Nick Colas and Jessica Rabe of DataTrek Research publish a terrific daily market analysis. They have kindly agreed to let us send their full Coronavirus survey note to our list. We thank them. The full February 23rd letter follows.

David R. Kotok

Chairman and Chief Investment Officer

Email | Bio

DATATREK MORNING BRIEFING

February 23, 2020

Nicholas Colas, Co-founder

[email protected]

Jessica Rabe, Co-founder

[email protected]

IN TODAY'S EDITION

Markets/Data: If the news around COVID-19 is causing you concern about your personal health, you’re much more likely to believe the virus will impact everything from global economic growth to Fed policy and stock prices. That is one key takeaway from our recent DataTrek community survey. The other one: further worrisome news about the virus’ spread will likely act as a near-term negative market catalyst because of that emotional feedback loop.

Disruption: Traffic was extremely light this weekend across China’s 5 largest cities and almost non-existent in Beijing and Shanghai. This is a reasonable proxy for Chinese consumer spending. Separately, news reports from the South China Morning Post reveal that China is using Alipay to essentially electronically/algorithmically quarantine users who may have come into contact with virus carriers or self-report symptoms.

Plus our usual roundup of market action, curated links, and mind candy.

Coronavirus Investment Survey Results

Today we have the results of our COVID-19 investor survey. Thanks to all who participated! First, some background information:

- 274 total completed surveys timestamped between Tuesday and Saturday.

- 81.0% of respondents from the US, 9.5% from Europe/UK, and the balance from rest-of-world including China, Africa, Canada/Mexico and Latin America.

- 96% of respondents were from the DataTrek community of professional buyside and sell side market participants. The remaining 4% came from social media.

Here are the replies to each question, with the most popular response in bold:

Question #1: When do you think China will contain the spread of COVID-19? (Choose one):

- Q1 2020: 6.2%

- Q2 2020: 44.2%

- Q3 2020: 23.7%

- Q4 2020: 14.2%

- 2021 or beyond: 11.7%

Our take: respondents believe COVID-19 will be an ongoing issue in China for at least a few more months, with the field essentially split 50/50 on containment before/after mid-year 2020. Translation: since China has to contain the virus before it can start to resume normal life, there is little consensus among our survey takers about a strong Chinese economic rebound in 2H 2020. This may be more of a 2021 story based on what we all know today.

Question #2: Do you think COVID-19 will cause a global recession (2 quarters of negative worldwide economic growth)? (Choose one):

- Yes: 24.5%

- No: 59.5%

- Unsure/No Opinion: 16.0%

Our take: there is some confidence here that the coronavirus will not cause a global economic contraction. Paired with the prior point, this means that respondents feel that even if the Chinese economy remains sluggish in 2020 the worldwide economy can still avoid a recession.

Question #3: Have you made any changes to either personal or client portfolios as a result of the potential risks posed by COVID-19? (Choose one):

- Yes: 33.9%

- No: 66.1%

Our take: that 34% of respondents reported having already shifted capital surprised us, but with Friday’s volatility is seems more likely that the 2/3rds who have not may consider such a move in the coming week. Put another way, there are still plenty of investors who have not responded to COVID-19 and could reduce risk if markets sell off further.

Question #4: Do you think the Federal Reserve will cut rates in 2020? (Choose one):

- Yes, because of the threat of economic contraction posed by COVID-19: 24.1%

- Yes, but not directly because of COVID-19: 36.9%

- No: 29.9%

- Unsure/No Opinion: 9.1%

Our take: just as Fed Funds Futures currently indicate, respondents believe the Fed will cut in 2020 (67% of those expressing an opinion). That belief is not necessarily tied to an impact of the coronavirus; 61% of those who believe the Fed will cut rates think other factors will drive that decision.

Question #5: Do you think COVID-19 will spread widely (+1,000 cases) through the US or Western Europe? (Choose one):

- Yes: 39.1%

- No: 47.8%

- Unsure/No Opinion: 13.1%

Our take: as of Sunday afternoon, the Johns Hopkins COVID-19 tracker (link below) counts 186 confirmed cases in Western Europe and 35 in the US. A sizeable percentage (39%) of respondents believe those numbers will grow meaningfully in the coming weeks. Less than half (48%) expressed confidence they will not.

Question #6: Do you believe the economic effects of COVID-19 will adversely affect US stocks this year? (Choose one):

- Yes: 56.2%

- No: 32.5%

- Unsure/No Opinion: 11.3%

Our take: most respondents took the survey before Friday’s downdraft, and there was still a narrow majority (56%) that saw COVID-19 hurting US equities. Whether they are willing to sit through any further volatility without reducing risk and feeding a vicious cycle of selling remains to be seen.

