written about the dynamics of the recovery in terms of inflation and the outlook for interest rates and earnings for stocks – these considerations appear in our commentaries continually. My colleagues and I are on the case all the time. The bottom line? The savings rate is an indicator for us to watch closely. It reflects changes in the behaviors of the US citizen and therefore of the macroeconomic profile of the United States. Keep an eye on the savings rate.

At the present time, we have implemented a small cash reserve in our US ETF portfolios and are enlarging it. This does not apply to the quant based portfolios.

We are no longer fully invested. Again, this does not apply to the quant based portfolios. This move was a change we had postponed and postponed but recently decided to implement. More changes are coming. Stay tuned.

David R. Kotok

Chairman of the Board & Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.