Kotok prefatory note: This 20-minute read (4700 words plus charts) is an exploration of the cost of the debt ceiling crisis. We expect that there will be serious academic work on this subject within a year or two, just as occurred after the 2011 debt ceiling crisis. Please consider all opinions herein as preliminary. The opinions are those of David Kotok and not necessarily those of the company, Cumberland Advisors.

HOW MUCH DID THE DEBT CEILING FIGHT COST?

I’ve had this question from clients, consultants, and journalists. So, below is my estimated range of the actual and prospective total cost of the recent (2023) debt ceiling political fight. I’ll summarize first, then outline my methods and explain why the markets and citizens seem to ignore the cost.

Summary: The recent debt ceiling fight was a politically contrived attempt to force the bypassing of the traditional budget process. It ended in a settlement prior to an actual default by the United States. The negotiation process extended to within a few days of what would have been an actual default by the US Treasury (the X-date). This political action has a cost attached to it, and I am trying to estimate what that cost will turn out to be when all is done. I use several methods. I include the references to the 2011 episode of debt ceiling brinkmanship. Depending on the methods used, the estimated cost of the 2023 debt ceiling political fight ranges from as low as $4 billion for one year to as much as $1 trillion for a ten-year period. In my opinion, the higher number for the longer period is closer to the correct estimate; the reasons are explained below. This cost will be distributed broadly among many sectors and elements in the US economy. Thus its impacts on individuals and entities are highly diffuse and not obvious to casual observers. I speculate that it is the diffuse nature of the distribution of the total cost that makes it mostly invisible to the taxpayers and voters. That is why there is no significant political reaction to such a high cost.

1. HISTORY LESSON FROM 2011

A Federal Reserve study titled “Take It to the Limit: The Debt Ceiling and Treasury Yields,” examined the 2011–2013 debt ceiling fights and has been updated through 2017. Authors David Cashin, Erin Syron Ferris, Beth Klee, and Cailey Stevens wrote:

“While there were many occasions on which this debt limit was raised without event, during the 2011 and 2013 episodes, there were a flurry of news reports suggesting that the debt limit may not be raised in a timely manner. In addition, top government officials warned of potential dire consequences to the global economy in the event of a debt limit ‘breach.’ Against this backdrop, yields on Treasury securities rose notably, and in particular, Treasury yields on securities that could be affected by delays in a principal payment increased even more.”

(Source: “Take it to the Limit: The Debt Ceiling and Treasury Yields,” https://www.federalreserve.gov/econres/feds/files/2017052pap.pdf.

Cashin, David, Erin Syron Ferris, Beth Klee, and Cailey Stevens (2017). “Take it to the Limit: The Debt Ceiling and Treasury Yields,” Finance and Economics Discussion Series 2017-052. Washington: Board of Governors of the Federal Reserve System, https://doi.org/10.17016/FEDS.2017.052.)

Their paper summarizes research done following the 2011 and 2013 debt ceiling crises and describes the mechanisms that raised the costs as the political fight progressed in those periods.

The Fed researchers sized up the impact on the Treasury’s borrowing costs:

“We find that yields across all maturities were 4 to 8 basis points (bps) higher than they otherwise would have been just prior to the projected breach dates during the 2011 and 2013 debt limit episodes, but fell precipitously upon resolution of the episode. As a result, Treasury borrowing costs during each episode were roughly $250 million higher than they otherwise would have been.”

Note that the 2011 and 2013 episodes were of much shorter duration (a few days) than the 2023 crisis (five months). Also, they didn’t overlap with three bank failures as happened during the 2023 debt ceiling crisis period.

The Fed report continues: “Our second finding is that excess yields on individual bills maturing soon after the projected breach dates appeared earlier and were significantly higher during the 2013 episode, peaking at 46 bps in 2013, but only 21 bps in 2011. We find no evidence of elevated yields on coupons with interest payable soon after the projected breach dates in 2011 or 2013.”

The Fed paper concluded: “This contagion effect — by which yields on longer-term Treasury securities not perceived to be at risk of delayed principal or interest payments are nevertheless affected — leads to higher borrowing costs to the Treasury as the projected breach date nears.”

