The US equity market continues to post new all-time highs week after week. While the equity market remains seemingly unstoppable regardless of the lack of fundamental support, many investors wonder how long the Fed-fueled market can go before we have a correction. It would be a fool’s errand to call a correction, but we want to share some indicators that might be helpful to our readers.

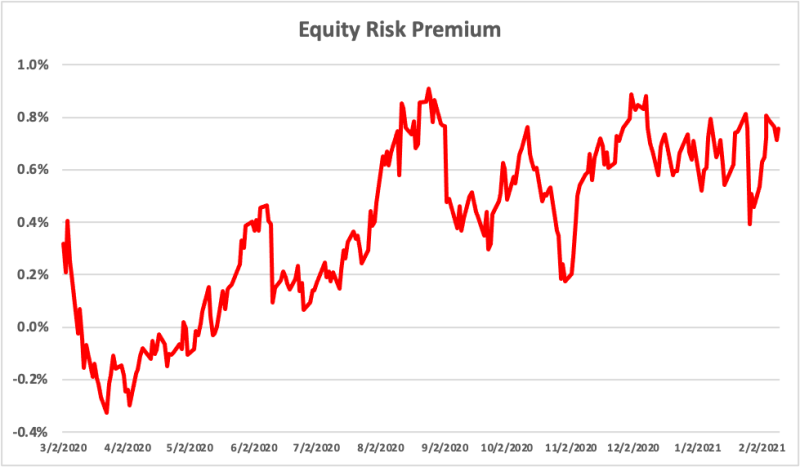

Equity risk premium (ERP) refers to the excess return earned in the stock market over risk-free investments. ERP shows how much investors are compensated for the amount of risk they incur by holding stocks. Intuitively, the market may become overvalued when ERP is high, as investors are overpaying for their excess returns, and vice versa. Below, we’ll use forward risk to demonstrate the ERP over the past 12 months.

Figure 1 shows that ERP turned negative during the COVID selloff in March 2020. This rare occasion could be interpreted as the market’s paying investors to take on equity market risk. Indeed, looking back from just one year later, that would have been a once-in-a-lifetime opportunity to buy stocks. The fast recovery since the March bottom brought the ERP up from -0.3% to +0.9% at the end of August – a very high level compared to its historical average of 0.6%. Shortly after, the S&P 500 suffered its first 10% correction since the March selloff. Not surprisingly, the huge uncertainty before the presidential election brought the ERP to a low of 0.2% right before the election. The market has returned 16.2% since then, bringing the ERP back to a high of close to 0.9% since December. Although this is not a definitive indicator of a market correction, the current ERP is certainly implying that underlying risk in the equity market is at a maximal level for the short term. As the market tends to mean revert over time, volatility is most likely to persist in the market.

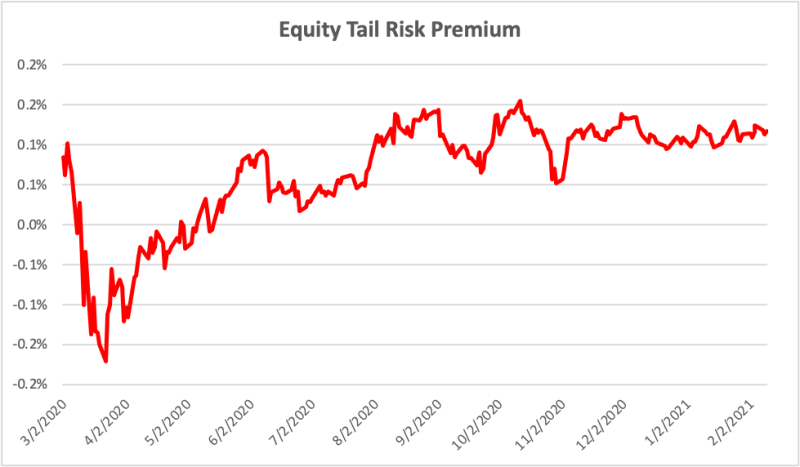

At Cumberland Advisors, we also use the equity tail risk premium (ETRP) for our analysis. Unlike risk in general, tail risk includes only the possibility of a large fall. Figure 2 confirms the same message as Figure 1. The current ETRP is 0.12%, twice the historical average of 0.06%, implying that equity market risk is favoring the downside more than the upside.

Although EPR and ETRP are not immediate correction indicators by nature, we hope they help our readers assess the current stock market. Given that the market tends to miscalculate volatility during significant price movements, we advise investors to use caution during the present market melt-up.

Leo Chen, Ph.D.

Portfolio Manager & Quantitative Strategist

Email | Bio

*Data from Bloomberg as of 2.12.2021.

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Sign up for our FREE Cumberland Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.