The chart below was featured in a Bloomberg column by John Authors, published on December 16 (“Fed's Last Christmas Before Biden Is All About WAM,” https://www.bloomberg.com/opinion/articles/2020-12-16/fed-s-last-christmas-before-biden-is-all-about-wam).

Core PCE has emerged as the most important inflation measure, as it is likely to have a stronger influence on the Fed’s policy decisions than other inflation measures. We use the Dallas Fed’s notices for updates on details involving PCE. See “Trimmed Mean PCE Inflation Rate,” https://www.dallasfed.org/research/pce.

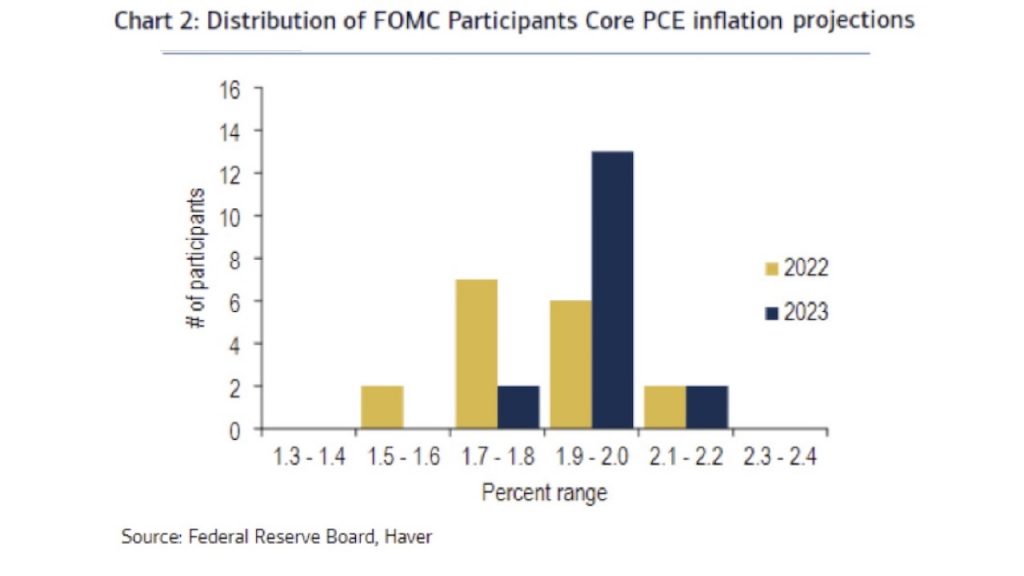

But what about the 19 people (7 governors, 12 presidents) who constitute the Federal Open Market Committee (FOMC)? They are “the deciders,” to use a term made memorable by George W. Bush (“The Decider,” https://www.nytimes.com/2006/12/24/weekinreview/24stolberg.html).

A fascinating study entitled “The Making of Hawks and Doves: Inflation Experiences on the FOMC” can be found in National Bureau of Economic Research (NBER) Working Paper 23228 (https://www.nber.org/papers/w23228). Researchers Ulrike Malmendier, Stefan Nagel, and Zhen Yan show that “personal experiences of inflation strongly influence the hawkish or dovish leanings of central bankers.” We recommend this study to anyone interested in central bank policy making. It may help explain some bias in policy making among human beings who try to be “data-driven.”

Nutritionists say “You are what you eat.” For central bankers the paraphrasing might be “You are what the inflation expectations were when you were in your formative years.” Please bear in mind that the NBER working paper is also “data-driven.”

My own formative adult years were the ’60s and ’70s. I personally recall a social gathering tent outside Jackson Lake Lodge at a time when anyone could walk up to chat cordially; security guards and cameras weren’t ubiquitous. Given all that period entailed, am I and others of my generation overly worried about inflation returning? This paper suggests the answer may be “yes.”

That said, I still worry. Guess it’s rooted my personal formative years and experience of inflation. If you’re “data-driven,” too, please read the working paper.

David R. Kotok

Chairman of the Board & Chief Investment Officer

Email | Bio

This originally went out via email to subscribers: Check it out.

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Sign up for our FREE Cumberland Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.