Japan surprised markets. Below is a brilliant analysis by Brent Donnelly, my friend, fellow fisherman and camper, and author of books on currency trading. We read his missives daily and encourage those who do not subscribe to try the service (https://www.spectramarkets.com/subscribe/). We thank Brent for permission to reproduce his entire piece in full for our readers. Please note that Japan’s actions were anticipated to come after BOJ Governor Kuroda retired, so this is defiantly and definitely a “Kuroda surprise.” Also note that it causes repricing in the entire array of global financial structures that relied on cross currency interest rate swaps. Cumberland’s US Equity ETF portfolio has been carrying a 10% model position in silver and gold miners as a hedge for an event like this. We are holding those positions for the time being, as events occurred months before we expected them. We can change those positions at any time.

Now here’s Brent Donnelly.

Japan wins currency war

In 2010, Brazilian finance minister Guido Mantega said the world was in an international currency war as everyone manipulated their currencies to improve export competitiveness. If you agree with that framework, Japan won. Not only did they get USDJPY up from 75 to 150 and eliminate deflation (with a little help from COVID…) They capped USDJPY with mega intervention from the MOF and now reinforced that 150.00 cap with a change in monetary policy. Here’s a brief history:

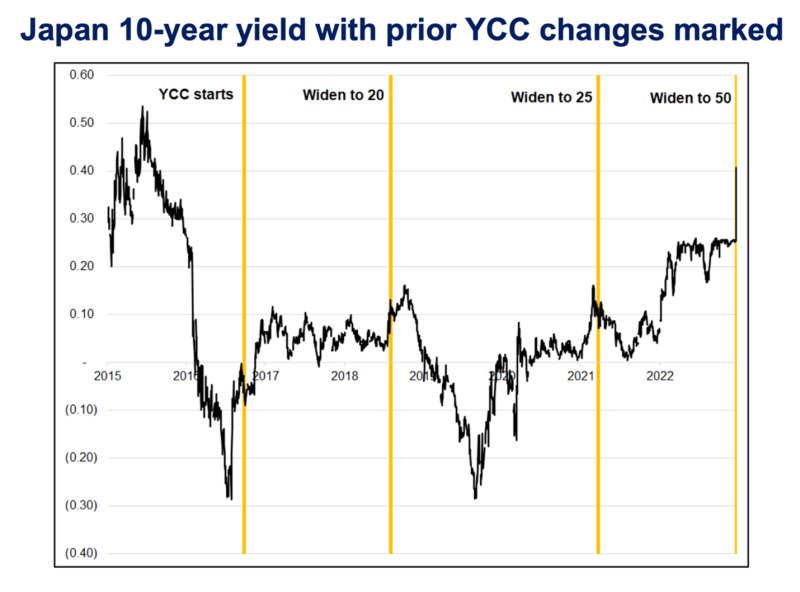

It's tempting to think of last night’s YCC change as a watershed event, but it’s worth remembering that every past change in YCC (including its enactment) was a fade. Japanese yields went higher shortly after YCC was introduced in September 2016 and fell shortly after the band was widened from 10 to 20 in July 2018 and again after it was widened to 25bps in March 2021. Here is the chart with orange/yellow vertical lines marking key dates in the history of YCC.

Japanese yields move with global yields, generally, though obviously you can see from the way the chart pressed up against 25bps that Japanese yields were out of equilibrium there. Swap rates told you the same thing. It is curious that yields didn’t shoot straight to the 50bp cap today, but perhaps that is a matter of time as the BOJ bought bonds last night and that may have dampened the selloff. While it’s exciting to think of this BOJ move as a watershed event, perhaps it’s just another part of the very slow, grinding unwind process of YCC. With nothing to look forward to from the BOJ or the MOF, USDJPY should go back to being a USD story now, not a JPY story.

I would not be paying up for JPY vol here.

The move from 137 to 132 is a bummer for specs because most people, including myself, were expecting this move in Q1, not now. Now that the move has happened, I’m not sure there is much to do here. In fact, USDJPY hasn’t been dictated much by Japanese rates. Even in 2016, USDJPY did very little in a 100/105 range after YCC was enacted. The big breakout higher came after the election and fiscal stimulus promises of US President Trump.

So while the move lower in USDJPY makes sense, of course, I’m not excited about chasing it from here. I think the reset to the next level of Japanese yields has mostly happened, and now we go back to watching US data and US 10-year yields. Bigger picture it is hard to ignore the epic double bottom in the JPY TWI (see first chart on page 1) so selling rallies makes sense in USDJPY but selling here feels fraught.

Other markets

I find it interesting that SPX is close to unchanged, US 10-year yields are up just 6 or 7 bps, USDCAD is lower, USDNOK is lower, and gold and bitcoin are both meaningfully higher overnight. This certainly doesn’t suggest any major contagion or cross-market effect and in a weird way, you could argue that the removal of the BOJ anticipation / uncertainty and concomitant lack of contagion after the move creates less for markets to worry about in the short run.

Today is Tuesday, and stocks are down the past four days in a row, so the odds would favor a rebound anyway. As discussed yesterday, I think the market will take stocks lower into January earnings, but down here after four down days, on a Tuesday, risk/reward probably favors long stocks for the next 24-36 hours—and find a better level to sell if you’re bearish. Though it is worth mentioning that Turnaround Tuesday hasn’t worked of late. Here is the cumulative P&L of Turnaround Tuesday since 2009. Maybe it’s becoming too well-known and oversubscribed?

Final Thoughts

This write-up from my friend Dave Nadig is chock full of interesting concepts. Of particular note is his point that as a society we seem to be focusing less and less on what is important. This resonates with me.

Reminder, South Korea export data comes out tonight at 7pm NY. It has been a good lead indicator for the PMIs.

Have a chatty day.

Brent Donnelly

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.