I want to follow up on my Sunday, March 19, morning missive, sent at the beginning of the current banking crisis (“50 Years & More of Bank Failures + SVB,” https://www.cumber.com/market-commentary/50-years-more-bank-failures-svb).

Let’s start with Treasury Secretary Yellen’s congressional testimony at the beginning of the crisis, when James Lankford (R-OK) pointedly asked, “Will the deposits in every community bank in Oklahoma, regardless of their size, be fully insured now?”

“What Is Your Plan? Lankford Grills Yellen over Fallout from Bank Bailouts,”

https://www.youtube.com/watch?v=AdvDR7C7TiY&list=RDNSAdvDR7C7TiY&start_radio=1&t=65s

Next, we offer Yellen’s more recent quote: “Our intervention was necessary to protect the broader US banking system, and similar actions could be warranted if smaller institutions suffer deposit runs that pose the risk of contagion.”

We first saw a tentative Yellen and then subsequently saw a more firmly positioned Yellen. But the one answer Secretary Yellen could not use when grilled by Lankford was “YES!” And therein lies the problem. Responses appear tentative and encourage contagion by increasing uncertainty and confusion. That is the fault of the Congress, not Yellen.

Yellen, the Fed (Powell), and the FDIC will need changes in legal authority to be able to answer YES! And any changes are fraught with moral hazard when they occur in a time of great financial angst and much controversy.

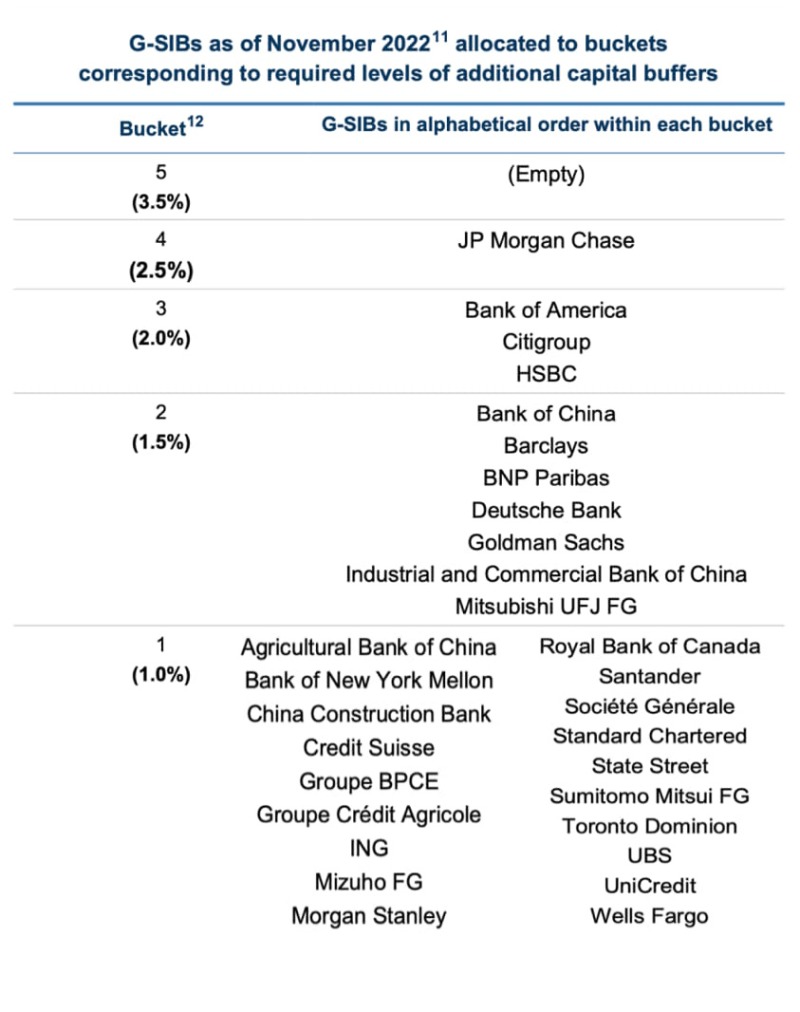

Right now, the group of three, which I called the resolution trifecta, must deal with the definition of the word systemic and the term contagion. Note that the definition of systemic risk has clearly changed; it has been flawed since the Trump Administration liberalized the rules in 2018. Note that Trump didn’t change the rules on his own; he needed Congress to authorize the changes. Note that, so far, the American banks which have failed are all under the size limit defined as globally systemically important banks (G-SIBs). Clearly, the arbitrarily drawn line of size isn’t working.

In America, we have 8 GSIBs, as you can see on the list linked at the end of this paragraph. In the entire world there were a total of 30 GSIBs until the forced merger of Credit Suisse with UBS recently reduced the number to 29. Here’s a link to the detailed list of the 30 GSIBs ranked by the Financial Stability Board (FSB) as of the most recent annual determination: “2022 List of Global Systemically Important Banks (G-SIBs),” https://www.fsb.org/wp-content/uploads/P211122.pdf

Washington is now looking at the options for extending FDIC coverage to all banks. This discussion has ratcheted up into a political theater of the absurd. Chris Whalen’s bank-focused newsletter and research service recently reminded us of a famous quote by Mark Twain, who called Washington “the grand old benevolent National Asylum for the Helpless” in his classic satirical novel The Gilded Age.