While the Fed study focused on Treasury bills maturing around the X-date estimate, the broader Bipartisan Policy Center (BPC) and the Government Accountability Office (GAO) derived more extensive estimates of one year cost and total cost from the 2011 crisis. Jonathan Masters, writing for the Council on Foreign relations, “A 2012 study by the non-partisan Government Accountability Office estimated that delays in raising the debt ceiling in 2011 cost taxpayers approximately $1.3 billion for FY 2011. BPC estimated the ten-year costs of the prolonged fight at roughly $19 billion” (“U.S. Debt Ceiling: Costs and Consequences,” Council on Foreign Relations, https://www.pbs.org/newshour/politics/debt-ceiling-1) https://www.gao.gov/products/gao-12-701). Here’s the public report: “Debt Limit:

Analysis of 2011-2012 Actions Taken and Effect of Delayed Increase on Borrowing Costs,” https://www.gao.gov/products/gao-12-701. See also “Debt Limit Analysis,” https://bipartisanpolicy.org/debt-limit/ (BPC).

Let’s move on to 2023.

2. USING EARLIER METHODS TO ESTIMATE THE 2023 DEBT CEILING CRISIS COST

Federal debt more than doubled between 2011 and 2023. Here’s the quarter-by-quarter history, captured in a chart, courtesy of the St. Louis Fed: https://fred.stlouisfed.org/series/GFDEBTN. Readers may hover over the graph and see the quarterly numbers. For the purposes of this narrative let’s just round and say that between 2011 and 2023, the debt aggregates more than doubled from about $15 trillion then to about $31.5 trillion in this year of the 2023 debt ceiling crisis.

While the debt was rising, so was the GDP; but GDP was not rising as fast as the debt was. Therefore, the debt/GDP ratio helps us evaluate the degree of pressure faced by the economy as that ratio expands. Here’s the link to the St. Louis Fed: “Federal Debt: Total Public Debt as Percent of Gross Domestic Product,” https://fred.stlouisfed.org/series/GFDEGDQ188S. Notice that the ratio has increased by about 20 points and is currently about 120%, down from the Covid peak of about 135% but up from the 2011 peak of about 95%.

So, my smallest estimates are easily derived by taking the earlier work focused on the 2011 and 2013 crisis and enlarging their estimates by the increase in the debt outstanding and by the change in the debt/GDP ratio. That assumes all other things are equal, which, of course, they are not. That is how I get to a low-end, one-year 2023 debt-ceiling-fight cost estimate of $4 billion and a low ten-year cost estimate of $50 billion.

Here’s an explanation of the 2023 mechanics of the debt ceiling fight explained by a politically neutral organization. https://bipartisanpolicy.org/explainer/debt-limit-analysis-may-2023/.

3. EVIDENCE AS TO WHY THE 2023 CRISIS WAS MUCH MORE SEVERE THAN 2011’s, HAS MORE LASTING EFFECTS, & IS MORE COSTLY

In 2011, the market response to a debt ceiling political crisis was severe for its time. And that was the case even though the event passed quickly. There was a credit rating downgrade of the United States issued on a Friday after markets closed. There were price changes in US Treasury securities.

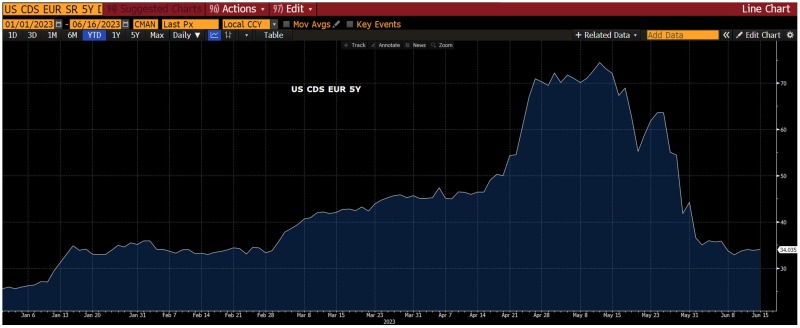

To estimate the cost of the debt ceiling fight we are using the cost of insuring the payments by the United States with a market-based pricing mechanism. That is the credit default swap price. It is a traded item and is denominated in euros, because you cannot denominate an independently traded credit insurance cost in the currency of the same country you are insuring. This is true for every nation that issues debt denominated in its own currency.

