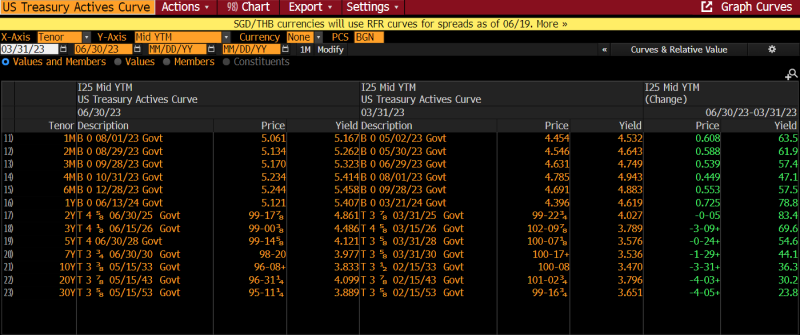

Treasury yields continued to be extremely volatile during the second quarter as market participants digested economic data and tried to time the end of the Fed hiking cycle. The net result of interest rate movements during the quarter was higher yields across the curve as expectations grew that rates will remain higher for longer. The biggest rise in rates was seen in the 2-year Treasury, which rose 83.4 bps to 4.861% during the quarter as of 6/30/23. The longer maturities also rose, with the 10-year up 36.3 bps to 3.832% and the 30-year up 23.8 bps to 3.889% over the same period. You can see the rest of the Treasury curve changes for that period in the chart below.

Source: Bloomberg

Spread volatility cooled, with both IG corporates and taxable munis tightening during the second quarter. The spread on the Bloomberg US Corporate Bond Index tightened 11 bps to +127 bps as of 6/30/23. The spread on the Bloomberg Taxable Muni US AGG Index also dropped 13 bps to +107 bps as of 6/30/23. This trend cushioned our strategy from higher Treasury yields, since we continue to maintain a higher weighting in spread securities relative to the benchmark.

As we move into the third quarter of 2023, we will look to continue increasing the book yield on portfolios by swapping out of lower-book-yield securities. There was limited supply in the taxable muni space during the quarter, but supply should pick up as summer comes to an end. Our expectation is that the volatility in the market will remain high until there is more clarity on when the Fed will stop raising rates. We will continue to take a conservative approach to credit while looking to be opportunistic as attractive deals come to market.

Daniel Himelberger

Portfolio Manager & Fixed Income Analyst

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Sign up for our FREE Cumberland Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.