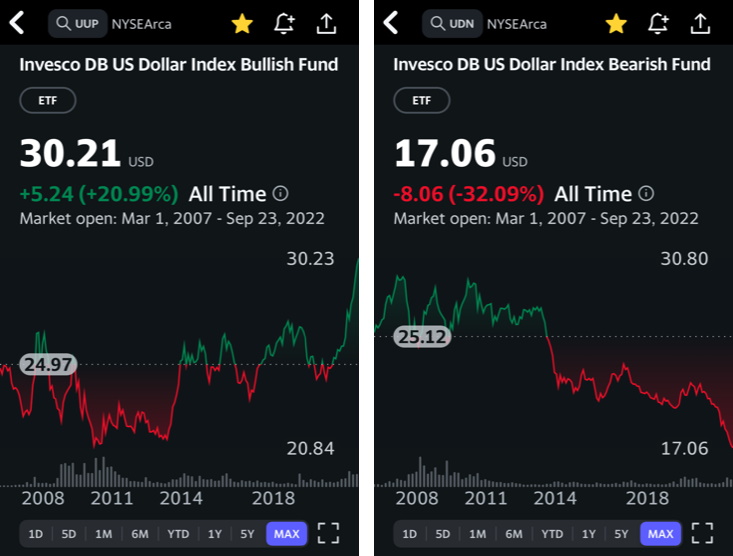

We used Yahoo Finance to extract the visual effects of the US dollar’s gyrations. Let’s tell the story with two ETFs. One shows US dollar strength and the other shows the weakness; these are against a basket of six major world currencies relative to the US dollar. The two ETFs operate as a basic inverse structure.

As you look at the two charts below, try to visualize how such gyrations interfere with international trade and how much additional cost is imposed for hedging. I will ignore the issue of trading these ETFs. Cumberland has only one strategy that might trade these securities and it currently has no position in either of them.

Some financial market agents tend to focus internally on portfolio management. They may use an ETF like the ones depicted here. Meanwhile, industrial and commercial enterprises focus on their business operations and costs. That’s what is important to us at the moment.

Gyrations like you see depicted in the two ETF charts result from the decisions of market agents. But such volatility can impact businesses adversely. For those publicly reporting companies, their cost increases will soon be showing up in the earnings results for Q3. The October and November earnings report season is now critical reading for analysts of companies whose business is partially international. We’re concerned about what may be revealed.

As this is written, Cumberland’s US Equity ETF portfolio is nearly 50% in cash and equivalents. Of course, that can change at any time. We’re looking for the opportunity to redeploy some cash.

Below are the two charts. We’ve purposefully shown the entire trading history.

David R. Kotok

Chairman & Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.