Pandemic financial shocks show up in data. Some can be forecasted.

We’ve written about Years of Life Lost (YLL) and about the American decline in life expectancy. Each occurred in 2020. We expect a more severe result for 2021. See the links below for those prior commentaries.

“Jobs, Wages, COVID Demographic Shocks,”

https://www.cumber.com/market-commentary/jobs-wages-covid-demographic-shocks

“M2 Velocity, Fed & Years Life Lost (YLL),”

https://www.cumber.com/market-commentary/m2-velocity-fed-years-life-lost-yll

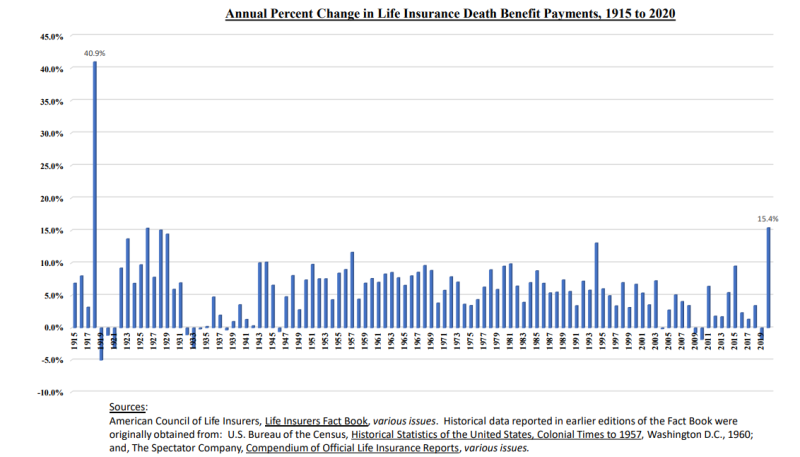

Now see affirmation of those forecasts. Life insurance companies have encountered the highest death benefit payouts since the 1918 Spanish flu pandemic, as reported in the Wall Street Journal.

(“Covid Spurs Biggest Rise in Life-Insurance Payouts in a Century,”

https://www.wsj.com/articles/covid-spurs-biggest-rise-in-life-insurance-payouts-in-a-century-11639045802)

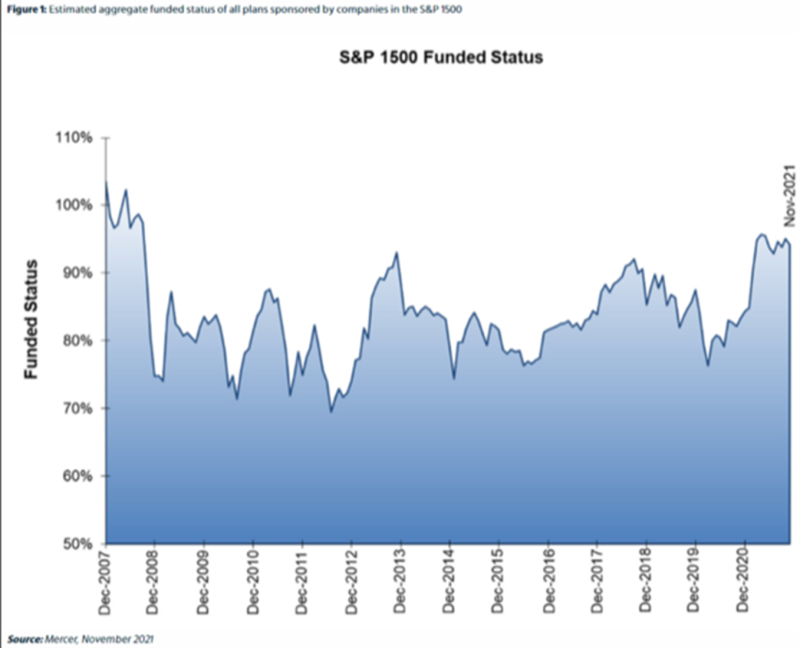

There is another, inversely related dimension of the COVID shock. Higher deaths mean longer-term pension benefit liabilities are lowered; the people who would have received those benefits are now dead.

That means defined-benefit pension systems achieved two forms of funding improvements. They got higher stock market valuations, while their expected payment liabilities were reduced by excess deaths. John Authers details the numbers in the subsection entitled “Exciting Times for Actuaries” toward the end his December 10 Bloomberg Opinion column, “What to Watch Out For in the Inflation Numbers,” https://www.bloomberg.com/opinion/articles/2021-12-10/inflation-numbers-grab-spotlight-from-payrolls-in-biggest-shift-in-decades.

He supplied two charts. The first depicts the rise in life insurance death benefit payments.

(Source: https://www.acli.com/posting/nr21-060)

The second depicts the funding status of pension plans sponsored by companies in the S&P 1500.

(Source: https://www.mercer.us/newsroom)

For nearly two years we have been writing about pandemic shock results and pandemic disruptions to financial and economic agents. We’ve argued that in every shock there are both winners and losers. These are some examples.

For a separate account portfolio manager like Cumberland, these shocks demonstrate that this is not a “business-as-usual” economic cycle. At Cumberland Advisors, we have been working under that assumption for two years. Furthermore, the impact of Long COVID’s partial, temporary or permanent disability from post viral disease effects is just starting to rear its ugly head.

To be blunt, COVID disruptions to human health and financial and economic agents isn’t over.

David R. Kotok

Chairman of the Board &Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.