Every financial crisis seems to trigger anxiety in the investment community and this one is no different. Some of the questions we're hearing from readers and in the financial press we list below in a few categories.

The Dollar on the world stage:

- Is the Dollar losing its reserve currency status?

- If so, what would replace it?

- Are we another Argentina, Argentina-Norte?

- Can China, or a basket of currencies including China, displace the dollar?

Cryptocurrency:

- Does the current banking crisis prove that digital and cryptocurrencies are viable alternatives to the mainstream banking system?

- What is the Federal Reserve's position on cryptocurrencies?

- Are cryptocurrencies an asset class, pure speculation, or something in between?

- Do cryptocurrencies now have a place in the asset allocation process?

- How much portfolio risk is introduced by adding a cryptocurrency?

- Is the volatility within the cryptocurrency market predictable?

- There are more than 20,000 cryptocurrencies. Should I own only some or a large swath as a hedge?

- Are their correlation coefficients between bitcoin and traditional asset classes?

Russia-Ukraine Conflict:

- Is there an outcome that will restore the prevailing world order and stability in supply chains and energy markets?

- Are IMF economic forecasts of Russian GDP growth reliable?

- How much risk does my portfolio have in relation to the conflict?

- Will the drop off in Russia-provided rare-earths result in a slower transition to carbon-neutrality?

- Are there ample substitutions for Russia-Ukraine supplied grain that won't fuel inflation and economic ruin in the developing world?

We plan to explore what we know and what needs more clarity at an upcoming conference organized by the Global Interdependence Center (GIC) at the campus of the University of South Florida Sarasota-Manatee (USFSM). As a sponsor, Cumberland has helped curate many of the panelists and keynote speakers so we might bridge the knowledge gap for the benefit of our advisors, clients, and wider audience that watch our weekly videos and read our commentaries.

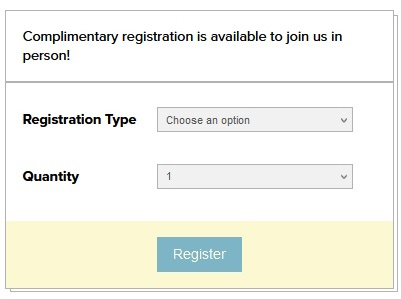

If you're a local to the Sarasota-Manatee area, which includes Tampa Bay, we invite you to attend in person our two days of talks and interactive discussions. A detailed schedule, list of participants, and free reservations are available here: https://www.interdependence.org/events/cryptocurrency-and-the-future-of-global-finance/

David R. Kotok

Chairman & Chief Investment Officer

Email | Bio

You're invited to the upcoming two-day conference, Cryptocurrency and the Future of Global Finance, taking place April 20-21, 2023 at the University of South Florida Sarasota-Manatee.

Speakers will explore cryptocurrency in depth through two days of keynotes and panel discussions along with other topics that intersect with digital money including banking, investments, exposure risk, and global trade (see below).

Keynote remarks will be delivered by Christopher J. Waller, P.h.D., Member of the Board of Governors of the Federal Reserve System (Thursday), Kevin Rudd, P.h.D., Australia’s Ambassador to the United States of America (Friday), and Herbert J. “Hawk” Carlisle, Commander, Air Combat Command, Langley Air Force Base, Virginia (Friday).

Topics:

- Cryptocurrency in Investments, Financial Markets, and Regulations

- Cryptocurrency Outside the U.S.

- Fiat Currencies during the last year and in response to the Russian invasion

- FTX Aftermath and Bankruptcy Laws

- Panel Discussion about China’s Economics

- Special Report: Geopolitical View – Focus on China

- Special Report: China, Russia, and Ukraine: Critical Minerals and Global Supply Chains

Keynotes:

- Cryptocurrency and Central Banks

- Military National Security

- Outlook on Asia, Global Risk, and Policy

University of South Florida Sarasota-Manatee

Address: Selby Auditorium, 8350 N Tamiami Trail, Sarasota, FL 34243

Thursday, April 20, 2023 - 8:00 a.m. - 12:30 p.m.

Friday, April 21, 2023 - 8:00 a.m. - 12:30 p.m.

Agenda & Speaker Detail Here:

Cryptocurrency & the Future of Global Finance

https://www.interdependence.org/events/cryptocurrency-and-the-future-of-global-finance/

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.