On June 15, the Federal Reserve published revised terms and conditions for what it calls its Secondary Market Corporate Credit Facility, which is a special-purpose vehicle (SPV) created to purchase in the secondary market corporate debt that meets certain eligibility requirements. See https://www.newyorkfed.org/markets/secondary-market-corporate-credit-facility/secondary-market-corporate-credit-facility-terms-and-conditions. Included will be individual corporate bonds, certain exchange-traded funds (ETFs), and bond portfolios that track a broad market index. The US Treasury will contribute about $25 billion in capital to provide loss protection to this SPV; and it is anticipated that this vehicle and another SPV, the Primary Market Credit Facility, could reach a combined size of $750 billion.

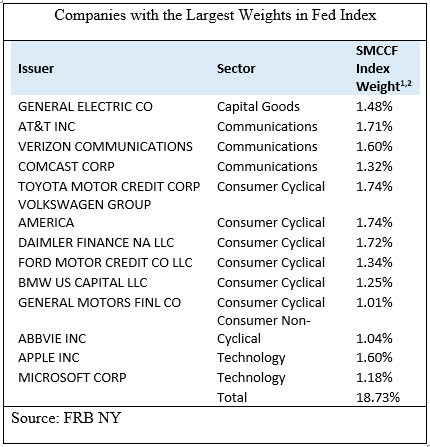

The market index that the bond portfolios must track has been created by the Federal Reserve and is now being published on the website of the Federal Reserve Bank of New York, which is administering the program. The securities in that portfolio must meet the program’s eligibility criteria for purchase. Just to mention a few of the more important requirements, entities must have a credit rating of at least BBB-/Baa3 as of March 22, 2020; they must be US-chartered companies, and eligible securities will be those with less than 5 years remaining maturity. The details on the names of the entities meeting the criteria, their industry category, and weights are provided. The information offered so far does not disclose how the weights were determined or how and under what circumstances the other end of the scale in terms of index weights, 54 firms are listed whose weights each are less than .01%. Among these are Boeing, Lockheed, Northrop Grumman Systems, CBS, Starwood Hotels, Quaker Oats, Blue Cross Blue Shield, Nomura America Finance, and Consolidated Rail Corp, just to name a few.

the other end of the scale in terms of index weights, 54 firms are listed whose weights each are less than .01%. Among these are Boeing, Lockheed, Northrop Grumman Systems, CBS, Starwood Hotels, Quaker Oats, Blue Cross Blue Shield, Nomura America Finance, and Consolidated Rail Corp, just to name a few.

Another interesting feature of the list is that while the Fed says it will not purchase securities of foreign institutions, the index of securities eligible for purchase as noted earlier contains the US-chartered subsidiaries of foreign institutions. In addition to the names of the auto companies mentioned above, other notable entities include Komatsu Finance America, American Honda Finance, Daimler Finance, Nissan Motor Acceptance, three subsidiaries of Anheuser-Busch now owned by INBEV, three US subsidiaries of Germany’s Fresenius AG, and ABB Finance US, a subsidiary of the Swiss company ABB Ltd. In many instances, the parent companies issue dollar-denominated debt in the US as well as guarantee the debt of the issuing subsidiary. To the extent that the Fed creates a market support system for the subsidiaries of foreign institutions, the strength of the parent is improved, and indirect subsidies flow to foreign entities even though the Fed is not purchasing their debt directly. It is hard to justify such subsidies in the name of supporting a market.

It is also important to ask the question, “What problem is the bond-purchase program attempting to solve?” The Fed argues that it is trying to ensure the smooth functioning of the bond market; but it has provided little or no evidence of problems, especially in 2020 after the pandemic hit the economy. In fact, the SFMA (Securities Industry and Financial Markets Association) reports that corporate debt issuance for each month in 2020 through June exceeded monthly totals for the comparable period in 2019. Year-to-date issuance in 2020 was $1.2 trillion, compared with $660 billion in 2020, an 89.2% increase (https://www.sifma.org/resources/ research/us-fixed-income-trading-volume/). This volume is quite surprising given what has happened to the US economy because of the pandemic. Moreover, the program has only been in place a short while and as of July1 totaled only about $10 billion.

One case study is especially relevant here. Boeing’s problems have been well documented for over a year as its sales have crashed due to problems with its 737 Max aircraft. The pandemic has contributed to both a broad-based decline in air traffic and a cutback in acquisition of aircraft, and the end is not in sight. Yet in late April, Boeing had a blockbuster debt issuance of $25 billion, bringing its total outstanding debt burden to $54 billion and increasing its projected interest expense from $722 million in 2019 to $1.2 billion in 2020 (https://www.forbes.com/sites/jeremybogaisky/2020/05/01/boeing-25-billion-debt/#40d246041f88). To be sure, the issue came at a large interest cost of about 5%; but considering the fact that Boeing is extremely risky, that the deal was even consummated suggests that financial markets are functioning.

In the face of a questionable rationale, the expansion of the Fed’s activities beyond the Treasury market represents a slippery slope that puts the Fed at risk of committing to more such activities in the future, especially if Congress regards the Fed as a cash cow whose activities don’t involve Congressional funding of projects, as it did when it raided the Fed’s capital surplus to fund a highway bill in 2015 and again in 2018 to help fund the Economic Growth Act of 2018. Moreover, the Fed now finds itself in the business of picking corporate winners and losers. Firms whose debt is eligible for purchase receive a subsidy that is not available to all, and with little or no oversight. Finally, the relationship with Goldman Sachs also raises issues. Goldman is a primary dealer with access to the primary dealer credit facility, but it also owns a bank that has access to the discount window at subsidized rates. This close relationship ranks it, along with JPMorgan Chase and BNY Mellon (who provide the plumbing for the tri-party repo market), among the three institutions that are most likely to be too big to fail under any foreseeable circumstance.

Robert Eisenbeis, Ph.D.

Vice Chairman & Chief Monetary Economist

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Sign up for our FREE Cumberland Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.