Question #7: Which major US stock sector do you think will be the most negatively impacted by COVID-19? (Choose one):

- Technology: 33.6%

- Consumer Discretionary: 20.8%

- Energy: 19.3%

- Industrials: 12.8%

- Consumer Staples: 2.2%

- Financials: 1.8%

- Comm Services/Health Care: 0.4% each

- No impact to any of these sectors: 8.7%

Our take: almost three quarters (74%) of respondents chose Tech, Discretionary or Energy, which were 3 of the 4 worst performing sectors on Friday. Worth remembering: Amazon is 26% of the Consumer Discretionary sector, the same as the combined weight of the next 4 names: Home Depot (10.7%), McDonald’s (6.5%), Nike (5.0%) and Starbucks (4.1%). That means the group not only has sizeable China exposure, but also that the sector’s anchor tenant is a 72x forward earnings stock.

Question #8: How worried are you at present about your personal health and that of your immediate family with respect to COVID-19? (Choose one):

- Very: 2.2%

- Somewhat: 31.8%

- Not at all: 66.1%

Our take: despite the virus’ very limited US presence to date and 81% of respondents based in America, just over a third (34%) reported either a lot or at least some personal concern about COVID-19. That’s an important market observation, because investors concerned about their personal health are more likely to have bearish assessments of its macro effects.

Specifically, those respondents who were very/somewhat concerned about their personal health:

- Were more likely to believe COVID-19 would cause a global recession (36% vs. 25% for the survey as a whole).

- Were more likely to have already made portfolio changes due the virus (46% vs. 34%).

- Think the Fed will cut because of COVID-19 (36% vs. 24%).

- Believe COVID-19 will spread widely in the US/Europe (59% vs. 39%)

- Believe COVID-19 will hurt US stocks (70% vs. 56%)

- Worth noting: despite all this, the “very/somewhat” concerned subgroup was actually slightly more convinced the Chinese outbreak would be contained in Q2 2020 (46% vs. 44%).

Question #9: Do you expect to travel less in 2020 than last year due to concerns about COVID-19? (Choose one):

- Yes: 25.5%

- No: 70.1%

- I do not travel: 4.4%

Our take: while a quarter of respondents saying they will travel less in 2020 may look like a limited impact, it is not good news for the travel/leisure sector where marginal customers drive profitability. Similar to the prior point, this shows that concerns over personal safety are already informing economic decisions.

Pulling together these findings we come to 3 conclusions based on the survey results:

#1: The combination of personal safety concerns about COVID-19 and uncertainty about potential near-term positive catalysts like Chinese containment likely means a continuation of Friday’s volatility and further near-term declines for US/global equities. We rarely make short term market calls, and perhaps the Fed will suddenly reverse course this week, but that’s what the survey data is stage-whispering to us.

#2: The de-risking playbook is clear: sell Tech, Consumer Discretionary and Energy and buy Staples and Health Care. Communication Services did OK in our survey, but it is too overweight high-valuation names like Google and Facebook to be a safe haven. Financials held up relatively well on Friday, but an inverted yield curve is a headwind for the group.

#3: On the plus side, only a quarter of respondents see COVID-19 causing a global recession. While US corporate profitability will see a ding in 1H 2020, the virus’ economic effects should not be enough to lower investors’ earnings expectations meaningfully. That should be enough to limit stocks’ reaction to a pullback rather than a full-on rout.

Final thought: another heartfelt “Thanks” to all who took the survey and supported DataTrek’s goal of providing you data-centric, actionable investment insights. We appreciate you!

Sources:

Johns Hopkins COVID-19 tracker: https://gisanddata.maps.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6

DAILY DISRUPTION FEATURE

Continuing on the theme of the coronavirus we started above, 2 further items.

