As the trifecta of the Treasury Department, Fed, and FDIC moved to contain the fallout of the failure of Silicon Valley Bank, here’s how American Banker summed things up on that fateful Sunday night:

After a tumultuous weekend following the failure of Silicon Valley Bank on Friday, the Treasury Department issued a “systemic risk exception” allowing it to cover uninsured deposits at SVB and Signature Bank, which was closed on Sunday. (“In abrupt reversal, regulators to cover SVB, SBNY uninsured deposits,” https://www.americanbanker.com/news/regulators-to-cover-svb-sbny-uninsured-deposits)

We’ve now seen a huge bailout of depositors by a new Fed-FDIC-Treasury combined approach. And many bank, insurance, and financial services stock prices have had multi-sigma volatility.

History rhymes again even as this SVB saga sequence is not a perfect repetition of past banking crises.

I’ve watched banking crises for over half a century. In my family history, my great grandfather encountered and survived the banking crisis of 1907 and watched the young Federal Reserve emerge from Jekyll Island and take form in 1913. My grandfather didn’t trust the banking system, and his precautions allowed the family business to survive the Great Depression. During my career I’ve been on two bank boards, had banks for clients & watched one saga after another with the lens of chair of the Central Banking Series for the Global Interdependence Center (GIC). That early initiative has been succeeded by the College of Central Bankers at the GIC.

The current Silicon Saga was preceded by shocks with names now etched in history — “Lehman,” “Bear Stearns,” “Countrywide.” And don’t forget Washington Mutual (WAMU). And before those, we had the savings & loan debacle. The list of failed banks is quite long.

Remember: Bank failures are not uncommon. Before this latest and still-counting saga, Jim Reid counted 563 since 2001 (“DB CoTD: 563rd US bank failure since 2001,” email, March 13, 2023). Trump won’t admit it, but he had some responsibility: He gave in to the weakening of Dodd-Frank supervisory roles. Ironically, SVB’s CEO was a successful lobbyist arguing for regulatory relief. His March 24, 2015, testimony before Congress can be found on pp. 115– 121 of this PDF: https://www.govinfo.gov/content/pkg/CHRG-114shrg94375/pdf/CHRG-114shrg94375.pdf.

Bullets:

