In the April 24 edition of his daily am/FX macro letter, Brent Donnelly gave us his take on day two of the Global Interdependence Center’s recent conference on “Cryptocurrency and the Future of Global Finance.” The focus of day two was Asia, and specifically China.

Brent has kindly allowed us to share his remarks in full, and they follow. You can subscribe to Brent’s excellent am/FX letter here: https://www.spectramarkets.com/subscribe/.

__________

China Alarm

By Brent Donnelly, April 24, 2023

It’s a quiet Monday in FX, so today I give you my takeaways from Day 2 of the GIC conference I attended in Sarasota last week. Day Two was all about China.

Disclaimer: Today’s am/FX is my best effort to distill the commentary of the China experts at the conference. I am not an expert on China/US geopolitics. I probably know less than you know on the topic. The views espoused were generally very hawkish and some readers may find them controversial.

Session I: Panel Discussion about China

• Leland R. Miller, CEO, China Beige Book International

• Michael Drury, Chief Economist, McVean Trading & Investments, LLC

• Malcom Riddell, Founder, CHINADebate & Editor, CHINAMacroReporter, Associate in Research, Harvard Fairbank Center for Chinese Studies

• Moderator: Alejandra Grindal, Chief Economist, Ned Davis Group

The resumés on these people are off the charts. Riddell was a CIA spy and paramilitary officer in China in the 1970s and 80s. You can read more about him here. Leland is a sane, smart guy I have known a long time (he runs China Beige Book) and Michael Drury writes my favorite economic weekly. He has a deep knowledge of China as well as the US economy, ags and commodities. Alejandra kept things flowing and added her own expertise on the economics side.

Before I get into the specifics of the session, I wanted to say that the vibe overall at the conference was kind of alarming with regard to the escalating threat from China.

The possibility of a war in Taiwan does not seem remote in the minds of most of the experts there and two of them specifically said they think that the odds of a hot conflict have gone up significantly in the last 12 months. I tend to be anti-alarmist, but it was hard not to be alarmed by the potential risks of military conflict.

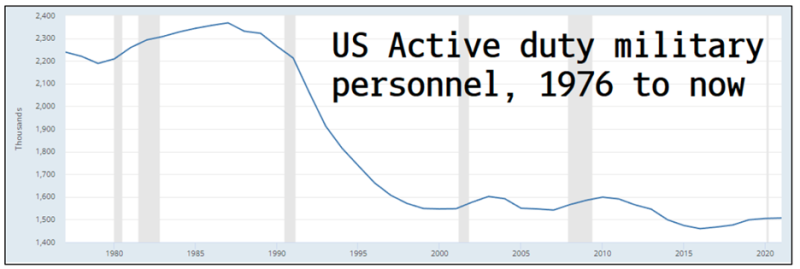

Before the session started, Major General David Scott Gray (US Air Force) gave a short talk and he spoke about the decline in active-duty forces due to demographics, obesity, opioid use, and other factors. The chart below gives you a sense of the decline. Keep in mind the US population increased 55% in the interval from 1976 to now, and so this nominal drop in troops is way larger in per capita terms.

General Gray said his personal opinion is that the US will need to reinstate the draft in the next five years and will draft women for the first time ever. As someone with a son who is draft-eligible, I found this rather eye-opening and scary.

Anyway, the topic for the first session was labeled as “Economics” but the overlap of economics and geopolitics is inevitable these days when discussing China. Leland Miller gave a positive view on China in the short term but emphasized that he saw only 2-4 strong quarters of a cyclical rebound as underlying structural problems remain. This cyclical bounce in Chinese growth is a product of easy comps given the weak growth during COVID-zero. He sees the cyclical rebound as a headfake because the Party is no longer gunning for strong growth. The dominant paradigm is still a slow return to more socialist, less capitalist policies.

This shift by Xi toward more Marxist policies was a big point of discussion as the view is now that middle class wealth has been achieved, it’s time to think more about global power and a return to socialist values. Strict and absolute party control is more important to Xi than economic growth hence the crackdowns on tech billionaires, limits on video games, and so on.

On the geopolitical side, the panel agreed that Xi has confidence that history is on his side as the East is rising and the West is falling. He wants to go down as the greatest leader in Chinese history and reunify China. He is committed to Taiwan as the centerpiece of his legacy. Xi’s geopolitical and internal control goals are not bullish for the economy, but he doesn’t care.

The challenge for the US is to figure out how to deal with an adversary that is such an integral part of the US economy. While US politicians (and to some extent the US public) have realized the threat from China (hence the tariffs and the recent executive orders, CHIPS Act, and so on)... Most large American businesses are still fully engaged with China and highly reliant on China for cheap production.

The administration sees a spectrum for decisions where there is very often a tradeoff between national security and economics. American businesses are making no such tradeoffs. The panel argued that until US businesses recognize the China threat and are willing to take economic pain for national security reasons (like corporations did in World War 2), it will be extremely difficult to disentangle from the economic relationships, even as the diplomatic relationship frays.

The vibe from several of the experts was that China- US conflict was overhyped for many years but is now underappreciated. A major part of the reason for this is that US capitalists do not want to recognize the geopolitical threat because doing so will remove their ability to produce things cheaply.

While there is talk of India rising as their population exceeds that of China, Michael Drury made the point that China is 1.4 billion people that mostly speak the same language and whose productivity is channeled by a single autocratic leader with total control. India is a fractured country of many provinces with 22 official languages, 122 major languages, and 1599 languages overall. See graphic [below].

It’s more difficult, though not impossible, to get things done. Apple just opened their first store in India, perhaps an important symbolic move.

Other points made by the panel: Xi may appear less rational going forward as there are fewer checks and balances and he has total control. Taiwan is important to the US because of semiconductors, but it’s also about alliances and maintaining US military hegemony. There are not many encouraging paths forward as some sort of Reagan/Gorbachev outcome looks impossible here.

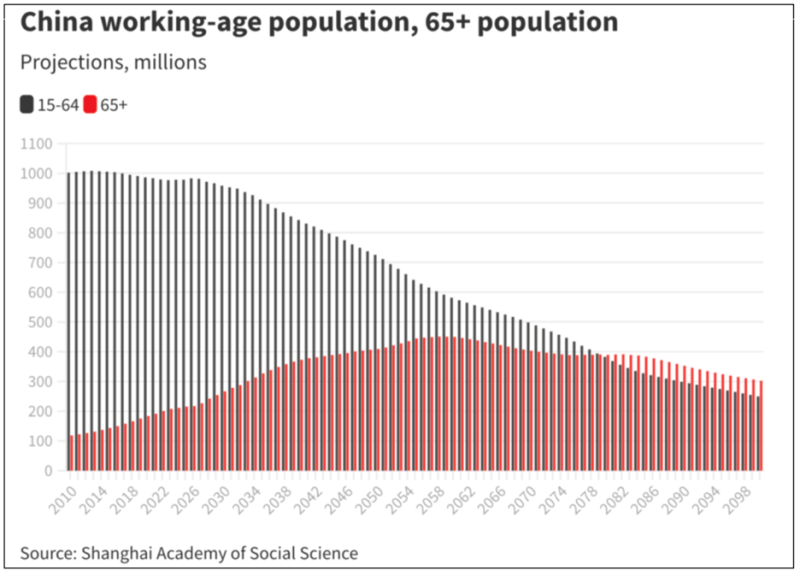

Final, insane fact: Current estimates suggest China’s working age population in 2100 will be <half of where it is now.

David R. Kotok

Chairman & Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.