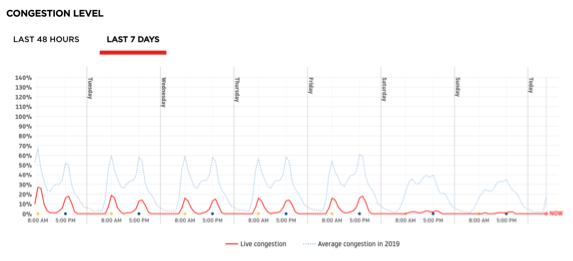

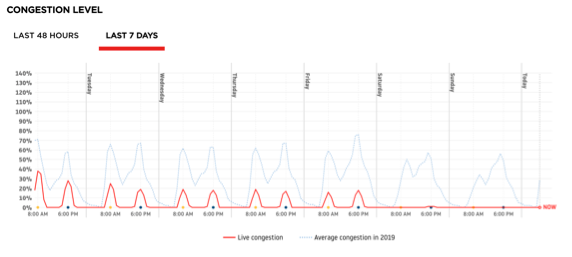

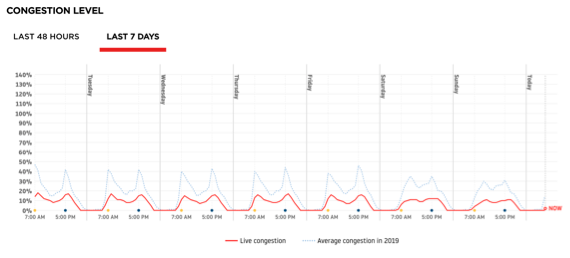

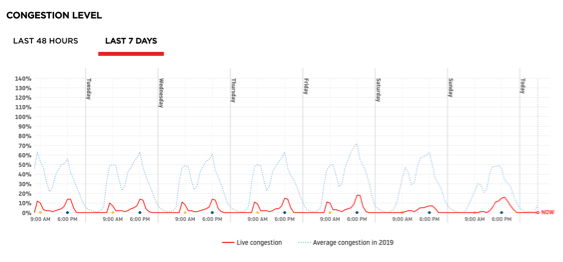

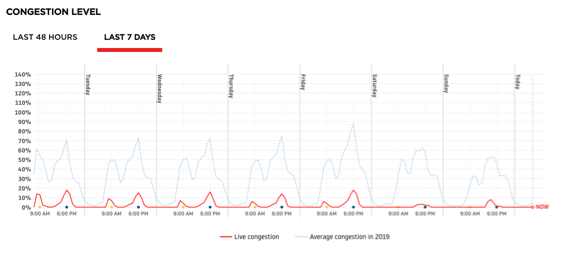

#1: Based on TomTom GPS data from drivers using its devices, discretionary road travel in China was extremely low this weekend. Here are the trailing 7-day time series for traffic congestion in China’s 5 largest cities, with the last week in red and normal (2019 average) levels in light blue:

Shanghai:

- Weekend traffic in China’s two largest cities – Shanghai and Beijing – is essentially congestion free just now, a dramatic change from the typical 35% - 57% congestion rates of 2019. The other 3 cities shown above have lower traffic volumes as well, just not as bad as the country’s political and commercial capitals.

- This shows the extent to which quarantines and travel bans are hurting Chinese household consumption. The typical Chinese work week is Monday – Friday (visible in the morning/evening rush hour data above), so Saturday-Sunday traffic is more likely to be personal shopping/leisure focused.

- The data puts in stark relief why investors are correctly concerned about near-term Chinese consumer consumption trends. Simply put, there’s not a lot going on just now.

#2: Two useful articles about China’s ability to manage the impact of COVID-19:

- From the South China Morning Post, an article that shows how the government is using smartphone apps like Alipay to control population movement. If data analysis shows a user may have been exposed to the virus or reports symptoms, they cannot enter public spaces or use it to pay for mass transit/restaurants/shopping at malls until a quarantine period (7 to 14 days) runs its course.The system is in place in 3 provinces now but will roll out to the rest of the country soon.Read more here: https://www.scmp.com/news/china/society/article/3051907/green-yellow-red-how-big-data-dividing-public-chinas-coronavirus

- The Atlantic magazine answered the question “If China is so good at Big Data, why did the virus spread so quickly?” They attribute the problem to the country’s centralized authoritarian regime, where bad news can travel too slowly to reach Beijing’s policymakers.Read more here: https://www.theatlantic.com/technology/archive/2020/02/coronavirus-and-blindness-authoritarianism/606922/

TODAY'S MARKET RECAP

US equities declined on Friday amid heightened fears about the coronavirus and its impact on the global economy. Large caps and small caps retreated: S&P 500 (-1.05%) vs. Russell 2000 (-1.03%).

Technology (-2.25%) and consumer discretionary (-1.63%) lagged the broader market indices, while real estate (+0.38%) and consumer staples (+0.28%) outperformed. Microsoft (-3.16%) and Apple (-2.26%) weighed on the Dow (-0.78%); United Technologies (+1.08%) and Johnson & Johnson (+1.05%) were the index's best performers.

