Cumberland, since its inception in 1973, has utilized separately managed accounts to execute its fixed income strategy. This was long before separately managed accounts (SMAs) were popularized in the early 2000s. The reasons for managing money in this fashion are the same today as they were then:

· Transparency (you know what you own)

· Flexibility to make strategic changes

· Ability to manage transaction costs and best execution

· Active management

· Individually catered management for client objectives including tax management, income production, state-specific needs, cash flow-specific needs, and ability to institute investment restrictions

Per Investopedia: “A[n] SMA is a portfolio of assets under the management of a professional investment firm. In the United States, the vast majority of such firms are called registered investment advisors, and operate under the regulatory auspices of the Investment Advisors Act of 1940 and the purview of the US Securities and Exchange Commission (SEC). One or more portfolio managers are responsible for day-to-day investment decisions, supported by a team of analysts, operations and administrative staff. SMAs differ from pooled vehicles like mutual funds in that each portfolio is unique to a single account (hence the name). In other words, if you set up a separate account with Money Manager X, then Manager X has the discretion to make decisions for this account that may be different from decisions made for other accounts.”

We will address municipal assets in this commentary; however, we also manage taxable fixed-income, equity, and balanced accounts. In managing equity accounts we utilize exchange-traded funds (ETFs) and actively conduct sector rotation. Exchange-traded funds allow flexibility and generally, a reduced total trading cost than individual-stock portfolios do and avoid sales and purchases that mutual funds must make due to funds flows.

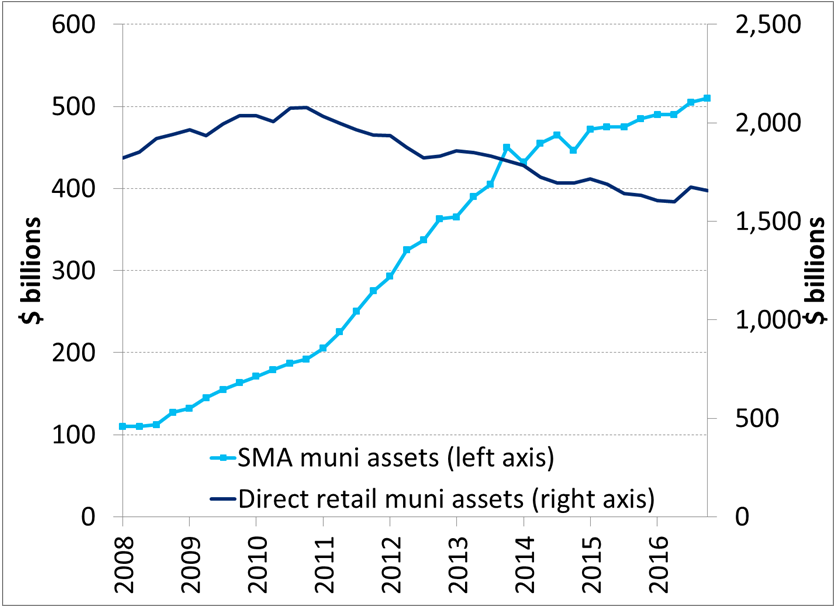

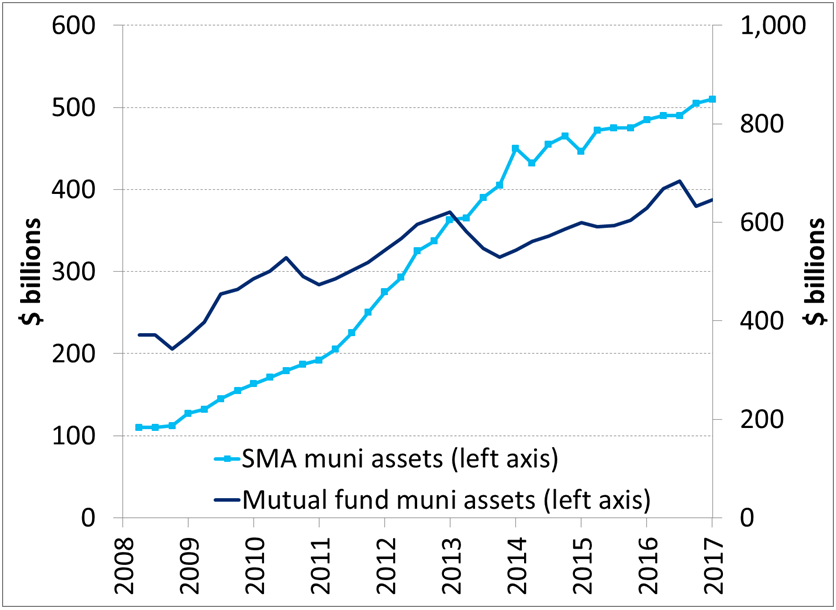

The benefits of SMAs have led to increased use by investors. According to Citibank, SMA municipal fixed-income assets, both taxable and tax-exempt, have grown from $100 billion in 2008 to $510 billion today. The details are not separately reported by the Federal Reserve, so Citibank uses as a quarterly survey of its customers and certain Federal Reserve flow of funds data to arrive at an estimate.

