Both the equity and fixed-income markets have been dealing with higher levels of volatility in the past few weeks (winner-equities). But the uncertainty, of course, comes out of left field (as it usually does).

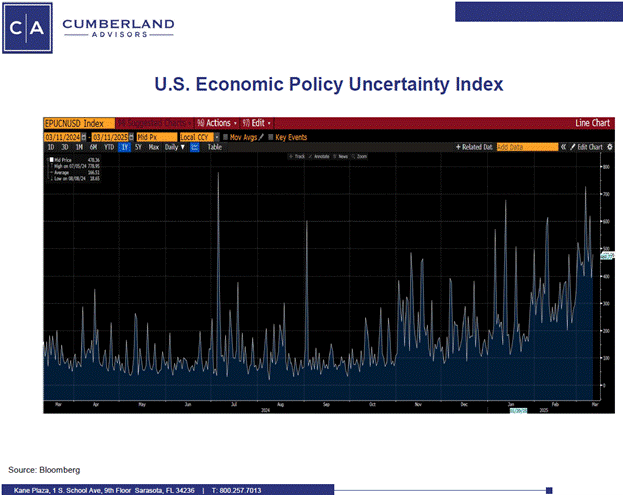

The first graph shows the US Economic Policy Uncertainty Index. It is derived from the headlines and stories published in many papers. We can see the sharp climb in the last seven weeks since President Trump was inaugurated for his second term. The uncertainty has been brought on by on-again, off-again tariff policies that have even Congress confused as to the final disposition of tariffs, reciprocal or otherwise. On top of that, DOGE's slashing of federal government employees has also set off uncertainty about the depth and scope of the layoffs, and turmoil in areas such as Veterans Affairs and Social Security has plenty of people worried.

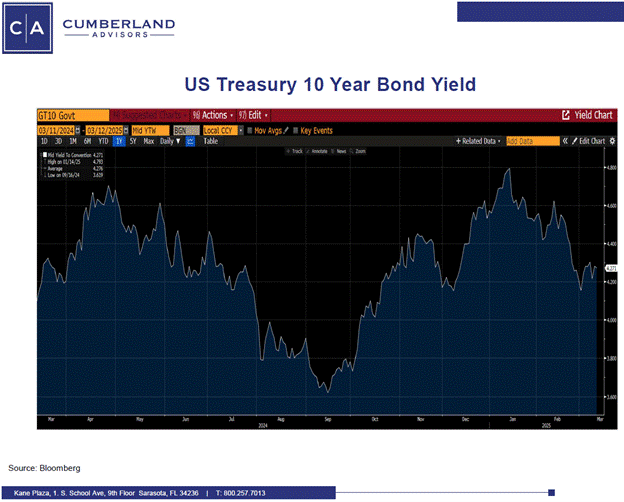

First the bond side. The second chart shows the US Treasury 10-year yield. It rose from 3.70% in mid-September, when the Federal Reserve began to CUT short-term rates, reaching 4.43% right after the election and touching 4.80% a week before the inauguration. Since then, the 10-year yield has fallen to 4.25%.

The one thing we know is that when uncertainty hits — whether from financial distresses, foreign policy surprises, or other events that catch markets off guard — the result is always the same: We can be CERTAIN that investors will run to the safety of US Treasuries, and this time has been no different.

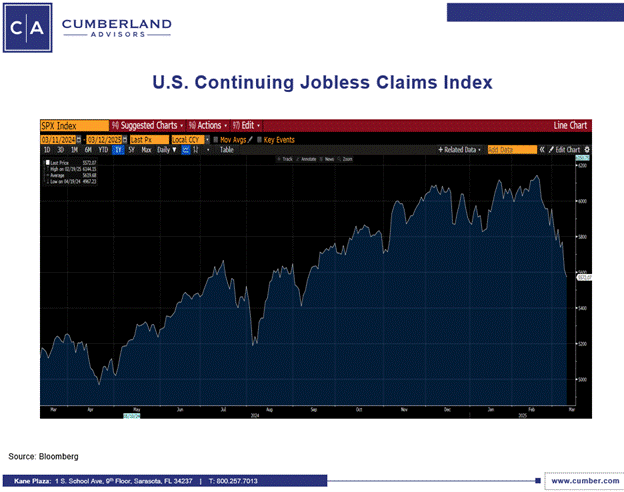

Are there other factors that apply here? We think so. Though no single factor stands out, several indicators, and anecdotal evidence, suggest that things are slowing down. These have been with us for some months. Rising credit card delinquencies and increasing numbers of credit cardholders paying only minimal payments on balances is one. Though jobless claims have been mostly below expectations, continuing claims keep rising, meaning people are entering the jobless rolls — at smaller rates than expected but not coming off (graph below). This trend is about to be compounded by the elimination of thousands of federal jobs. A rising percentage of 401k participants are taking early hardship withdrawals. Subprime auto loan delinquencies have risen to the highest numbers in many years. Housing markets in many areas of the country have stalled — and not due to storms and fires. The latest new home sales have stalled out and fallen 10% month over month. We could keep going, but you get the picture.

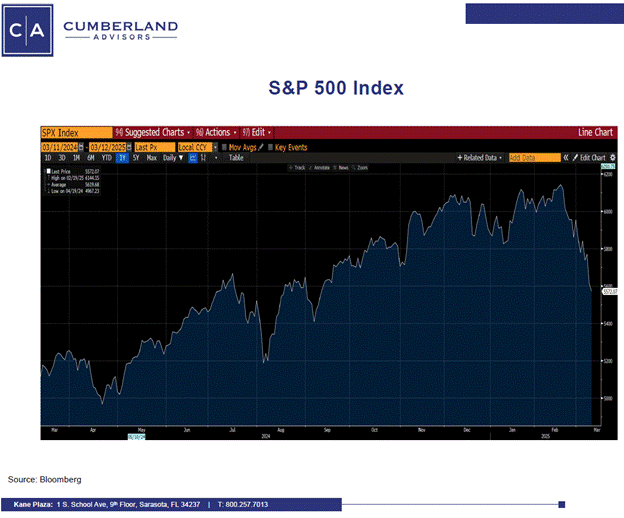

The aggregations of this anecdotal data have started to catch up with equity markets, and we can see the S&P 500 in a correction mode, with the index down 8.73% from its peak on 2/19/2025. Drawdowns in the equity markets happen often, and this is an example of another one. Historically, drawdowns in the S& P 500 have been a normal part of market behavior and typically experienced a 13% intra-year drawdown. P/E ratios certainly got stretched, particularly in the tech sector of the market, so some of this is reversion to the mean. But the wealth effects can also affect consumer spending, and we will be watching that measure closely.

We continue to watch Congress attempt to get a bill passed to keep the government running beyond next weekend. We are also watching discussions about capping the benefit of municipal bonds to the 28% tax rate. And of course, every new administration mulls over the possibility of removing the tax exemption from municipal bonds. (We rate the chances of that happening as low, though not zero.)

One thing is certain: UNCERTAINTY, whether over tariffs or federal payrolls, will keep volatility of markets high. And so far, investors are voting with their wallets.

John R. Mousseau, CFA

Vice Chairman | Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Sign up for our FREE Cumberland Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.