The Nasdaq lost 1.79%, while the "FAANG" stocks fell: Facebook (-2.05%), Amazon (-2.65%), Apple (-2.26%), Netflix (-1.54%), Alphabet (-2.18%).

The VIX increased 9.77% to 17.08. The 30-year and 10-year Treasury yields ended at 1.917% and 1.473% respectively, while the 2-year yield finished at 1.354%. The difference between 2-Year and 10-Year Treasuries is at 12 basis points. History shows that once the Treasury yield curve inverts (10s yield less than 2s) a US recession is likely.

If you missed today's market action, here is a useful summary by CNBC.

TODAY'S CURATED LINKS

Must Read of the Day: "A new study by Chinese researchers indicates the novel coronavirus may have begun human-to-human transmission in late November from a place other than the Huanan seafood market in Wuhan. The study published on ChinaXiv, a Chinese open repository for scientific researchers, reveals the new coronavirus was introduced to the seafood market from another location, and then spread rapidly from market to market. The findings were the result of analyses of genome-wide data, sources of infection and the route of spread of 93 samples of the novel coronavirus collected from 12 countries across four continents." Source: Global Times

"As coronavirus prevention and control measures continue in China, new outbreaks of the respiratory disease COVID-19 in South Korea, Italy and Iran have health officials on high alert over the global spread of an illness that has infected nearly 77,000 people in China, with more than 2,400 deaths tied to the virus. In a meeting with Communist Party leaders on Sunday, Chinese President Xi Jinping called the epidemic 'severely complex,' noting that efforts to control the spread of the virus have entered a 'crucial stage'." Source: NPR

"Italian authorities have announced sweeping closures in the country's north as they scramble to contain Europe's biggest outbreak of the novel coronavirus. Italy's confirmed cases surged from three on Friday morning to more than 130 by Sunday morning." Sources: CNN

"Intuit is nearing a deal to buy personal-finance portal Credit Karma for about $7 billion in cash and stock, in a move that would push the bookkeeping-software giant further into consumer finance." Source: WSJ

"Warren Buffett’s Berkshire Hathaway stock underperforms the most since 2009. The conglomerate’s stock rose 11% in 2019 compared with a 31.5% total return in the S&P 500." Source: WSJ

"SpaceX is seeking to bring in about $250 million at a price of $220 a share... The fundraising increases SpaceX’s market value to around $36 billion... The raise comes as SpaceX continues development on its three important projects: Crew Dragon, Starlink and Starship." Source: CNBC

MIND CANDY

Garry Kasparov is one of the best chess players ever, but he is known for losing to IBM's Deep Blue in 1997. Last week he went back to the ballroom of a New York Hotel where he was defeated for a debate with AI experts. WIRED senior writer Will Knight interviewed him on "chess, AI and a strategy for staying a step ahead of machines".

One quote that caught our attention: "Technology is the main reason why so many of us are still alive to complain about technology."

You can read the full transcript here on WIRED.

Spread the word!

For every person you refer to subscribe to our DataTrek Morning Briefings, we will give you and our new paying customer a $50 Amazon gift card each as a token of our gratitude.

**Just email [email protected] the name and email of your referral after they subscribe and we'll send you both a gift card asap. As always, thank you for your support!

**New readers can get a 2-week (no credit-card) free trial at datatrekresearch.com.

Questions or Comments? Reach us at: [email protected]

Visit our website at: datatrekresearch.com

DataTrek Research, LLC (“DataTrek”) is making the material, data and information (collectively “DataTrek Information”) contained in this email newsletter (this “Newsletter”) available to its subscribers for informational purposes only. The DataTrek Information is not intended to provide tax, legal or investment advice, and does not constitute a suggestion, solicitation or offer to purchase or sell securities. DataTrek believes that the DataTrek Information is reliable, but does not warrant its completeness or accuracy. DataTrek assumes no duty to update such information. Subscribers should carefully read the DataTrek Terms of Service, Privacy Policy and Subscription Agreement, including accompanying documentation, as those documents contain important information and disclosures about the products or services covered thereby. These documents are available at https://datatrekresearch.com/terms-of-service-for-datatrek-research-services/, https://datatrekresearch.com/subscription-agreement-eula/, and https://datatrekresearch.com/datatrek-research-privacy-policy. DataTrek Information is subject to change at any time. DataTrek is not responsible for third-party information or services, including market data from any securities exchange.

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Sign up for our FREE Cumberland Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.