On Tuesday, the Labor Department released its Job Openings and Labor Turnover Survey (JOLTS) data for the month of August. Given that we are already a week into October, that reading on the labor market is really for the second month of the third quarter is a bit old. Estimates of growth for Q3 range from 1.4% from the Conference Board and the Survey of Professional Forecasters to 2.7% from the Atlanta Fed GDPNow forecast. We know that the economy created 315,000 jobs in August, and new claims for unemployment insurance averaged 207,000 for the month of September, which is in line with what we experienced in the run-up to the Covid pandemic in early 2020.

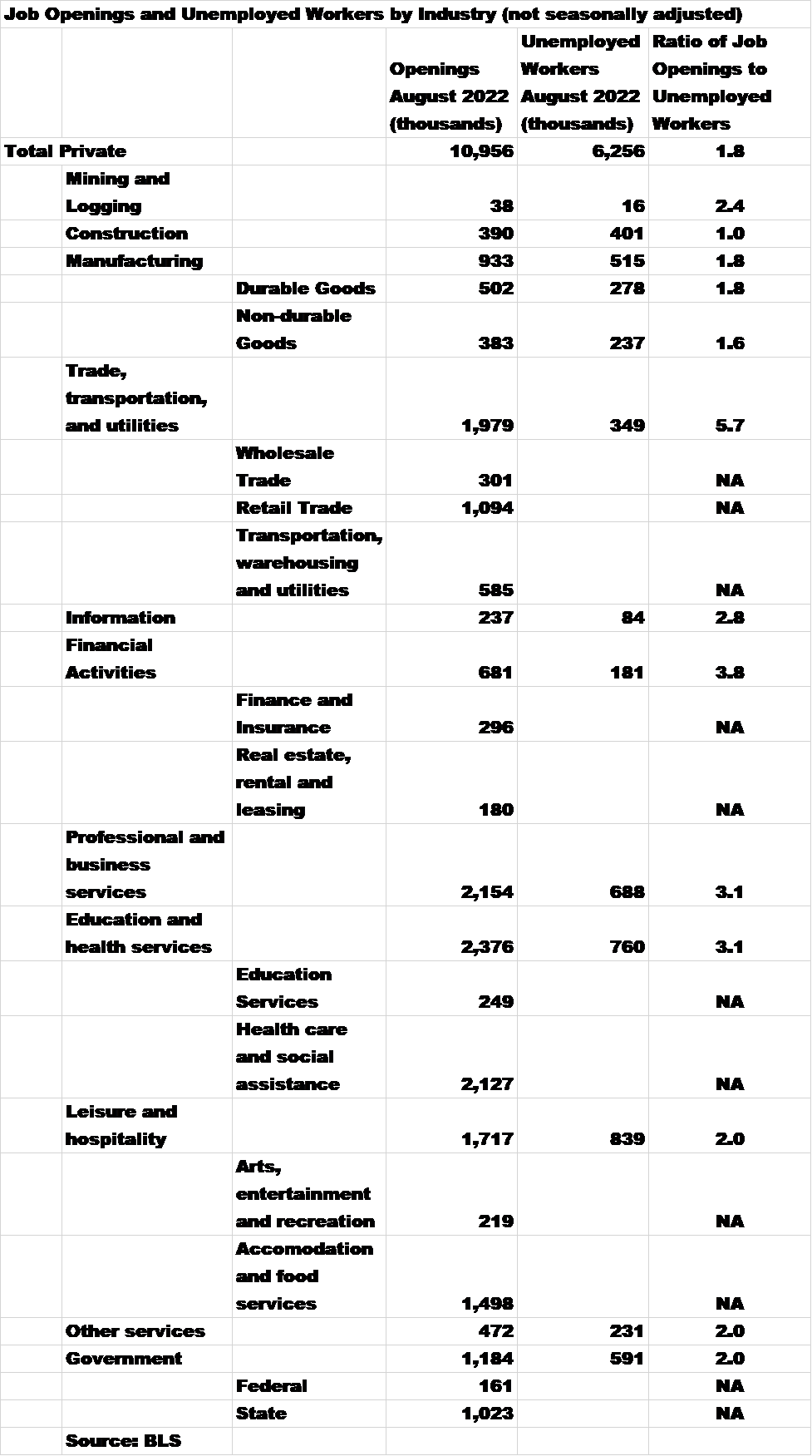

What did the August JOLTS data suggest? It was argued in the Wall Street Journal that there was a big drop in job openings, from 11.2 million in July to 10.1 million in August, and that this suggested the Fed’s policy tightening might be having the desired effect of slowing the economy and might thus cause the FOMC to slow somewhat its policy tightening. Whether this JOLTS news is of any policy significance is uncertain, but there is some useful information on how various industries may be faring. The table below shows for various job segments the not-seasonally adjusted number of job openings from the JOLTS survey, compared with the number of unemployed people in those industry segments where the data are available. The last column shows the number of job openings per unemployed worker.

Overall, while there may have been a drop in the number of job openings, there remain 1.8 jobs for every unemployed person. Looking at the industry breakdowns, the highest number is in trade, transportation, and utilities, where there are still 5.7 jobs per unemployed worker; and the largest number of openings is in retail trade, at 1.094 million jobs. Surprisingly, the next highest ratio of openings to unemployed workers is in financial activities, at 3.8 jobs per potential employee. This is followed by professional and business services and education and health services, each with over 2 million job vacancies and a ratio of job openings to unemployed workers of 3.1 to 1. The picture that emerges from these data is that the job market is still extremely tight, and workers are scarce relative to available jobs but the market is slowing a bit as indicated by the fact that employers added 263,000 jobs in September Understandably, it is not clear whether this pattern has continued into September and October, but there is little in this look into the rear-view mirror to suggest that the Fed will ease at this point from its present rate path policy.

Robert Eisenbeis, Ph.D.

Vice Chairman & Chief Monetary Economist

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.