The Cumberland Advisors Week in Review + Digest is a compendium of news, commentary, and opinion from or of interest to our team. These are not revised assessments, and circumstances may have changed in the market from the time of original publication. We may include older and/or guest commentaries that our editors have determined may be of interest to our audience. Your feedback is always welcome.

Our latest Week in Review Video is now available online. This end-of-week update on markets generally features equities, bonds, and trading highlights. Thank you for joining us.

Matt McAleer & Equities

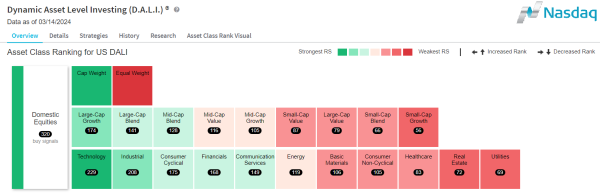

- Our Tactical Trend strategy relies heavily on Relative Strength

- Adobe hit hard by less than optimal forward guidance

- Yields have impacted sector performance

John Mousseau & Bonds

- PPI reported much higher than what was expected

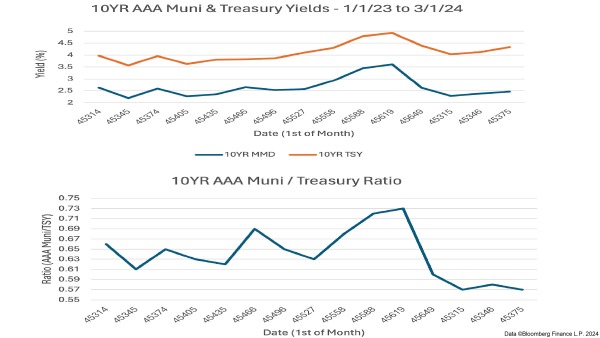

- 10yr U.S. Treasury yields sitting just above their recent 4-4.25 range

- Muni/Treasury Yield Ratio shows why demand for Munis remains strong

Check out this week's featured charts below:

Watch this week's video using either the link above or the following:

Cumberland Advisors’ Week in Review on YouTube

Access past video updates including the most recent via this YouTube Playlist URL: https://www.youtube.com/playlist?list=PLu1JZIQ1mPrtx_q7i_C9FWN-cb9f594C1

Please send any feedback from today’s email/video to Matt McAleer. You can reach him at:

Email: [email protected]

Twitter: https://twitter.com/matthewcmcaleer

LinkedIn: https://www.linkedin.com/in/matthew-c-mcaleer/

Call Matt: (800) 257-7013 ext. 346

Other questions or comments? Email us at [email protected] or give us a call at (800) 257-7013

Have a great weekend,

Cumberland Advisors

Camp Kotok Corner Perspectives, News, and/or Resources from Attendees |

China Demographics Slidedeckby Michael Drury December 11, 2023 Michael Drury is a frequent "camper" up in Maine and the chief economist for McVean Trading & Investments, LLC. Michael assesses macroeconomic developments around the world to help develop hedging strategies using futures markets in interest rates, currencies and industrial materials. He travels extensively in the United States and China, as well as to Japan, Europe and Latin America. In this slidedeck, he gives his assessment of China's current and projected demographics, thus shining a spotlight on what type of market opportunities those demographics may reflect. |

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Sign up for our FREE Cumberland Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.