Forty-three percent of US COVID-19 deaths are linked to nursing homes. State figures range from a high of 80% in New Hampshire and 77% in Minnesota down to 27% in Nevada and 34% in Nebraska and Tennessee. See both

“43% of U.S. Coronavirus Deaths Are Linked to Nursing Homes,” New York Times, June 27, 2020, https://www.nytimes.com/interactive/2020/us/coronavirus-nursing-homes.html?referringSource=articleShare and

“Nearly half of all coronavirus deaths in US occurred inside nursing homes: report,” Fox News, June 29, 2020, https://www.foxnews.com/health/almost-half-of-all-deaths-in-us-occurred-in-nursing-homes-report.

We offer two citations for this story to show that it is possible for competing news channels that occupy different places on the political continuum to report statistically based information that is helpful to each and every one of us. We further note that the Fox News report credited the New York Times for its data-based analysis.

If you have one person who is dear to you and who is living in a nursing home because of age or infirmity, you understand that watching diverse sources for news is better than being a captive of Hannity and Ingraham on the extreme political right or Lemon and Cuomo on the left. In my own daily work, I watch both news outlets and a lot of others: TV, radio, print, web, social media, and a mountain of research sources on economics and financial markets. These days about 100 COVID-19 items a day make it across my screens. We seek them from worldwide sources and in English translation from other languages.

Let’s get to one example regarding the other 57% of US COVID deaths and how it impacts our economic decisions. Here’s an Associated Press story about a ”Let's see who can get COVID first” party in Alabama (“Alabama students throwing ‘COVID parties’ to see who gets infected: Officials,” ABC News, July 1, 2020, https://abcnews.go.com/US/alabama-students-throwing-covid-parties-infected-officials/story?id=71552514). The organizers of the parties are purposely inviting guests who have COVID-19. “They put money in a pot and they try to get COVID. Whoever gets COVID first gets the pot.” You can decide for yourselves about the intelligence levels of the participants in this one.

Another data point. A very recent note from my personal physician in Sarasota included this item: “At Sarasota Memorial Hospital, the number of patients in the hospital admitted to the ICU and on ventilators has increased significantly over the last 3 weeks. We are seeing all age groups affected. The ages of the last 5 admissions to our ICU were 18, 36, 46, 55, and 64 years old. While we previously saw many cases due to nursing home outbreaks, currently we are seeing new cases coming from community spread due to the reopening process.” Dear readers: These new patients are from the 57% cohort, not from nursing homes.

Another example on a different tack is the latest information about the leading Chinese entry in the global COVID-19 vaccine race. On May 22, a China-led consortium published its full data and technical information for the world to see (“Safety, tolerability, and immunogenicity of a recombinant adenovirus type-5 vectored COVID-19 vaccine: a dose-escalation, open-label, non-randomised, first-in-human trial,” https://www.thelancet.com/journals/lancet/article/PIIS0140-6736(20)31208-3/fulltext). Here is an article about the paper, in case readers prefer a distillation that’s quick to read: “Coronavirus vaccine developed in China shows promise after early study in 100 people,” Live Science, May 22, 2020, https://www.livescience.com/coronavirus-vaccine-adenovirus-china.html.

The company responsible for the vaccine, CanSino Biologics Inc., started at a backyard BBQ with a gathering of Canadian and Chinese vaccine sleuths a decade ago. You can read their story here: “How China’s CanSino Biologics jumped to the front of the coronavirus vaccine race,” Japan Times, July 2, 2020, https://www.japantimes.co.jp/news/2020/07/02/asia-pacific/science-health-asia-pacific/china-cansino-coronavirus-vaccine/#.XwCRKvJ7l-U and here: “How a Chinese Firm Jumped to the Front of the Virus Vaccine Race,” Bloomberg, July 1, 2020, https://www.bloomberg.com/news/articles/2020-07-01/how-a-chinese-firm-jumped-to-the-front-of-the-virus-vaccine-race.

