The FOMC has now significantly revised its policy path going forward, dropping its target rate by a somewhat surprising 50 basis points, and is now on track to reduce rates by 25 basis points two more times in 2024 and as many as four more times in 2025. This is the first rate cut in four years – and also the first decision with a dissenting vote from a governor since 2005. The decision, as Chairman Powell clearly implied in his prepared remarks at the post-meeting press conference, was based upon the view that the balance of risks was on the downside for inflation and on the upside for unemployment, and it was time to focus on employment. Chairman Powell stated that, overall, the economy was in good shape; that the Committee had growing confidence that inflation was on a downward trend; and that, while unemployment had ticked up, the labor market was still in good shape. This decision had all the marks of a Committee determined to bring inflation down while engineering a soft landing for the real economy.

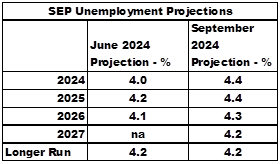

When we look at just how much the September Summary of Economic Projections had changed from the last iteration, we see an indication of just how differently the Committee has come to view the outlook for the economy and what appropriate policy should be. The projection for real GDP growth in 2024 edged down from 2.1% in June to 2.0% but was unchanged at 2% through 2027. For 2024, the PCE inflation projection dropped from 2.6% in June to 2.3%; and for 2025, it dropped from 2.3% in June to 2.1%. Beyond that, the Committee expected to hit its 2% inflation goal. The real change in the SEPs was, as the next table shows, for unemployment.

Not only did the projections show less progress toward what the Committee apparently viewed as “full employment” than previously envisioned, but also the projections for 2024 and 2025 remained constant at 4.4%. The projected increase in unemployment is above the current 4.2% rate through 2025, despite the updated path for the target rate. The Committee foresees two more cuts in 2024, four more cuts in 2025, and three more cuts in 2026.

There has already been some speculation about the Fed’s being behind the curve when it comes to policy, and the combination of the projected paths for unemployment and rate cuts is certainly fuel for such an argument. But hindsight is always clearer than foresight. The real issue is whether such cuts will do more to stimulate demand and excess inflation than they will do to support the real economy and employment, such that we find ourselves contending with stagflation. It does seem that the projections imply a very challenging next couple of years; and without the projected rate cuts, a recession seems the most likely outcome, in the Committee’s view. Skepticism about whether the Fed can achieve its inflation goals while getting unemployment down from its current rate to equilibrium is clearly justified, and probably helps to explain the negative market reaction post-meeting. If the projected rate path is actually realized, then the economy will see substantial volatility in financial markets in the coming years.

Robert Eisenbeis, Ph.D.

Vice Chairman & Chief Monetary Economist

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Sign up for our FREE Cumberland Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.