Below are three graphics. The source is Bloomberg. They depict credit default swap pricing for the first half of 2023. You can see the pricing in basis points (1/100th of 1% equals 1 basis point). Each chart shows the dates at the bottom, so that we can track the changes in pricing the creditworthiness of the United States as time progresses and the sequence of events unfolds, between when the first political discussions started and when they peaked in intensity right before the X date threshold was reached. Please remember that the impact you are seeing in these charts is only on the US Treasury debt. We will discuss the impact on other debt elsewhere.

In the one-year chart we see that the costs of CDS insurance for the US skyrocketed to over 1.5% annualized for over a month. Market agents saw the US Treasury bill trading more than a half a percentage point above the Federal Reserve’s policy-setting interest rate. Short-term funding markets faced turmoil when they perceived that the probability of default by the US rose as Congress closed in on the X date without a political deal. To estimate the one-year cost, we are applying this metric to about $4 trillion in shorter-term US Treasury bills and estimating that the average of these fluctuating premium costs was about 80 basis points and the period applied was about 5 months. The cost of each basis point for an entire year on $1 trillion is $100 million. There was an average of about 80 basis points times 5/12ths of a year times about $4 trillion.

But the US Treasury wasn’t issuing debt at its normal pace because of the debt ceiling limit, so we must guess at what the true cost in the very short term is. The Treasury was rolling T-bill maturities but could not enlarge the issuance. Let’s cut the above method in half arbitrarily. So instead of between $13 and $14 billion of direct cost in the five months, let’s say (guesstimate) that the impact on the very short term in just US Treasury bills is $7 billion. In other words, while the US Congress was wrangling in the House and was held up by a handful of obstinate Members of Congress, the US Treasury was directly bleeding almost $2 billion a month of taxpayers’ money in just the direct short-term funding cost of doing business.

A look at the 5-year CDS shows the intermediate term effects. At the 5-year maturity range, the evolving longer-term costs are about 10 basis points higher after the resolution than they were before it all started. This is where the actual longer-term cost and pain for the American taxpayer starts to appear. I won’t repeat the detailed cost exercise at the 5-year maturity, to save space in this very long preliminary analysis. The same 10 basis points are now embedded in the longer-term structure, as we will see below.

Let’s look at the 10-year credit default swap. It captures nearly the entirety of the US Treasury issuance. Not all, but nearly all. The cost of the 10 years of credit insurance on the United States today is about 10 basis points higher than it was in January. That cost is spread on the entire range of all federal debt, which totals about $27 trillion. This is not a Kotok estimate; this is a market-based price that is currently in the market following the so-called resolution of the debt ceiling crisis. Remember that the so-called resolution of the crisis only lasts until 2025. So, markets are already pricing in the increased risk from the next expected crisis.

To restate, the debt ceiling fight has resulted in additional cost to the aggregate of all federal finance of about 10 basis points in each of the next 10 years. Each basis point on $27 trillion is $2.7 billion a year. So, I estimate that the running cost of the debt ceiling fight is 10 times that number, or $27 billion a year. However, there is a compounding effect over the 10 years. Using the Brookings’ formula in the seminal work of Salil Mitra and Brian Sack, I estimate that the 10-year cost will rise by an additional one third. For the details of this formula, see https://www.brookings.edu/blog/up-front/2022/07/27/projecting-the-structure-of-us-treasury-debt/. Mitra and Sack find that a 1 basis point rise on the entire US Treasury debt costs $12 billion, with the estimate rising to $16 billion by the end of the decade. Note that the Brookings work is about a year old and is thus based on numbers that were significantly lower in 2022 than those at the time of 2023 debt ceiling fight.

In sum, an estimate of the cost of financing all federal debt over the next 10 years has risen by more than $300 billion just because of the politically driven debt ceiling fight that lasted only five months.

4. DOES EACH PROGRESSIVE DEBT CEILING CRISIS INCREASE THE COST IN YIELD SUCH THAT THE DAMAGE IS WORSE EACH TIME? THE ANSWER IS YES.

Let’s examine the change in yields in each debt ceiling crisis: 2011, 2013, 2023. I will start with this finding from Cashin, Ferris, Klee, and Stevens: “Our second finding is that excess yields on individual bills maturing soon after the projected breach dates appeared earlier and were significantly higher during the 2013 episode, peaking at 46 bps in 2013, but only 21 bps in 2011. We find no evidence of elevated yields on coupons with interest payable soon after the projected breach dates in 2011 or 2013.” (Source: “Take it to the Limit: The Debt Ceiling and Treasury Yields,” https://www.federalreserve.gov/econres/feds/files/2017052pap.pdf.)

