Jamie McGeever’s article at Reuters, “Fed’s inflation target ambiguity risks market misstep on the Fed’s communication dilemma,” is a worthwhile four-minute read for any investor trying to sort out a directional pathway in the second half of this extraordinary 2022. Here’s the link: https://www.reuters.com/business/finance/feds-inflation-target-ambiguity-risks-market-misstep-2022-06-30/.

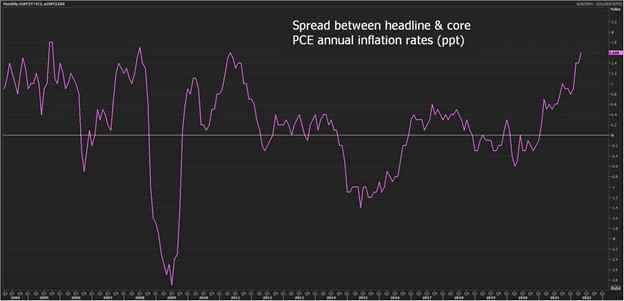

McGeever particularly notes the asymmetry between setting Fed policy when headline inflation is lower than core and when headline is higher than core, as it is today. Here’s a Reuters chart that depicts the asymmetry.

The best guess is that the Fed will raise policy-making short-term rates (SOFR or fed funds) into the range between 3% and 4%. Futures pricing will set market-based expectations at every moment in time, but accuracy of the rates’ forecasts is uncertain. Futures’ prices change on every headline.

Meanwhile, the disparity among global central banks’ policies results in highly volatile foreign exchange markets. We remind readers of the free availability of our new pamphlet on the subject. Here’s the link to the electronic version of “Yield Curve Control”: https://www.cumber.com/pdf/Commentary/Yield-Curve-Control-the-story-of-ZIRP-and-NIRP.pdf.

Gary Shilling and Fred Rossi were kind enough to grant permission to use chart #13 from their monthly Insight newsletter (http://www.agaryshilling.com/insight). Here’s the chart:

Note how the Japanese yen is now the funding currency as the Bank of Japan maintains an unlimited bid to sustain the 10-year government bond yield at 0.25%. Who wouldn’t want to borrow at that rate and loan the proceeds out at a higher rate? Note that the market agents who do this run their books with a maturity mismatch since the currency portions of their trades are hedged with rolling short-term currency futures. Why? Because shorter-term interest rates are predicted by central bank policy interest rate-setting meeting schedules. So sophisticated market agents can now trade against the central banks. Is it any wonder the US ten-year Treasury yield drops rapidly? It’s a one-way trade until Japanese monetary policy changes. When that happens and how violent it will be is anyone’s guess.

Add war, pestilence, a viciously divided American political landscape, a news flow of disruptions from disinformationistas, and a world that we will characterize as unstable and with high risk premia, and you see that the stage is set for extremes in gamma.

For those unfamiliar with the math, gamma is how you distinguish between the delta of a derivative and the delta of the underlying security. Delta is the rate of change in each; gamma is the difference between the two rates of change.

We enter the second half of this year with a 20% cash reserve in our US Equity ETF accounts. The next 20% is deployed in our quantitative strategy. The remaining 60% is overweight aerospace-defense, healthcare, and alternative energy (not fossil fuels). We have minimal exposure to banks, as we believe the long period of banks funding at near-zero interest rates has passed.

Here are two official photos that describe something about our current world. Notice who is among the absent. He’s busy with “one country, two systems” – new version, 25 years after the demise of the old version.

The world without Xi is depicted below. No offense, Africa, South America, and Antipodean Twins.

Lastly, we send this depiction from Twitter of post-Brexit cuisine. You may draw your own conclusions. Stay safe.

And as a postscript, here’s Justin Lahart’s excellent July 4 column on why uncertainty premia are looming large — kudos to the WSJ and to Justin.

“Our Recession Forecasting Model Is Broken,” https://www.wsj.com/articles/our-recession-forecasting-model-is-broken-11656943200.

David R. Kotok

Chairman & Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.