Years ago, the late John Liscio coined the term “sado-monetarists.” It is a term that Barron’s (October 28, 2008, Randall Forsythe’s column) used to label the “central bank’s efforts to cushion the pain of credit contraction (which) invariably puts us on the road to perdition.” Hat tip to Philippa Dunne. Her TLR named research service stands for The Liscio Report. She was kind enough to retrieve the citation from the archives.

The questions about interest rates are (1) how high will they go, (2) how fast will they rise and, lastly and the biggest unknown, is (3) what will the shrinkage of the Fed’s balance sheet do to financial markets and to financial stability? Answers: (1) we don’t know; (2) we don’t know and (3) we really, really, really don’t know.

As readers know, we are not worried about a rise in the interest rate taking the policy above the zero boundary. We would have liked to see that happen a while ago. We guess it will take a policy rate floor of 1% or more to clear all the market functioning and restore the traditional metrics we haven’t seen in over a decade. We would prefer a no shock gradual pace. The idea is not to surprise markets but instead to be predictable and consistent. Our guess is ¼ point hikes. We think 4 or 5 this year is reasonable and a yearend policy rate of between 1% and 1.5% is a reasonable target.

When it comes to number 3 we fear a policy error. Why? The Fed doesn’t know the optimum size of its balance sheet and neither do we. They have only tried this “shrinkage (QT) once before and the outcome wasn’t good. Our position is that they should do only one thing at a time. Think about it, If you’re doing two things at once and something goes wrong, you do not know which thing went awry. We do know that the Fed will be changing the duration of the entire debt market. And that will be integrated with the US Treasury bills, notes and bond issuance.

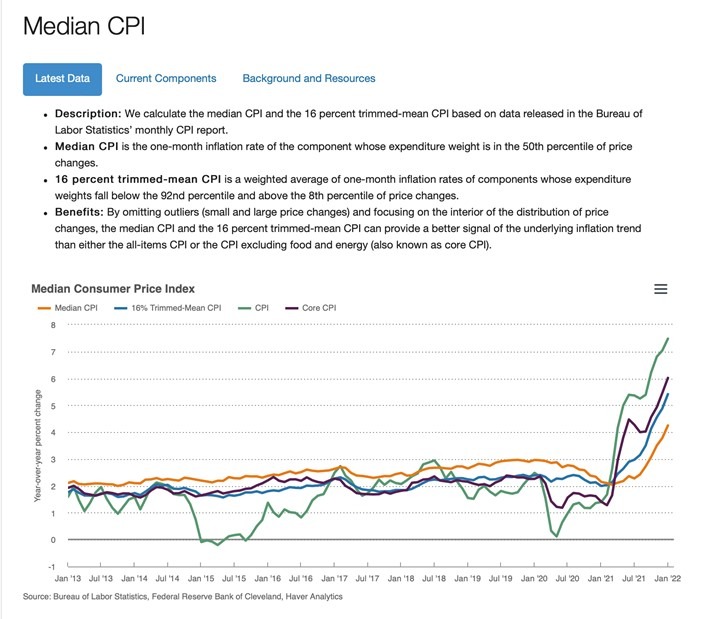

The definitions below and the chart are extracted from the Cleveland Fed’s release dated February 10. The link takes you to the entire discussion, which we recommend. The purpose of this follow-up piece on CPI inflation is to show readers that there are many ways to estimate the CPI. Here are just four of them, and these are all focused only on the Consumer Price Index (CPI).

https://www.clevelandfed.org/our-research/indicators-and-data/median-cpi.aspx

Notice what the series looked like in July or August. At the same time the Delta variant was surging throughout the United States and its severity was unknown. It delivered another shock to the economic system. Omicron variant impact was also unknown. And it turned out to be milder than originally thought. You can see the divergence in trend in the September-October period where the Trimmed Mean and the Median CPI trend was consistently upward but the Core CPI and Headline CPI turned down for a brief period.

Only now have we seen a consistent enough upward trend to firmly start the rising interest rate pattern. I see many prognosticators articulating criticism about the Powell Fed. That is as easy to do as playing the Super Bowl on a Monday. But in real time and with a once in an hundred years shock and with a fiscal policy having peaked, determining when to move the policy interest rate and by how much is not so easy.

In earlier commentaries we have discussed the Dallas Fed trimmed-mean PCE, the CPI and various ways to look at inflation. All measures have reached the trend which is clearly above the Fed’s target and therefore justifies the policy change.

Here are selected links:

“Phillips Curves & the Fed,”

https://www.cumber.com/market-commentary/phillips-curves-fed

(Feb 3, 2022 – Kotok)

“Inflation – What Does It Look Like?”

https://www.cumber.com/market-commentary/inflation-what-does-it-look

(Nov 15, 2021 – Bob Eisenbeis)

“Inflation Front and Center,”

https://www.cumber.com/market-commentary/inflation-front-and-center

(July 16, 2021 – Bob Eisenbeis)

“Inflation?”

https://www.cumber.com/market-commentary/inflation-0

(May 13, 2021 – Kotok)

“Interest Rates and Yield Curve Control, Part 1,”

https://www.cumber.com/market-commentary/interest-rates-and-yield-curve-control-part-1

(August 11, 2020 – Kotok)

Let’s repeat: all measures are clearly above the Fed’s targets, so the path to higher interest rates has definitely arrived. How high and in what time frame are subjects of debate. Any estimates are purely guesstimates.

David R. Kotok

Chairman & Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.