Discussion on the Monday morning internal portfolio-management strategy call within Cumberland included this quote, which I lifted from a Bloomberg Monday morning piece:

“Some 87% of 331 survey respondents expect the Fed to cut interest rates to 3% or below — some significantly so — in a loosening that 40% believe will start this year, according to the latest MLIV Pulse survey. That stands in contrast to market pricing that puts the implied policy rate around 3.05% in two years.”

Note that this is an internally driven survey by Bloomberg via the terminal. That means the respondents are terminal users and therefore likely to be skilled professional investors rather than the general public.

My colleague David Berson chimed in with this addition:

“And the differential is even bigger compared with the median fed funds projection from the FOMC:

December 2023: 5.1%

December 2024: 4.1%

December 2025: 3.1%

Someone is going to be very wrong.”

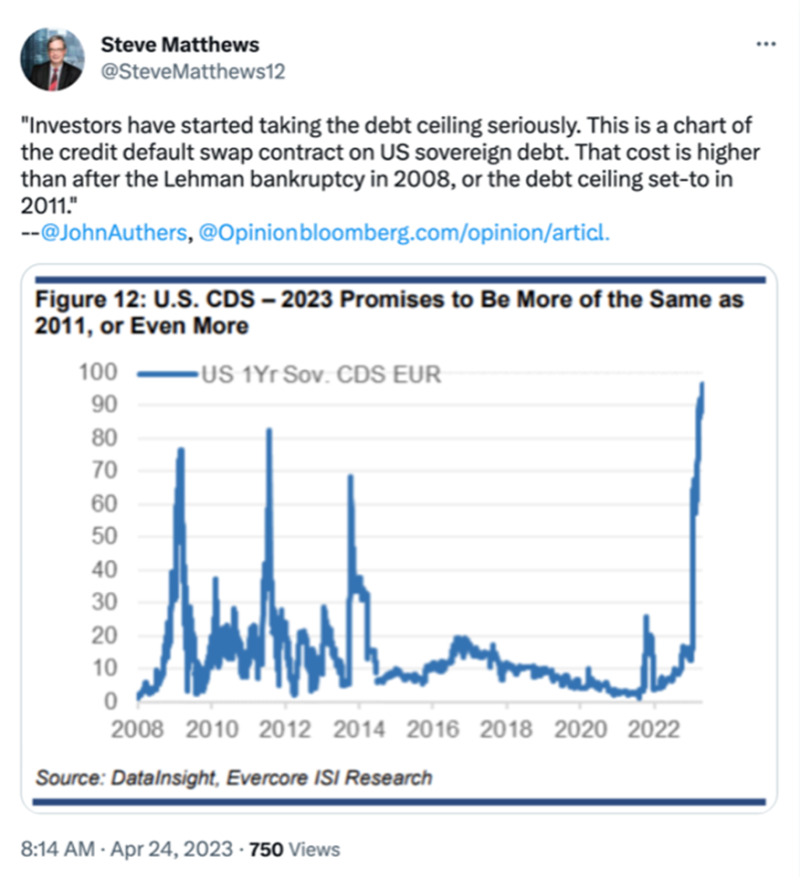

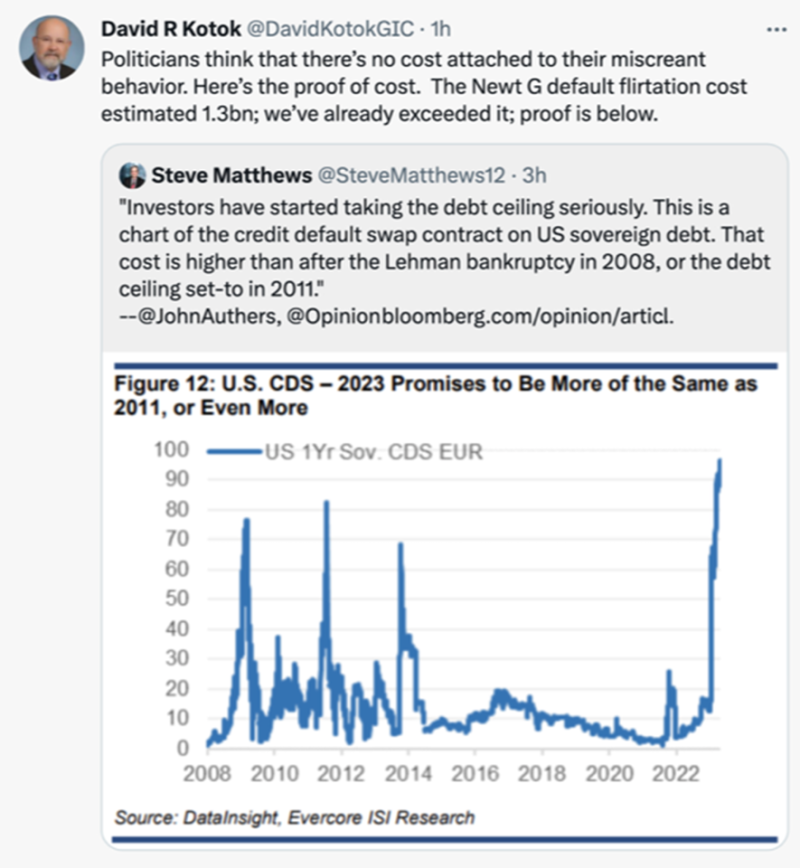

Meanwhile, Steve Mathews, a Bloomberg journalist, tweeted a message that included John Authers’ Bloomberg chart showing that the credit default swap (CDS) on the US is now priced higher than it was at previous peaks, including the peak in 2011 when the debt ceiling fight was heating up, as it is again today.

The American investing public doesn’t pay much attention to credit default swap pricing, but professionals watch it daily. The reason may be that the CDS on the United States is priced in euros. It must be priced in a currency other than the US dollar if its purpose is to achieve a market-based pricing on the creditworthiness of the US. If it were priced in USD, it would be measuring the creditworthiness of ourselves by us.

Steve Matthews tweet: https://twitter.com/SteveMatthews12/status/1650473283555414017

Kotok tweet: https://twitter.com/SteveMatthews12/status/1650473283555414017/retweets/with_comments

My conclusion, offered on our morning call, is “Something has to give.”

We have raised cash in the US Equity EFT portfolio.

David R. Kotok

Chairman & Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.