In advance of Friday’s jobs report for April, numerous surveys (https://www.cnbc.com/2021/05/06/april-jobs-expected-to-top-1-million-as-consumers-boost-the-economy.html) showed that economists were expecting close to 1 million jobs to be created in April and were predicting that the unemployment rate would fall from 6.1% to 5.8% on the heels of what was thought to be 916,000 jobs created in March.

On the extreme side, Aneta Markowska, Jefferies chief economist, predicted that as many as 2.1 million jobs would be created and the unemployment rate would fall to 5.2% (https://www.businessinsider.com/april-jobs-report-preview-payrolls-double-average-forecast-jefferies-economist-2021-5). Similarly, the widely followed jobs numbers put out by ADP said that 742,000 jobs were created in April. Not surprisingly, markets closed higher on Thursday in anticipation of a robust report, with the Dow Jones up 318 points to a record close.

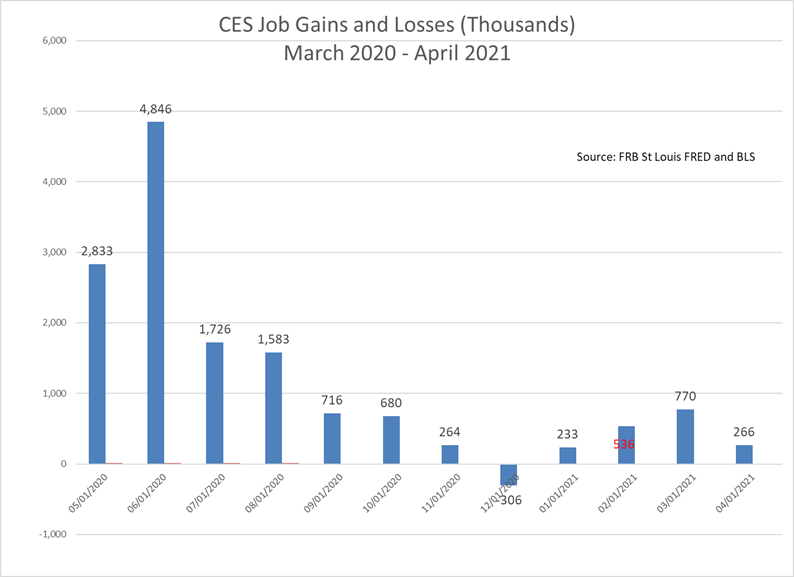

But so much for economists’ ability to make forecasts. The BLS reported Friday that job growth had slowed, as shown in the following chart, with the economy creating only 266,000 jobs on a seasonally adjusted basis in April, while the unemployment rate held steady at 6.1%. In addition, the lofty March number was revised downward to 770,000, though it was still higher than ADP’s March estimate of 565,000.

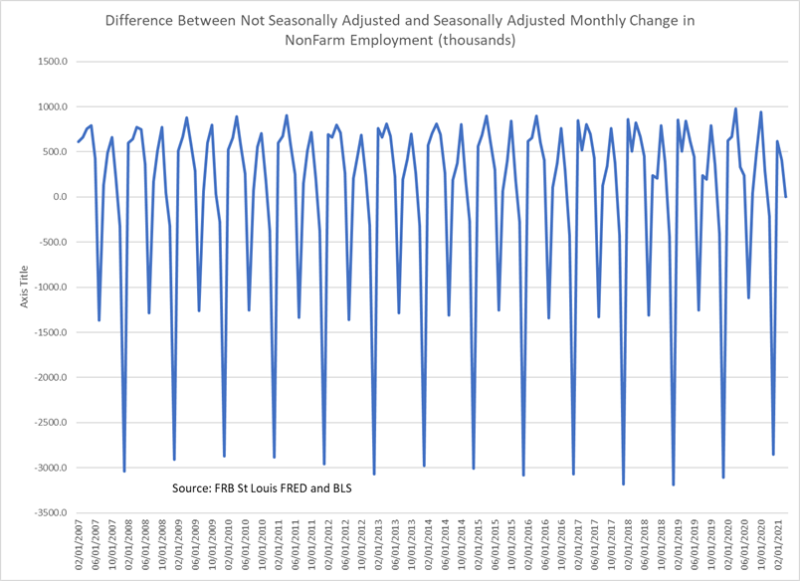

Interestingly, it is customary to focus on seasonally adjusted data, but BLS also reports the data on a non-seasonally adjusted basis, and those data suggest quite a different picture. The release shows that the economy supposedly created 1,089,000 jobs. The difference between the seasonally adjusted and non-seasonally adjusted number was 823,000, and, and as the next chart shows, such differences occur with a regular frequency, especially at the end of January and July. For example, in January the non-seasonally adjusted data showed a decline of 2.6 million jobs, while the seasonally adjusted data showed an increase of 233,000. So maybe things are not as they seem, which points out the danger of not digging deeper into the data.

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.