And while we’re doing time in the Washington theater of the absurd, Lyric Hughes Hale, editor-in-chief of EconVue, noted on March 20 that “the asset class that has been most closely scrutinized over the past couple of years is crypto, with a market cap of maybe $1 trillion, which is less than 1% of the size of the banking system and shadow lending” (https://twitter.com/lyrichues/status/1637997647649972225?s=20).

And here’s some more theater, reported by Bloomberg: “SVB’s Loans to Insiders Tripled to $219 Million Before It Failed,” https://www.bloomberg.com/news/articles/2023-03-21/svb-s-loans-to-insiders-tripled-to-219-million-before-it-failed .

My friend Joe Mason, professor of finance at Louisiana State University and a senior fellow at the University of Pennsylvania's Wharton School, has articulately discussed the SVB failure and why it happened. Here’s his CNBC interview: https://www.cnbc.com/video/2023/03/17/heres-why-the-key-metric-used-to-test-the-health-of-us-banks-is-flawed.html?&qsearchterm=joe mason.

Finally, please try to imagine what the SVB saga would look like if the full faith and credit of the United States were in jeopardy because of the debt-ceiling political culture war. In my opinion, the debt ceiling must be removed as a political tool at once. Responsible Democrats and responsible Republicans in the Senate and in the House know it. To protect the interests of every American, they could set aside the partisan poison and change the outcomes for millions of Americans and their businesses, institutions, pensions, insurance companies, and many more.

To alter the phrase from history, “Citizens unite! You have nothing to lose but your money and wealth!” Kotok addition: If you leave it to the politicians, they will try to lose it for you.

Let me offer a solution and then close this missive. There is absolutely a need for deposit insurance; that was established many decades ago after the Depression era bank failures. For best results, the cost of the insurance must be separated from the concept. The FDIC fund must be fully funded and self-sustaining, so it has absolute credibility. It can have tiered pricing. There could be one rate for small depositors or mid-sized depositors if you include the many smaller businesses. Maybe the $250,000 coverage should be $1 million? Or $5 million? Maybe something else?

A separate and higher cost might be imposed on the larger depositors. There are fewer of them, but they represent much larger contagion risks when they fail.

If I were the monetary czar, there would also be a third type of deposit that was clearly and certainly uninsured. It would allow for a market-based pricing of this risk. It could be done through a form that elevates the risk to the bank holding company (BHC) level (something like BHC commercial paper). Think of it as a modernized version of the TED spread. The market could price an insured deposit and an uninsured deposit in the same bank; that would allow market agents to see how the consensus is pricing the actual risk of each BHC. Kotok note: many bankers don’t want this market-imposed discipline because it forces them to change their behavior and be more transparent. Other bankers, who are not afraid of scrutiny, welcome it. Politicians are caught in the middle.

Right now, we have a temporary lull in bank failures. We have public assurances from high profiled folks like Warren Buffett (CNBC interview on April 12). But we don’t have the law to back up what they say to us.

Remember that there were nearly 15,000 banks in the United States in the 1970s when Cumberland Advisors was founded. There are about 4000 banks now. So, if there are fewer banks, and they are much larger and concentrated, shouldn’t we expect the system to change its operating framework?

Now let’s ask this question: If a $3 billion bank or an $8 billion bank is facing a deposit run, does the bank run constitute contagion risk or systemic risk? Where is this amorphous line drawn? What if that bank cannot be resolved by merger as the least expensive cost to the FDIC? The current law requires this least cost method. That was the standard that applied to SVB, because about 90% of the SVB deposits were uninsured. Notice how quickly they became “insured” using the “systemic” risk exception.

At Cumberland, we have advised all clients to take safety precautions with deposits as far as possible. Our confidence in others’ well-meaning assurances is low.

I don’t trust politicians regardless of their political party. Any client who wants to discuss this matter may email me directly or may reach out to their designated contact. Any reader may email for information about how we address the safety issue.

Over the course of my professional life, I have witnessed multiple instances of financial contagion. It CANNOT be forecast. It takes various forms. It triggers behaviors of flight (money) and fear. We’ve just witnessed another version. The legal system to fix this problem is still broken.

David R. Kotok

Chairman & Chief Investment Officer

Email | Bio

The Global Interdependence Center invites you to join them for the upcoming two-day conference taking place April 20-21, 2023 at the University of South Florida Sarasota-Manatee in Sarasota, FL. Speakers will explore cryptocurrency in depth through two days of panel discussions including keynote remarks from Christopher J. Waller, Ph.D., Member of the Board of Governors of the Federal Reserve System, and Kevin Rudd, Ph.D., Australia’s Ambassador to the United States of America.

Registration is free and available now: https://www.interdependence.org/events/cryptocurrency-and-the-future-of-global-finance/

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.