1. Kotok rule number one: “You never see just one cockroach, and remember, they breed in the dark.”

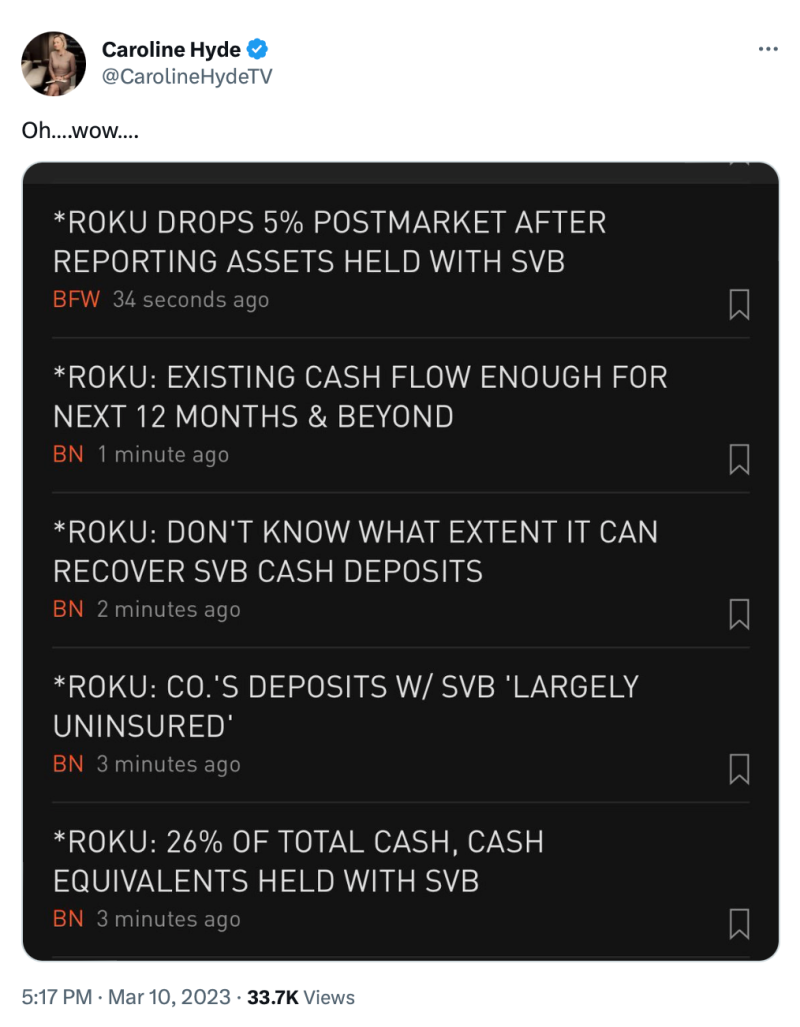

2. Contagion exists in many forms and cannot be predicted in advance. Here’s an example from a tweet by Caroline Hyde of Bloomberg TV sent in the early phase of this crisis. A few other examples follow hers.

(https://twitter.com/CarolineHydeTV/status/1634317519723851776?s=20)

"Sunrun Down Over 10% On Silicon Valley Bank Exposure: What Other Companies Are Exposed?"

https://markets.businessinsider.com/news/stocks/sunrun-down-over-10-on-silicon-valley-bank-exposure-what-other-companies-are-exposed-1032160734

"Silicon Valley Bank failure could wipe out 'a whole generation of startups’"

https://www.npr.org/2023/03/11/1162805718/silicon-valley-bank-failure-startups

3. Crypto, including stablecoins, is a casualty. Here is an example.

“Circle’s USDC Stablecoin Breaks Peg with $3.3 Billion Stuck at Silicon Valley Bank,”

https://www.wsj.com/articles/crypto-investors-cash-out-2-billion-in-usd-coin-after-bank-collapse-1338a80f

4. By now, every professional financial firm has already reviewed any secondary exposure to the SVB contagion. I’m on the advisory board of RiskBridge Advisors (https://www.riskbridgeadvisors.com), a private OCIO company. Bill Kennedy, who is CEO and CIO at RiskBridge, has given me permission to share his internal notes, sent early on the fateful Saturday morning.

In light of the news around the failure of Silicon Valley Bank and the potential concern about First Republic Bank, RiskBridge conducted a counterparty review. We can confirm that RiskBridge has no direct exposure to these banks. Of the third-party funds we deal with, a handful had exposures that were below the $250,000 FDIC insurance limit. We continue to monitor one venture capital fund with material exposure to Silicon Valley Bank.

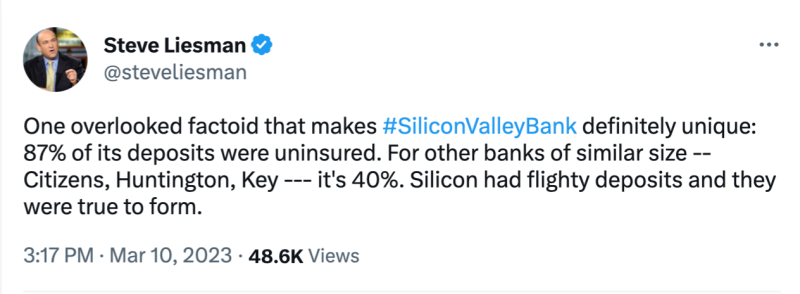

5. CNBC’s Steve Liesman was quick to note the very high percentage of uninsured deposits at SVB. Kotok wants to remind readers that the FDIC intervention occurred during the business day and within the business week. This timing is unusual, as most FDIC resolutions occur on weekends and permit accumulating precise information.

(https://twitter.com/steveliesman/status/1634287341656330244?s=20).

My point is the unusual timing of an FDIC action in midweek to stop a bank run.