In the 2023 debt ceiling crisis a new threshold was reached. Treasury bill rates hit 5.78% on May 6, 2023 (source: US Treasury). That is the most intense level of uncertainty demonstrated by market-based pricing. On that date, the spread between the Fed Funds policy rate and Treasury bills was at the widest ever in modern times. Given that there was also a two-month banking crisis and a Fed intervention with lending to the FDIC at the same time, the excess T-bill yield of nearly 70 basis points appears to be lower than it would otherwise have been if there had been no banking crisis and Fed intervention. I offer that counterfactual because those things normally trigger a “flight to quality” in financial markets, and that usually means additional buying of US Treasury securities. In addition, and unlike in the 2011 crisis, the increase in intermediate and longer-term yields appears to have persisted.

So, the evidence is summarized as excess T-bill yields at 21 basis points in crisis 2011, 46 basis points in crisis 2013, and about 70 basis points in 2023. This is just in the T-bill section of the yield curve. Note that a linear model projecting the difference between 21 and 46 would give you the number 71. But an accelerating model would likely take the number into the mid-80s. As I’ve shown in #3 above, the same thing happens in the intermediate- and long-term section of the yield curve.

5. WHAT ABOUT THE REST OF THE DEBT DENOMINATED IN US DOLLARS?

Let’s examine the total of all debt. An interactive chart from the Federal Reserve shows that total US debt is over 70 trillion (“Debt of Nonfinancial Sectors, 1952 – 2023,” https://www.federalreserve.gov/releases/z1/dataviz/z1/nonfinancial_debt/chart/).

We now must guess at what has happened to borrowing costs for all the other market agents besides the federal government. If we disaggregate this vast category into the many debt forms in play, we can examine the various credit spreads between US government debt and other types of debt. What we don’t know is if they were impacted by the debt ceiling fight, because there are so many other factors involved. Maybe the creditworthiness of all the others was unchanged and just the federal government is paying more. Or maybe the fact that credit costs for the US have risen means that credit costs for the rest of us have increased.

I have seen anecdotes and written about them. I saw it in the Columbus, Ohio, municipal bond refinancing (refunding), which suffered a higher cost because of the structure of the debt escrow. The US Treasury had to stop the issuance of SLGS (SLGS are special state and local government securities used in municipal debt refundings; when not available, the municipal issuer must replace them with open market purchases, which cost more). I also see this in the housing and mortgage sector, because debt tied to home mortgages in the United States are viewed as government paper because of the influence of Fannie Mae and Freddie Mac. I see it in the issuance of US state housing agency tax-free municipal bonds, which are paying over 100 basis points above the US Treasury long-term bond rate each time that the housing agencies are borrowing. I see it in many financing structures.

And I have written about the fact that the Federal Reserve had to use extraordinary measures to avoid a banking system meltdown when SVB, Signature, and First Republic Bank failed. Note that the FDIC’s $100 billion credit line was unused. To fund it, the US Treasury would have had to issue debt. But it couldn’t do that because it was under a debt ceiling limit.

If we apply the 10-basis-point cost to the entirety of outstanding debt, the cost of the debt ceiling fight rises to nearly 1 trillion dollars over the next 10 years, and that is a permanent cost. Damage to the reputation of the United States has resulted from the political antics of the debt ceiling fight. Those costs are still growing daily.

Right now, there are 21 Members of the US House of Representatives who have signed a letter to wage another government funding fight in the coming few months as the defense budget is developed and funded (“House GOP conservatives send McCarthy an ultimatum on funding the government,” https://www.nbcnews.com/politics/congress/house-gop-conservatives-send-mccarthy-ultimatum-funding-government-rcna93549).

In other words, the costs of this purely political activity are still rising. We can see it in the slight uptick of 10-year CDS in the last few days.

6. HOW MUCH DID THE DEBT CEILING FIGHT SAVE?

The debt ceiling fight resulted into passage of something named the Fiscal Responsibility Act (FRA). It only lasts until 2025. So, how much did the FRA cut the deficit? Let’s examine the issue.

