The minutes from the most recent June 2023 FOMC meeting have been released. They contained the expected recitation of the Committee’s commitment to fighting inflation, and routine discussion of participants’ views about the economy, employment, and the risks to the outlook. There was considerable concern about how much of past policy moves were being reflected in the current data and how much of that tightening remained to be reflected in future data. This uncertainty provided much of the rationale for the Committee’s focus on incoming data rather than on forecasts per se in formulating future policy moves. The Summary of Economic Projections that accompanied the meeting showed in the dot chart that 9 of the 18 participants saw two more rate increases this year, while 3 saw more than that, 4 saw only one more increase, and 2 saw no more increases in 2023. More interesting this time, than the account of participants’ views, was the discussion of the staff forecast, which we know has a significant influence on the policy positions taken by the Board members.

The staff observed that while the economy grew at a modest pace, the job market remained tight; job gains were robust; and inflation remained elevated. In terms of the outlook, the staff concluded that the effects of previous tightening, combined with more restrictive bank credit conditions, would result in declines in real GDP in the fourth quarter of 2023 and the first quarter of next year, resulting in a slight recession. The staff also revised downward its growth projections for both 2024 and 2025. Inflation was projected to be 3.0% this year, reflecting, in part, declines in housing prices. Most importantly, while the staff noted considerable uncertainty about the forecast, due in part to substantial potential effects of development in the banking sector, it saw the possibility of continued growth that would prove sufficient to avoid a downturn. “On balance, the staff saw the risks around the baseline inflation forecast as tilted to the upside, as economic scenarios with higher inflation appeared more likely than scenarios with lower inflation and because inflation could continue to be more persistent than expected and inflation expectations could become unanchored after a long period of elevated inflation.” It seems clear that these upside inflation risks lie behind the SEP projections of two more rate increases in 2023.

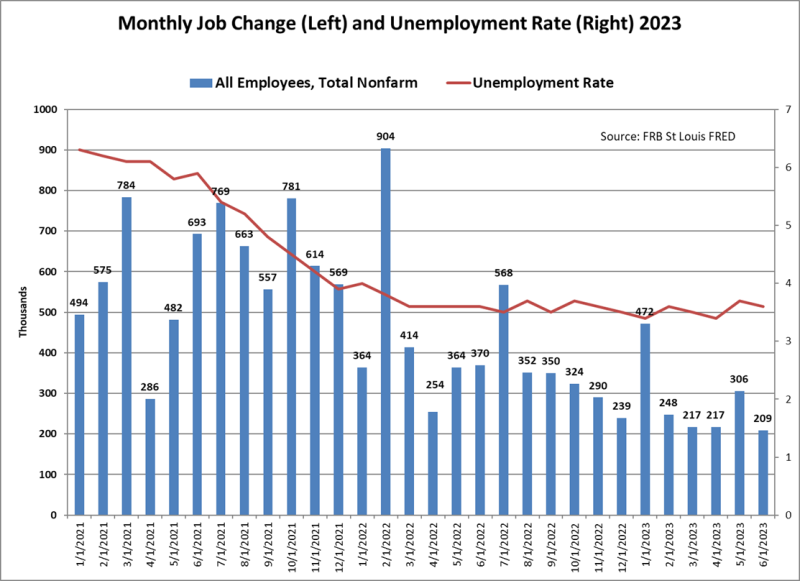

After the release of the FOMC minutes, we got the BLS June report on job creation. Nonfarm payrolls increased by only 209,000 in June, with the unemployment rate at 3.6 As the chart below shows, that number is the lowest we have experienced in the last two and a half years. This is a sign of potential slowing in job creation.

The May data from the JOLTS (Job Openings Layoffs and Turnover Survey), which found that fewer workers were voluntarily leaving their jobs, appears to have been a harbinger of the June data on job creation. This combined with the downward revisions of the employment report for April and May by some 110,000 jobs suggest that the labor market may be weaker than people thought.

The bottom line is that with inflation continuing to decline, some signs of weakening in the job market, and possible slowing of economic growth, combined with the Fed staff’s suggestion that the risks may be to the upside, it is not clear that the potential decline in real GDP growth necessarily implies a recession as distinct from a soft landing.

Robert Eisenbeis, Ph.D.

Vice Chairman & Chief Monetary Economist

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Sign up for our FREE Cumberland Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.