Please note that, according to Bloomberg, “CanSino has also received scientific kudos for publishing the full data from the first phase of its human trials in the Lancet medical journal,” while “other front-runner vaccine makers, including major western efforts have only released selected data points and positive press releases” (“Coronavirus Daily: China’s Leader in the Vaccine Chase,” Bloomberg, July 3, 2020, https://www.bloomberg.com/news/newsletters/2020-07-03/coronavirus-daily-china-s-leader-in-the-vaccine-chase). (Bloomberg, with its global media services, represents one of the finest accumulations of financial and economic data and analysis in the world. They are a well-curated and politically neutral reporting source. In my daily work I count Bloomberg, Reuters, and the AP as among the most credible, neutral, fact-checked news sources.)

The case study above is instructive and determinative. America faces crucial choices, and the outcomes of those choices will be decided partly in Washington DC and partly by the global network of academic, corporate, and government researchers and manufacturers. Which approach do we want to take – information sharing and accelerated development of globally acceptable treatments, cures, and vaccines, or a piecemeal approach with politically inspired barriers and inaccurate and incomplete information? Want the first? Stop the blame game now and reactivate global relationships at once, starting with WHO funding by America and others. China never withdrew from the WHO, and every other member country is engaged in a full, open exchange of information. Americans from the professional and scientific side are as well. Erect more barriers, and we’ll get an even more disastrous outcome. The first choice gets us economic recovery; the second choice prolongs the pain.

An American leadership element that is not participating in a global solution is the Peter Navarro-poisoned faction in the Trump administration. They have taken the stupid trade and tariff war that was focused on soybeans and lobsters and tied it to the pandemic blame game. On June 22, on Fox News’s The Story, Navarro told host Martha MacCallum that the US-China trade deal was “over” because, Navarro said,

“They came here on January 15th to sign that trade deal, and that was a full two months after they knew the [coronavirus] was out and about. It was a time when they had already sent hundreds of thousands of people to this country to spread that virus, and it was just minutes after wheels up when that plane [with the Chinese delegation] took off that we began to hear about this pandemic.”

Navarro went on to liken China’s actions to the Japanese government’s holding peace talks with the US in late 1941, just weeks before the attack on Pearl Harbor. (“Peter Navarro walks back statement implying trade deal between Trump, China is ‘over,’” Fox News, June 22, 2020, https://www.foxnews.com/media/peter-navarro-walks-back-china-trade-deal)

Navarro had to quickly walk back his assertion that the trade deal had been killed by Chinese duplicity; but he has reiterated his caustic thesis as recently as July 3, in an interview with MSNBC host Ali Velshi, in which Navarro added the accusation that, under the shield of the WHO, China had failed to divulge an accurate genomic picture of the virus. (“Trump trade adviser Navarro blasts Beijing for ‘spawning’ the coronavirus and then ‘seeding and spreading’ the disease,” MarketWatch, July 3, 2020, https://www.marketwatch.com/story/trump-trade-adviser-navarro-blasts-beijing-for-spawning-the-coronavirus-and-then-seeding-and-spreading-the-disease-2020-07-03)

To be fair, we should remember that Navarro was apparently the first person to warn Trump about the virus: “Trump learned of a memo in January warning ‘half a million American souls’ could die of coronavirus, and he was displeased his adviser put it in writing,” Business Insider, April 11, 2020, https://www.businessinsider.com/trump-peter-navarro-january-memo-coronavirus-deaths-2020-4.

In my personal opinion, Navarro is a vile influence on US policy. He has duped the president and may ultimately help to sink him in November. Blame game in the midst of a pandemic works against economic recovery from a pandemic shock. Markets are moving on post pandemic outlook, not on blame game acrimonious media by Navarro. Trump himself chose to “walk back” his own advisor.

Fortunately, the major American companies and research institutions have ignored the Navarro policy attacks. So we see US firms and labs in consortia with global partners to advance the effort for COVID-19 treatments, cures, and vaccines. That is why the health sector outperforms.