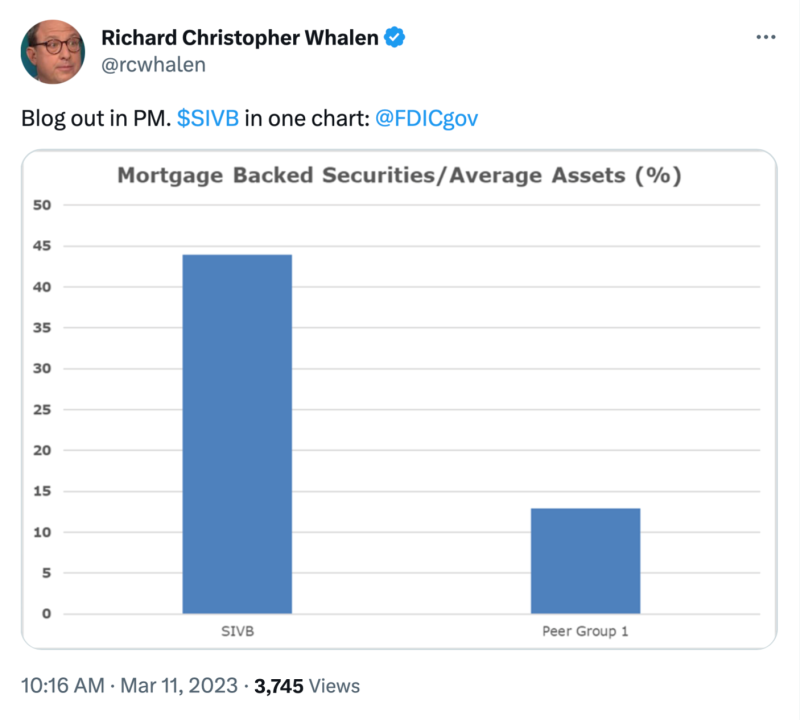

6. My friend Chris Whalen (https://www.theinstitutionalriskanalyst.com) writes often about banking and mortgage finance. He is one of the analysts who has been warning those who will listen. He tweeted a chart summing up the percentage of mortgage-backed securities at SVB relative to its peer banks.

(https://twitter.com/rcwhalen/status/1634574022217199616?s=20)

Chris also gave permission to fully quote his remarks on Signature Bank (SBNY) in his March 14 Institutional Risk Analyst (https://www.theinstitutionalriskanalyst.com/post/qe-the-yellen-banking-crisis). (Hat tip to Bill Kennedy for prompting the exchange. We thank each of them for the insight.)

The decision to support SIVB and SBNY was essential, yet as Politico reports, the Biden Administration almost balked at providing cover to the failing banks. “President Joe Biden began the weekend highly skeptical of anything that could be labeled a taxpayer-funded bailout, according to four people close to the situation, who were not authorized to speak for attribution,” Politico reports.

“Biden, who as vice president had watched then-President Barack Obama get hammered over his role in bailing out giant banks during the financial crisis, had little desire for a repeat, Politico relates.

And why is SBNY, a bank half the size of SIVB, systemically important? Because SBNY is a major player in both the commercial and residential real estate markets. The $110 billion asset bank traced its lineage bank to Edmond Safra and Republic National Bank.

SBNY is the last lender willing to finance rent stabilized multifamily real estate in New York City. Do you think that New York Governor Kathy Hochul understands this? As mortgages mature on these properties, SBNY will not be there to roll the assets.

The Real Deal reports that the bank has already stopped issuing letters of credit to landlords of these properties. "Withdrawing deposits, drawing down loans and replacing letters of credit are among the issues borrowers and depositors are facing after the Federal Deposit Insurance Corporation took the bank into receivership Sunday," TRD reports.

Not only is SBNY the ONLY bank now willing to lend on rent stabilized apartments in New York City, but the prospect of a purchase of the bank means that these assets and the businesses that own them will be basically orphaned. When the New York legislature in Albany crippled the ability of landlords to recover costs on multifamily rentals with the latest rent control law, this entire asset class was impaired. Once SBNY is sold to a larger lender, these assets will be impossible to finance with a bank.

