Using the most recent report of the Consumer Price Index monthly change, the inflation rate in the US is now over 7%. Some commentary calls this “running hot.”

Bloomberg notes that among the major economies of the world (G7 plus China), the US’s inflation rate is the highest. Japan’s is the lowest. All eight countries have a rising inflation rate, regardless of the differences in how they calculate it.

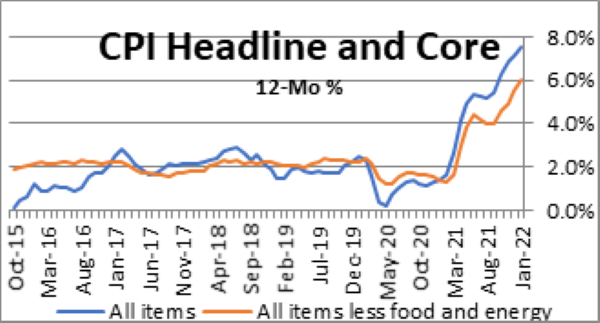

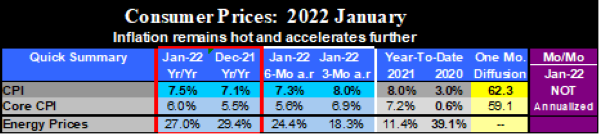

Many thanks to Bob Brusca, Chief Economist at FAO Economics, for the following charts.

CPI gains at 7.5% pace; Core at 6% – No Respite

source: Bob Brusca

source: Bob Brusca

Many American commentators are now outbidding each other in forecasting interest-rate policy changes by the Fed. Will it be a 50-basis-point hike In March? Or only a 25-basis-point hike? Will they hike four times in a row? Five times in a row? Seven times in a row? One Fed president is calling for a 1% rate hike by summer.

What will be the terminal rate, and when will it be reached? Terminal rate means the peak interest rate in this cycle. We haven’t even started yet, and some are trying to guess the terminal rate. Really!

When will the terminal rate be reached? This one is absurd. How can anyone know the timing of something in the future when they cannot even estimate the level with any confidence?

Calm down!

Here’s our take.

1. It is time for the Fed to move the policy interest rate above zero. The move has been a long time coming, and every sensible person on the planet knows that the zero-interest-rate policy (ZIRP) could not last forever. Even in Japan, where this monetary policy has persisted for decades, discussion about moving away from zero has begun.

2. It’s good that it is happening. We are about to restore some basic metrics by having a positive yield above 0.01% for your cash sitting in your money market fund account or in your bank. Getting to a clearly positive interest rate for an overnight money market fund or bank deposit is a good thing. And it will change behavior so that certain activities of yesteryear may resume. Example: My granddaughter may find a few pennies of interest in her savings account and start to consider the value of saving. Second example: Our institutional clients will have more competitive options for millions in deposit funds and will have to look at the term structure of those deposits. That means they will be making more thoughtful decisions about the time value of money, which is what the nominal interest rate term structure is all about.

3. Sensible pricing of returns to assets is very important. When the interest rate is zero, the theoretical value of an asset is infinity. That is the simple math. Discount a future value at a zero-interest rate, and the result is infinity. Infinity pricing means things rise in price forever. This invites crazy behavior. We see it every day and have seen it for years, since the first use of a ZIRP took place in Sweden in 2009.

4. “What is the most extreme, bizarre pricing you have seen?” This is a question I’m asked from time to time. Well, here’s one about a non-fungible token (NFT) sold on a jar of flatulence: “US Woman Who Made Rs 1.5 Crore From Her Fart Jars is Now Selling NFTs of Them,” https://www.news18.com/news/buzz/us-woman-who-made-rs-1-5-crore-from-her-fart-jars-is-now-selling-nfts-of-them-4645397.html. I will leave it to readers to fill in the rest of the jokes about this one.

Bottom line. Getting interest rates up is overdue and will happen. That is a good thing.

Will the Fed overshoot? That is a much harder question. My opinion: They don’t want to create a recession. They realize that we are still in a pandemic shock period. They know from history that such a period doesn’t just end because a politician says it does. They also know that it is critical for them to maintain financial stability in the banking system. So the Fed needs to balance their approach and not succumb to political pressures. Will that happen? We shall soon find out.

Because of this present market volatility, we are seeing some special opportunities in the tax-free municipal bond space from time to time as this panic reaction in markets makes them available. In our US Equity ETF portfolios we remain fully invested. Our international ETF strategies are deploying cash. Please remember that these things may change at any time.

Anyone wishing to see some of our marketing materials about these strategies may email me, and I will relay the request to the appropriate Cumberland department to send details.

The Fed’s moving away from ZIRP is not the end of the world. It is a good thing.

David R. Kotok

Chairman & Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.