In our Cumberland portfolios we have been and continue to be overweight in the healthcare sector. First, it makes good sense strategically to own public companies that comply with disclosure rules in this health sector. The logic is obvious. But what about the prospects for financial success and the risks involved? That is harder to evaluate today, because the outcomes are not likely to be seen for about two to three years. Today we see the spending on research and development; tomorrow we see the results.

For a macro view, we start with the following sequence. In the United States at the beginning of this year and in the pre-COVID statistics, the entire healthcare sector was about 18% of gross domestic product (GDP). Readers must note that the GDP calculation is of output and does not take into account revenue sources. If you look at the companies that trade publicly in the US and specifically at the larger ones that are listed on stock exchanges, you will see that about 40% of their revenues are obtained abroad. Company by company, you will encounter this composition. Readers can do their own detailed research. Healthcare is one sector with a high percentage of revenue sourced abroad; domestic electric utilities are a sector with one of the lowest percentages.

The point is that the 18% healthcare component of GDP is destined to head to about 20% in the post-COVID world. That is a Cumberland opinion. 2022 is probably the first full year when reporting information will guide us to a more refined estimate, so today we are guessing. The figure may end up being 21% or 19%, but we believe it will go up, not down. It is the upward direction that gives this investment robustness. The American healthcare sector is destined to be a huge, globally profitable, and immensely powerful influence. It will be the sector that restores health to the United States and contributes to the improving health of the rest of the world.

Can America capitalize on this outcome for our nation’s benefit? Will that work for investors as well? It can, but achieving that result will require a different policy approach than the Navarro-poisoned well from which President Trump and his acolytes are drinking. In the midst of a global pandemic, protectionism hurts America; isolationism hurts America; barriers to exchanges among technical professionals hurt America. And the anti-immigration blanket application of physical or administrative walls hurts America. For the nation’s health, these policies must be reversed. Start immediately with three million refugee green cards for Hong Kong emigrants and bring that HK brain drain to the US.

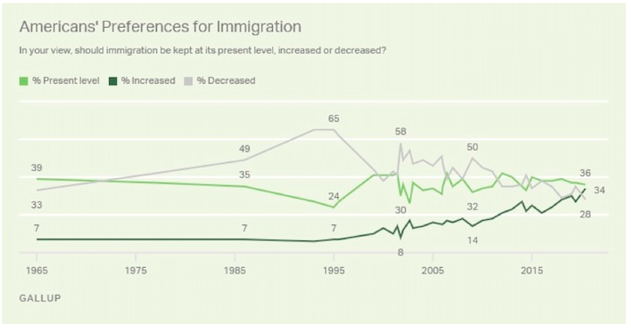

The American populace is once again waking up to the fact that well-managed immigration can help the nation. The Gallup polling organization has found that for the first time in decades, more Americans favor increasing immigration than decreasing it. Farmers who do not have the labor they need to help them grow and harvest their crops are now victims of a policy that is reliant on barriers, even as they do their level best to feed our country and the world. Tech companies that have used work visa programs successfully now have to put in triple the effort to bring people to the US and keep them here. This administration’s blame game and its isolationist policies are doing more and more damage daily.

Meanwhile, the inter-country and inter-company exchanges in the science-driven war on COVID-19 are progressing robustly. Sometimes it takes repeated shocks to change things. Maybe, just maybe, we have reached that stage. Confirmed disease cases in Florida that now regularly surpass 10,000 in one day have Governor Ron DeSantis’s attention. Five young admissions to the ICU unit have prompted the Sarasota commissioners to pass a mask ordinance that fines violators.

Events can get serious enough to make politics change. Four times the deaths of the Vietnam War era have got Trump’s attention. They had better.

We recommend that investors and financial market agents overweight the healthcare sector for longer-term strategic positioning. At Cumberland, we have done so and continue to do so.

David R. Kotok

Chairman of the Board & Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Sign up for our FREE Cumberland Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.