Steve Sexauer and I spent about an hour discussing a superb paper he coauthored with Laurence Siegel. I recommend it to readers. It will give investors and decision makers some perspective on how to navigate through the COVID-19 shock and out the other side. Here’s the link.

https://blogs.cfainstitute.org/investor/2020/08/20/living-with-risk-the-covid-19-iceberg/

Below is an excerpt that the authors provided in lieu of an abstract. There is a comments section at the end of the full paper. – David Kotok

Living with Risk

Laurence B. Siegel and Stephen C. Sexauer

August 2020

“On the other side is everything else that matters: livelihoods that allow people to feed and shelter their families; civil liberties; the education of children; social well-being, including the prevention of loneliness, isolation and domestic violence; and all other medical conditions, from cancer and heart disease to dental emergencies.”

Sooner or later, the threat of the novel coronavirus epidemic will fade. The virus will not be eradicated, but we will adapt and learn how to live with the risk of SARS‑nCoV-2 infection. (The virus will also adapt, something very much on the minds of researchers and public health officials.)

The new normal: Lockdown economics

What is new this time is that public authorities in much of the world, including the governors of forty-five of the fifty U.S. states, have issued emergency orders that have locked down large swaths of economic and social activity – schools, restaurants, church services, weddings, and funerals, as well as most of the factories and offices that produce the world’s goods. Internal and external travel restrictions have compounded the economic paralysis.

These lockdowns, while apparently beneficial if imposed early and briefly, have delivered an enormous economic shock – one so large it is a “crisis” by any historical measure. In the U.S., the decline in GDP in just three months has wiped out five years of economic growth, and on a per capita basis the standard of living may have fallen to 2004 levels. Government employment is down 1.5 million jobs and is at year-2000 levels. Not even in the Great Depression was any one quarter’s economic decline so rapid. Worse, the economic freefalls have been devastatingly uneven. Some industries, such as air travel and hotels, have been almost obliterated, while online shopping and delivery jobs boom.

Many core commonwealth goods provided by governments are at risk. Many needed medical procedures are postponed. Government revenues have collapsed while debt levels rapidly expand.

The COVID iceberg

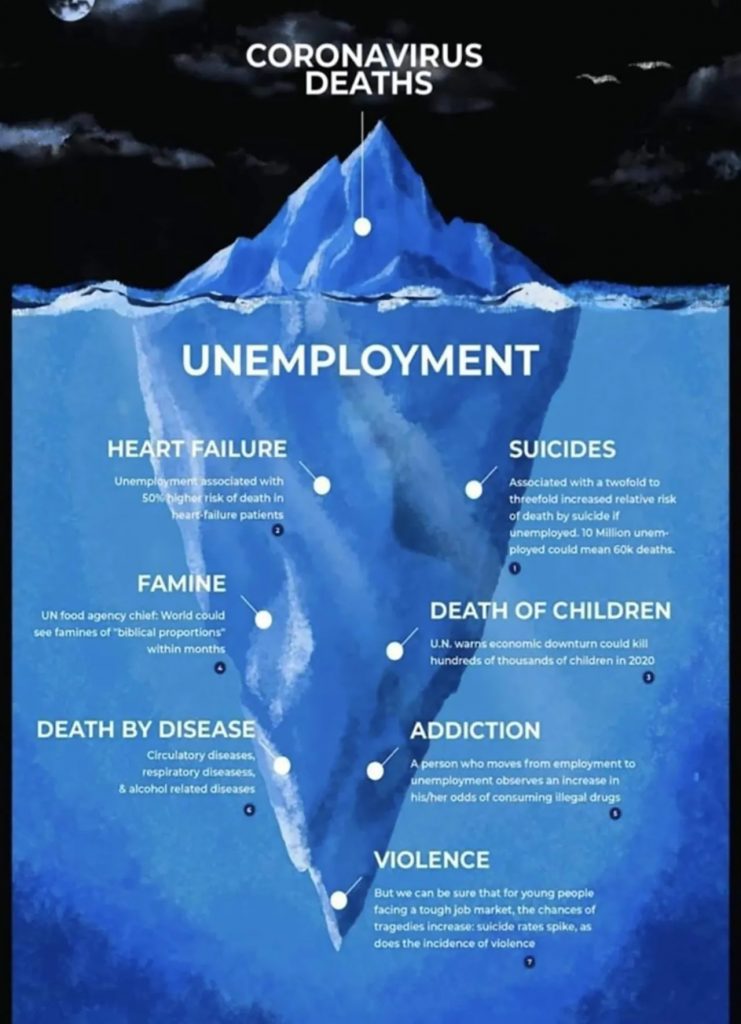

The great 19th century French economist Frédéric Bastiat famously distinguished “what can be seen” from “what cannot be seen.” Policymakers focus almost entirely on the former while neglecting the effects on the latter. This observation is relevant to the COVID-19 pandemic.

What formerly could not be seen is rapidly being seen, as Exhibit 2 illustrates: disruptions to the global food supply chain, medical and psychological effects that include stress-related heart disease, untreated complications of diabetes and cancers, suicides, homicides as violence spirals upward, and the slow death (aided by drugs and alcohol) that accompanies the sudden poverty of the wallet and of the spirit.

Exhibit 2 - Source: Dan Mitchell

Note: “Death by disease” should also include death due to delayed medical diagnosis and treatment. Coronavirus deaths during the pandemic period must be compared with deaths from economic causes and delayed or forgone medical treatments over the next five to 10 years, not just over the pandemic period.

Another major loss is from delayed or avoided medical diagnoses and treatments, due to unavailability of doctors and/or fear of infection from going to the hospital. Cancer treatments are being skipped. Diagnoses of heart attacks are way down, not because coronaviruses are good for your heart, but because marginal symptoms are being ignored instead of investigated.

Bill Gates has pointed out yet another casualty: “We will have lost many years in malaria and polio and HIV [remediation] and the indebtedness of countries of all sizes and [degrees of] instability. It’ll take you years beyond that before you’d even get back to where you were at the start of 2020.” [Levy, Steven. 2020. “Bill Gates on Covid: Most US Tests Are ‘Completely Garbage’.” Wired (August 7), https://www.wired.com/story/bill-gates-on-covid-most-us-tests-are-completely-garbage/] And Gates calls himself an optimist!

Last word

As we adapt to the SARS-CoV-2 virus – for that is what our almost infinitely adaptable species is going to do – we expect to be on the other side of Dr. Ladapo’s fulcrum where “everything else that matters” is renewed. What matters includes livelihoods that allow people to feed and shelter their families; civil liberties; the education of children; economic and technological growth; social well-being, including the prevention of loneliness, isolation, and domestic violence; and the treatment of all other medical conditions, from cancer and heart disease to toothaches.

The sooner, the better.

David R. Kotok

Chairman of the Board & Chief Investment Officer

(Again, the original Steve Sexauer / Laurence Siegel paper can be read here: https://blogs.cfainstitute.org/investor/2020/08/20/living-with-risk-the-covid-19-iceberg/)

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Sign up for our FREE Cumberland Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.