2008 – Q1 2017: Mutual fund rate of growth has declined while SMA growth has increased.

[caption id="attachment_39121" align="aligncenter" width="837"] Source: Citibank[/caption]

Source: Citibank[/caption]

Direct retail muni assets have declined since 2010 from just over $2 trillion to $1.6 trillion.

[caption id="attachment_39122" align="aligncenter" width="836"] Source: Citibank[/caption]

Source: Citibank[/caption]

We feel that mutual fund performance is exacerbated by fund flows and herd mentality and thus presents opportunities for active fixed-income management. When investors are dumping assets, the mutual fund portfolio manager may not be able to fully practice active management and must liquidate funds as required by redemptions. In these cases, the most liquid and generally higher-quality assets may be sold first in order to minimize effects on net asset value (NAV). Alternatively, when assets are pouring into mutual funds the increased demand for assets, resulting in higher prices, can present a selling opportunity for SMA managers.

At Cumberland we buy bonds in large lots and allocate positions to individual portfolios, which allows for better execution and pricing for our clients compared with individual trades for each client.

Cumberland has been able to take advantage of oversold situations during times of stress such as the Meredith Whitney incident (2010), the “taper tantrum” (2013) and President Trump’s election.

Cumberland’s policy of investing only in high-quality bonds improves liquidity and the ability to execute an active strategy. At the end of last year, municipal bonds were not in demand and yielded more than Treasuries did, while the normal muni-Treasury yield ratio is about 76% to account for tax exemption. This turned out to be a good buying opportunity, with expectations that the yield would revert to normal. Technical matters such as lower municipal supply projections and high levels of maturing bonds and interest payments have now reversed the relationship, resulting in outperformance of our bond purchases. For example, on January 25, 2017, we bought a 4% Philadelphia bond for a dollar price of $101.77 and sold it on June 14, 2017, at a dollar price of $106.20. We are expecting this opportunity to continue, with continued low municipal supply anticipated for the remainder of the year.

Retail accounts do not enjoy the economies of scale that are available to an SMA manager. In addition, active SMA managers that practice total-return investing have credit-research resources and relationships with many broker dealers that allow them to achieve competitive execution and develop strategies to optimize investment holdings to meet individual client’s needs.

Some argue that while mutual fund shares can be purchased and sold any day in any amount, an SMA account has many individual holdings that may take longer to sell. However, when one sells shares in a mutual fund, the price received is calculated at the end of the day based on the net asset value of the fund. If one is invested in high-quality liquid bonds like the ones Cumberland purchases in its accounts, barring an extraordinary event in the market the liquidity should be there, and the bonds will be sold at a time that maximizes price. Additionally, knowledge of our clients’ needs has Cumberland looking ahead to provide liquidity when needed. SMAs also give the client the advantage of providing the portfolio manager with sectors or categories that the account owner would like to exclude or include, such as “green” or “ESG.” Customization is not possible with a mutual fund.

Marketing attention focused on millennials has led to the proliferation of robo advisors, which let a person input basic information into an application or website and instantly be granted access to invest funds. This practice may represent a challenge to the traditional asset manager; however, as the millennials’ assets grow, they may well look for active management.

Separately managed accounts have higher minimum investment requirements than mutual funds, so they are not available to all investors. But as an investor acquires more assets and develops more tailored goals and objectives, an SMA may be appropriate.

Finally, the management fee charged on SMA accounts can be affected by the competitive environment. The fee is based on the type of strategy and can be scaled based on the level of assets invested. There may also be minimal custodial fees. Mutual funds have an expense ratio, which includes a management fee as well as miscellaneous ancillary expenses, any custodial expenses and a distribution charge. Many have various levels of sales charges. So it is important to look at all expenses when comparing funds.

At Cumberland we continue to operate as our founders did, investing clients’ funds in separately managed accounts. Our approach to investing is top-down and takes account of global interest rate expectations and credit quality trends. Accounts are actively managed with a total-return or income orientation, depending on clients’ needs.

Sign up for our FREE Cumberland Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.