Oxford Economics estimates that “FRA would knock no more than 0.3ppts off real GDP growth in 2023 and be a 0.1ppts drag in 2024. The unemployment rate would rise by 0.2ppts and payrolls would be about 375k lower by the end of 2024, relative to the current baseline forecast.” The Congressional Budget Office estimates that the 10-year deficit shrinkage because of FRA is $1.3 billion (Source: CBO and Oxford Economics database). There are some items which are “soft and unknown” but only referred to as the discussion items between President Biden and House Speaker McCarthy. FRA also rescinds $1.4bn in funding for IRS tax enforcement efforts, which CBO estimates will, on balance, increase deficits by $0.9 billion because of lost revenue. For the Oxford Economics analysis see: https://my.oxfordeconomics.com/reportaction/f8334594ad774239a48Fb4/Toc (paywall).

Here’s what the House Budget Committee said in their release: “Breaking Down the CBO Score of H.R. 3746, the Fiscal Responsibility Act of 2023,” https://budget.house.gov/press-release/breaking-down-the-cbo-score-of-hr-3746-the-fiscal-responsibility-act-of-2023#:~:text=The%20Fiscal%20Responsibility%20Act%20(FRA,%242.13%20trillion%20over%20ten%20years.&text=The%20Big%20Picture%3A%20CBO%20scores,billion%20in%20the%20short%20term. Readers can decide for themselves how self-serving this is.

Here’s what the Senate said in their release: “CBO Analysis Blows Gaping Hole in Republicans’ Balanced Budget Pledge,” https://www.budget.senate.gov/chairman/newsroom/press/cbo-analysis-blows-gaping-hole-in-republicans-balanced-budget-pledge. Again, readers can decide for themselves how self-serving this is.

Here’s the CBO: https://www.cbo.gov/publication/58984.

7. WHAT WAS THE ACTUAL TRIGGER THAT PROMPTED A RESOLUTION?

Warnings about the approach of X-date were occurring for months and months. Various organizations including the US Treasury continually sounded the alarm. As the US Treasury cash balance was deteriorating, extraordinary measures were instituted for the department to remain in business and conduct its daily activity. Treasury curtailed things one at a time. Each action introduced some form of increased cost to the US economy. The Treasury tried to preserve its cash as it labored under a debt ceiling prohibition of additional borrowing above $31.4 trillion total outstanding debt. While politicians kept saying “there will be no default,” the time of possible default was approaching, and the burdens of the uncertainty premium were already appearing in the marketplace and are measurable with the credit default swaps we discussed above. So, what was the actual catalyst that triggered politicians to agree and President Biden and House Speaker McCarthy to make a deal?

Below is a copy of a notice from one of the major clearing firms. The company’s name and the personal contact names have been removed by me. Cumberland Advisors received many such notices. So did every other firm and every other financial institution in the entire world. This one came in at 1:00 PM on May 25, 2023. On receipt of this type of notice, every single firm must initiate extraordinary procedures regarding every holding of any federal security. The entire system of accounting for payments can be upended at any time. This notice triggered a huge outcry to regulators and officials and every Member of Congress and every Senator and all their staff.

U.S. Debt Ceiling Update

We continue to closely monitor the news and developments related to the U.S. Debt Ceiling and are prepared to address several potential scenarios, including funding constraints, delayed payments, and impacts to security prices. The U.S. Government’s failure to raise the Debt Ceiling, or otherwise address its resulting funding constraints, may result in missed or delayed principal and/or interest payments on U.S. Treasury debt. For your awareness, below is a summary of actions we are prepared to take.

Change From Contractual to Actual Payments

If we reach the X-date without a resolution to the Debt Ceiling limit, we will likely switch from contractual to actual payment processing for U.S. Treasury securities. This means we will only process payments, including interest, after we receive the corresponding funds from the issuer.

Interest Payments

The U.S. Government may delay interest payments on U.S. Government securities as it manages the Debt Ceiling. A delayed interest payment will not be automatically credited to you by us on the original payment date. We expect to credit these payments to you once we receive interest, based on our record of ownership. In the case of an “interest only” payment delay, we expect that the related security will remain transferable on the Fedwire Securities Service.

Proceeds Payments

Operating under an “actual” payment processing convention means that we will not pay proceeds to you unless and until we receive funds from the issuer. Proceeds blocked from payment will be suppressed from cash projections.