But there is more. Not only is SBNY a major player in multifamily, but it also plays in financing residential real estate and has participated in most of the financings for mortgage servicing rights (MSRs). SBNY will be but the latest lender to exit this market for MSR financing. The bank also manages escrow balances for a number of nonbank lenders, all of whom may now need to find a new bank at a time when many regionals are fighting for their lives.

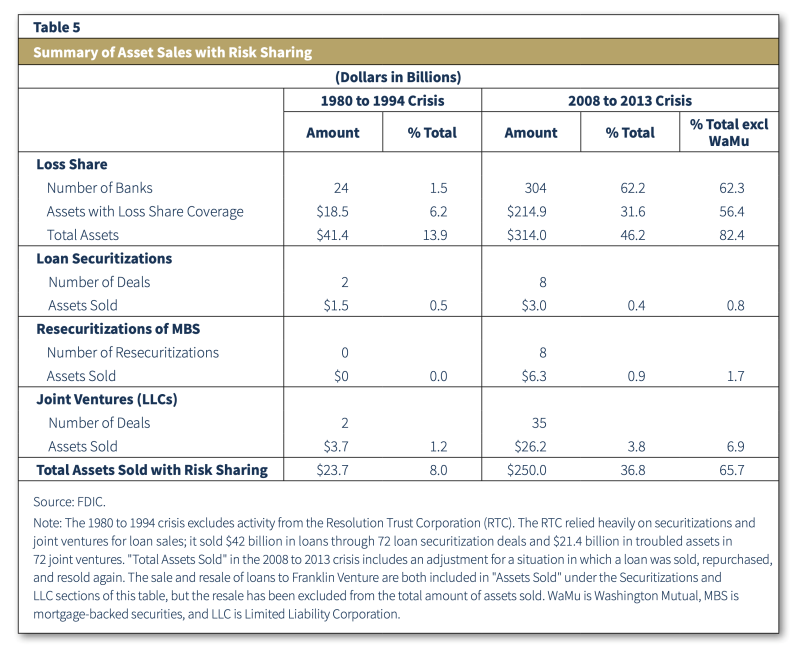

7. We must send a Hat tip to Michael Cembalest of J.P. Morgan for his reference in the March 10 edition of Eye on the Market to this report of FDIC activity in earlier crises: “FDIC Resolution Tasks and Approaches: Comparison of the 1980 to 1994 and 2008 to 2013 Crises,” https://www.fdic.gov/analysis/cfr/staff-studies/2020-05.pdf.

We have excerpted two charts from this FDIC report. Table 5 compares asset sales with risk sharing.

(“FDIC Resolution Tasks and Approaches: Comparison of the 1980 to 1994 and 2008 to 2013 Crises,” https://www.fdic.gov/analysis/cfr/staff-studies/2020-05.pdf, p. 30)

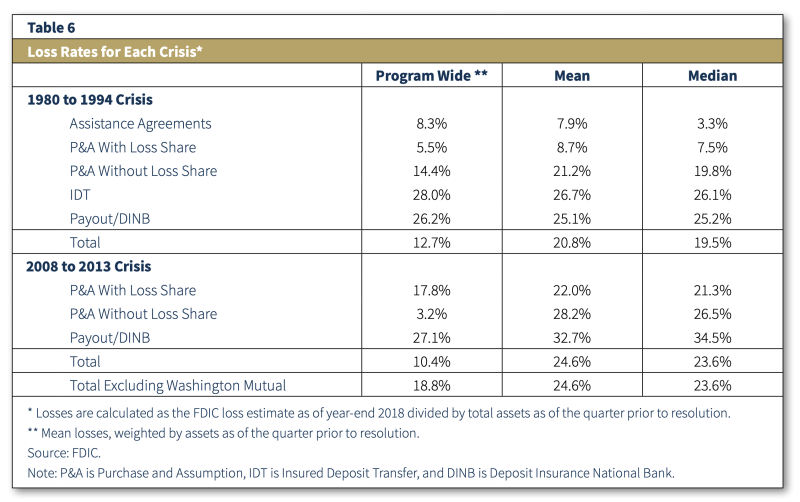

Table 6 compares loss rates incurred:

(“FDIC Resolution Tasks and Approaches: Comparison of the 1980 to 1994 and 2008 to 2013 Crises,” https://www.fdic.gov/analysis/cfr/staff-studies/2020-05.pdf, p. 30)

Readers may want to give Part 4 of this FDIC report a lot of attention. SVB has caused a policy revision to FDIC’s approach as discussed in Part 4 of this report. The failure of SVB is a result of changes in the financial system landscape that have occurred since the previous crises.

Kotok note: In my opinion, The effect will be to tighten credit conditions broadly, and that tightening will shrink credit multipliers. The long period of easy money and easy credit is over. To quote the famous economist, “Toto, we’re not in Kansas anymore.”

8. We’ve been asked about SVB asset management operations. Here’s the link to the Form ADV disclosure document. Readers may want to examine it starting on page 16 to see possible issues. The ADV is dated in 2022.

“SVB Wealth LLC: Part 2A of Form ADV: Firm Brochure,”

https://www.svb.com/globalassets/private-bank/svbw-adv-firm-brochure_2022.08.02.pdf

“SVB Wealth LLC: Form ADV, Part 2B Brochure Supplement,”

https://www.svb.com/globalassets/private-bank/svbw-adv-supplement_2023.02.08.pdf

9. The high profile of SVB happens in a politically charged, culture-war-divided time. That means congressional inquiry into the supervision system at the San Francisco Fed may become a media show, since SVB’s CEO was a Class A board member.

“CEO of failed Silicon Valley Bank no longer a director at San Francisco Fed,”

https://www.reuters.com/markets/us/ceo-failed-silicon-valley-bank-no-longer-director-sf-fed-2023-03-10/

10. There is controversy about the 2018 Trump Administration decision to move the stress-test limits up to $250 billion from the $50 billion threshold for a systemically important bank. My friend Joe Mason and his co-author Kris James Mitchener have argued the counterfactual and faulted the stress-test mechanism for not being designed to capture a rapid rise in interest rates. Here’s the link to their excellent editorial in the Wall St. Journal: "Stress Testing Wouldn’t Have Saved Silicon Valley Bank,” https://www.wsj.com/articles/stress-testing-wouldnt-have-saved-silicon-valley-bank-fomc-federal-reserve-treasury-bank-run-signature-bank-1573ab77.

Kotok note: We will never know the answer. Counterfactuals are argued frequently, but there is no way to test their hypotheses. What this editorial does is add to the debate about the forthcoming regulatory regime for the United States. The one thing we know today is that the pre-SVB regime failed, and there is certainly going to be a change.

Conclusion

This story is still changing as contagion unfolds. Note the news about Credit Suisse. Or Zions Bank. Or First Republic. Moody’s has downgraded the entire US banking system. (See "Moody’s cuts outlook on U.S. banking system to negative, citing ‘rapidly deteriorating operating environment’,” https://www.cnbc.com/2023/03/14/moodys-cuts-outlook-on-us-banking-system-to-negative-citing-rapidly-deteriorating-operating-environment.html). Blanket sector downgrades have happened in the past but are unusual.

For the Cumberland US Equity ETF portfolio, the exposure to banks is negligible and found only in a small portion of some broader-based ETFs. We exited the larger banks ETF some time ago. That decision preceded SVB. We have not bought the regional bank ETF. That may happen in the future. We have avoided crypto exposure.

As this is written, the US Equity ETF portfolio maintains a large cash position earning over 4%. Large exposure to aerospace and defense companies continues. We have not sold any defense exposure and have rebalanced new-money additions.

Of course, these positions may change at any time. I can have a colleague send details about the US Equity ETF portfolio strategy to anyone who emails me.

David R. Kotok

Chairman & Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.