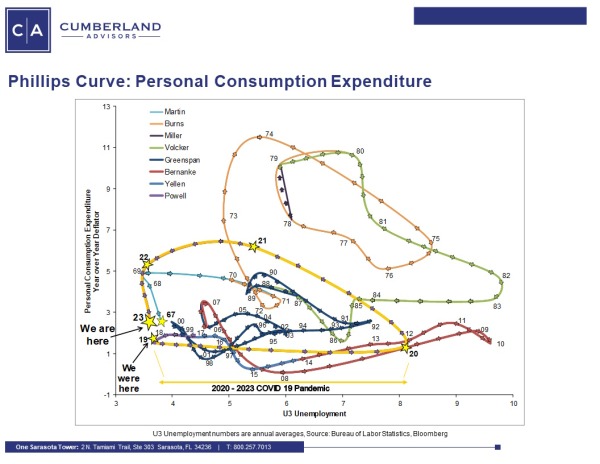

We believe that the effects of Covid on the economy and financial markets are diminishing. And we believe that the Phillips Curve (which represents the tradeoff between inflation and unemployment) is supporting this.

For now, we want to share a long-term chart of the Phillips curve. The horizontal yellow line at bottom identifies the 2020–2023 period of the Covid shock.

Here’s the Phillips curve for just the four main Covid years:

My takeaway is that the initial shock and its results are pretty easy to see. That has been just as true throughout history as in the Covid period.

A study of history tells us that there is a lingering effect from epidemics and pandemics that can last for years. One of those impacts is for the real neutral interest rate to fall in the medium term. This was initially observed by three researchers associated with the San Francisco Fed (Taylor, Alan M., Oscar Jorda, and Sanjay R. Singh. 2020. “Longer-Run Economic Consequences of Pandemics,” Federal Reserve Bank of San Francisco Working Paper 2020-09. Available at https://doi.org/10.24148/wp2020-09), as we found in the course of research for our forthcoming book, The Fed and The Flu. We went on to examine the 19 case studies listed in the SF Fed working paper, and then we researched other plagues, epidemics, and pandemics to see if their economic effects repeated throughout history. The basic answer is yes, and the evidence is carefully laid out and discussed in the book.

So, now the hard question is: Will history repeat in the second half of this decade as the initial Covid shock subsides but lingering effects continue?

Time will tell. Right now, there is a debate. Many observers expect the real neutral interest rate to rise. Our examination of history says it will fall. The implications for financial markets and economic outcomes are substantial. So is the risk.

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Sign up for our FREE Cumberland Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.