We continuously assess the size of the once-in-a-hundred-years economic shock from COVID-19. There are two parts to the economic toll that COVID is taking. The first is deaths and what that means in the computation of years of life lost (YLL). The second part is post-COVID syndrome (PCS), or long COVID, and its consequences – loss of work, loss of income, cost of care and rehabilitation, and other economic impacts. This work is ongoing.

For the United States, we have been using a ratio of 9 YLL for each death. That ratio is an early estimate and is still being developed by the medical and scientific community. The deeper we dig, the more important this estimate becomes. Consider the anecdotes. Cruise ship customers are mostly from the older demographic cohort. Bars in spring break college destinations are mostly the younger cohorts. Auto sales are different by demographic. So is apparel. If a million people disappear in addition to the natural demographic, their collective income and spending and saving also disappears. Below we will outline some effects of the disability cases and offer a new approach to estimate the excess deaths which takes comorbidities along with other factors into consideration.

The issue of COVID disability is much harder. We’re just learning more about it.

We are trying to divide COVID long haulers into two cohorts: those who contend with partial disability and those who suffer total disability. There is growing evidence that as many as 10% of COVID survivors evidence some form of long haul symptom. Many of these long haul cases are only starting to evolve.

Much remains to be discovered: What symptoms resolve and how long does that take? What damage may last a lifetime? We are also working on the estimation of the additional burden to healthcare systems from long haulers. We want to remind readers that these are new references for economic and financial market users. Until COVID, we had no reason to develop these metrics. What is clear to us is that the ratio of the deaths number to the long haul disability number is narrowing into something like 5 to 10 times the actual COVID deaths. In the United States, that means millions of people who are likely to experience a form of COVID disability. When you do this on a global scale, the issue becomes an enormous human shock and an unprecedented economic shock.

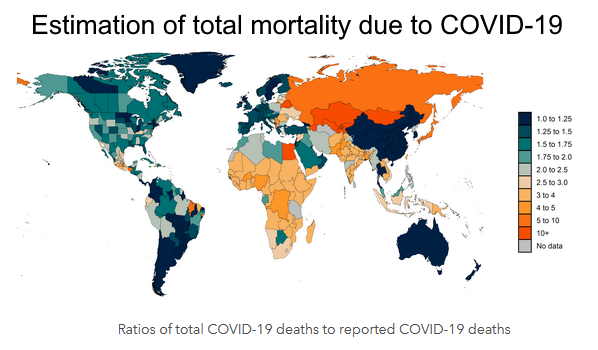

Now there is a more detailed update on the estimates regarding deaths, from the Institute for Health Metrics and Evaluation (IHME), an independent population health research center housed at University of Washington Medicine. Bottom line: the number of deaths has been underestimated, and the revision is a profound increase. We expect figures to be refined again over time. What the actual numbers of pandemic-hastened deaths mean for the long haul multiplier is still to be revealed. We have excerpted below the paragraph about the six “drivers” of this newer method and estimate of deaths.

“Excess mortality is influenced by six drivers of all-cause mortality that relate to the pandemic and the social distancing mandates that came with the pandemic. These six drivers are: a) the total COVID-19 death rate, that is, all deaths directly related to COVID-19 infection; b) the increase in mortality due to needed health care being delayed or deferred during the pandemic; c) the increase in mortality due to increases in mental health disorders including depression, increased alcohol use, and increased opioid use; d) the reduction in mortality due to decreases in injuries because of general reductions in mobility associated with social distancing mandates; e) the reductions in mortality due to reduced transmission of other viruses, most notably influenza, respiratory syncytial virus, and measles; and f) the reductions in mortality due to some chronic conditions, such as cardiovascular disease and chronic respiratory disease, that occur when frail individuals who would have died from these conditions died earlier from COVID-19 instead. To correctly estimate the total COVID-19 mortality, we need to take into account all six of these drivers of change in mortality that have happened since the onset of the pandemic.”

Here is the link to the full paper: “Estimation of total mortality due to COVID-19,” http://www.healthdata.org/special-analysis/estimation-excess-mortality-due-COVID-19-and-scalars-reported-COVID-19-deaths.

So far, our investment thesis remains intact. We believe the American healthcare sector faces increasing demands due to long COVID treatment and rehabilitation needs. Our US ETF portfolios continue to be overweight that sector. We expect American companies to be world leaders as global long COVID symptoms reveal their impact throughout the entire array of countries and economic regions.

David R. Kotok

Chairman of the Board & Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.