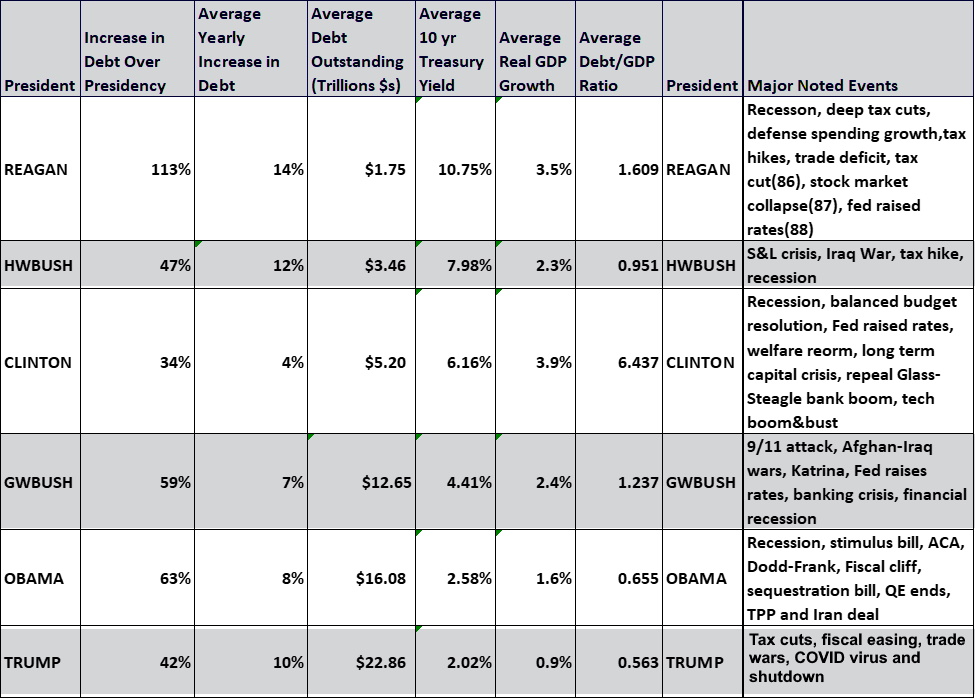

With all the political handwringing about the federal deficit, we wanted to find a picture worth a thousand words – in this case a chart – to tell the story. Hat tip to David Blond for assembling this graphic.

Our conclusion is that the noise about the deficit is just that. The political party in control ignores the noise. The political party in the minority makes the noise. Then they reverse roles when politics swaps out the old majority party for the new one.

Financial markets seem to ignore the deficit. Only when the Federal Reserve launches an interest-rate hiking cycle does the deficit seem to matter — and, even then, it isn’t clear that it does. History is mixed on the question.

One additional note. The federal deficit is currently running about $230 billion a month and will soon start to shrink, albeit slowly. The Fed is purchasing $120 billion a month. Foreigners purchase about $70 billion a month just with the capital account surplus. Remember, a trade deficit has to be recycled with a capital account surplus.

The net financial pressure from the federal deficit is about $40 billion a month, and that relatively small amount is likely to shrink. Such shrinkage would permit the Fed to taper asset purchases without engaging in a tightening of QE policy.

We don’t know how markets would respond to the tapering. Fed communications could help if the Fed clearly explains its rationale.

Our bottom line is this: The deficit handwringing by politicians is a sham. The graphic by David Blond of QuERI International tells the story. It appears in David’s post, “26 Trillion Is Just a Number,” at http://www.queriinternational.com/queri-papers-on-global-issues.html.

David R. Kotok

Chairman of the Board & Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.