Principal Repayments

The U.S. Treasury and Federal Reserve may take actions to preserve the ability to settle positions over the Fedwire Securities Service. In cases where a principal repayment is not made in a timely manner, but the corresponding maturity date is extended, these securities are expected to maintain the ability to settle over the Fedwire Securities Service. If the maturity date of a security has passed, a maturity extension is not announced, and a related failure to pay principal has occurred, then the securities are not expected to remain transferable.

Security Pricing

Pricing vendors have confirmed that they expect to be able to continue pricing these securities beyond their maturity dates if the situation arises. If the US Government were to miss a scheduled payment for a particular security, the pricing vendors may or may not apply a “defaulted flag” to the security, like they do for defaulted corporate and non-US Government securities.

Loans Secured by Marketable Securities

Loans secured by marketable securities (Margin and Loan Advance) generally are marked to market daily. A decline in the value of impacted securities or change in a security issuer’s debt rating in the event of a downgrade or default could result in the borrower being out of compliance with margin or collateral requirements and may need to be remediated in accordance with established policies, procedures, and applicable client agreements. Currently, we do not have any plans to change our eligibility or margin requirements for U.S. Treasury securities but may reassess as the situation develops.

In the event of a prolonged U.S. Government default, we will re-evaluate the operational and other impacts and notify you of material updates. We are prepared to support higher volatility, transaction volumes, and margin call volumes as the need arises. We will continue to closely monitor this situation and provide updates as needed.

Please reach out to your relationship manager with any questions. We are here to help you navigate this uncertain situation.

Dear readers: Please note the coincidence of this date and the date of the peak excess interest rates depicted in the charts showing the various maturities of CDS. Credit default swap pricing is instantly adjusted by market agents.

This notice said in effect, “Take this seriously; default risk is real; we are changing the accounting and reporting systems to reflect that risk.” In plain language, this notice said that time for political shenanigans had run out.

Readers, we call this to your attention. The very next day after this notice went to paying agents, clearing firms, and advisers around the world, House Speaker Kevin McCarthy made the deal with President Biden. This notice was the reason. This notice was the smoking gun that said stop the political charade right now, or the consequences are about to roll all over you.

8. CONCLUSION

This analysis shows that the cost of each debt ceiling fight is progressively higher and higher each time it occurs. We can now project what the next debt ceiling fight will cost since we have 2 clear data points and a third data point with some estimates that can be refined. 2011-2013-2023 and then comes ????? A slight negative change is already taking place in the CDS market even though the next possible debt ceiling crisis date is in 2025.

The evidence also reveals how much the world’s financial community is willing to pay for credit insurance. We can speculate about why, but in my opinion the creditworthiness of the United States is being slowly but surely impaired by our national politicians who use this debt ceiling fight vehicle for their own selfish purposes. The credit default swap mechanism reveals a global market-based pricing of that growing distrust. In my opinion, a repeal of the debt ceiling provisions and a permanently substituted fix would eliminate this cost. It needs to say, “If the Congress authorizes and appropriates the expenditure, the money must be financed and refinanced permanently.”

In my opinion, the diffusion of the cost allows our politicians to get away with this charade. The buyer of a new home for $400,000 with a $300,000 mortgage doesn’t see that he is paying an extra 10 basis points on his loan — and thus an additional $4535 for his house, assuming a 30-year mortgage — because of the 2023 debt ceiling battle. The entrepreneur doesn’t see her added cost for her credit line. The users of sewer and water services in a county don’t see the added financing cost when that is passed through to their annual bill for services. And the nations’ taxpayers don’t see it in their bills for the cost of financing the federal government, etc., etc.

Diffusion allows these politicians to get away with this charade even as they raise the cost for their own constituents. Were they, in fact, to otherwise pass a 10-basis-points tax on all borrowing, there would be outrage by citizens. The impact is the same, but the hidden tax of bad policy allows obfuscation.

My personal conclusion is that it will take a substantial crisis to alter this behavior. I don’t see how the civil discussion and policy compromise will occur. I wish it were otherwise.

As a professional in financial services in the United States for more than 50 years, I now worry for my country and for the younger people in it who are innocent victims of this miscreant political behavior.

David R. Kotok

Chairman of the Board & Chief Investment Officer

Email | Bio

Sign up for our FREE Cumberland Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.